Stock Market 2015 Top May be in Cyclical Harmony with 1929 Peak

Stock-Markets / Stock Markets 2015 May 01, 2015 - 04:41 PM GMTDo you sometimes turn a question over and over in your mind…and suddenly the answer comes to you? That was my experience as I kept asking the question…”Why did the market top come on April 27?”

I had done shorter-term calculations and arrived at the 7.525 year (90.3 months + 7 days) calculation from the peak in 2007. By the way, the 2007 high was also 7.525 years from the March 23, 2000 market peak.

There seems to be no harmonic with the 1987 high or low.

However, September 3, 2015 is exactly 86 years from the 1929 high. A quick calculation show that April 27 is exactly 129 days (4.3 months) prior to that date.

It is also exactly 5 years and a day from the April 26, 2010 peak leading to the Flash Crash.

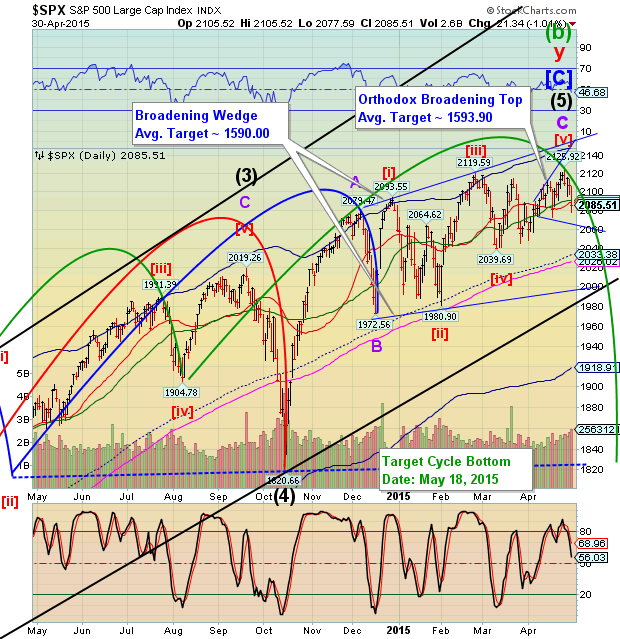

That leaves open the possibility of a Flash Crash that may make a low between May 6 and May 12 (60.2 months). That makes some sense, since May 15 is options expiration, which would be devastating should the decline continue through that period. This simply suggests that we should be 100% short through the next two weeks.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.