The Treasury Yield Curve and the Gold Bull Market Trend

Commodities / Gold & Silver Jun 12, 2008 - 12:36 PM GMTBy: Jim_Willie_CB

Some very confusing factors are at work relating to the US Treasury Bond market and the gold market. To assume that gold will rise in knee jerk fashion in response to the gargantuan grotesque growth in monetary inflation (aka US$ money supply) is simply naïve for the public and amateurish for professionals. Never in the US history has more confusion reigned within the body financial. This is to be expected, since the US banking system is insolvent, in parallel to the US housing landscape being increasingly insolvent. The nation must soon make difficult decisions on rebuilding the United States , its infrastructure, its energy supply industry, and put down its military weapons used abroad. Some strange effects are detectable regarding the US Treasury yield curve changes in recent weeks.

Some very confusing factors are at work relating to the US Treasury Bond market and the gold market. To assume that gold will rise in knee jerk fashion in response to the gargantuan grotesque growth in monetary inflation (aka US$ money supply) is simply naïve for the public and amateurish for professionals. Never in the US history has more confusion reigned within the body financial. This is to be expected, since the US banking system is insolvent, in parallel to the US housing landscape being increasingly insolvent. The nation must soon make difficult decisions on rebuilding the United States , its infrastructure, its energy supply industry, and put down its military weapons used abroad. Some strange effects are detectable regarding the US Treasury yield curve changes in recent weeks.

They coincide with the broader usage of the US Federal Reserve Lending Facilities. In my view, the US Fed is slowly killing the US Economy in order to grant a reprieve to a criminal collusion of corrupt Wall Street bankers. They lied, they cheated, they stole, and now they are being given money as that same funds are being drained from the private sector. The evidence lies in the US Treasury yield curve and gold price. Helicopter Ben Bernanke is more like a Mad Scientist draining the blood out of a victim on a surgeon's table. His helicopters only travel over Wall Street. He has become a tool for the Manhattan Ruling Elite.

USTREASURY YIELD CURVE CHANGES

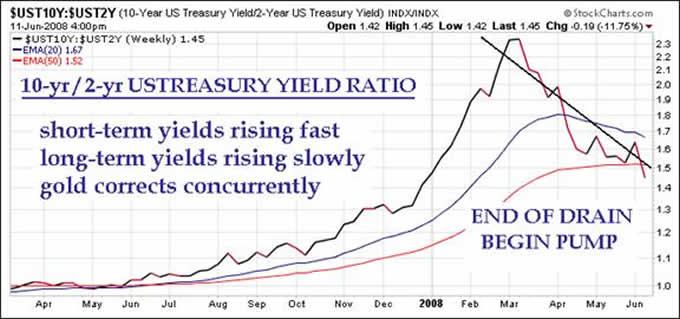

The US Treasury yield spread is of crucial importance. The ratio of the 10-year US Treasury yield to the 2-year yield is telling the story of the US Fed betrayal to the economic participants on Main Street USA. The gold price tends to rise in brisk fashion when the yield ratio rises. The gold price consolidates when the yield ratio tends to consolidate. Here is some reasoning as to why. Generally, a flat yield curve has the short-term yields roughly equal to the long-term yield. That signals a period of economic stagnation expected. The cost of short-term money would not be very high, since no significant demand would come for that money intended for business investment. Economic prospects would be somewhat dampened. Generally, a steep yield curve has long-term yields much higher than short-term. The cost of long-term money would be set higher in order to reflect the erosion from price inflation on assets. The entire system would gear toward the systemic price inflation. Volumes can be written on the yield curve topic. The short and long ends of the US Treasury yield curve do not stand still. In recent weeks, both ends are rising. The short end is rising much faster, in almost a scary fashion, like a panic.

Today's climate is very confusing. Silly questions prevail as to whether we have inflation or deflation. We have both, and will continue to have both. The key question is which is winning. Asset prices are falling as costs are rising, all without the benefit of wage gains. That is the formula for system implosion. As the US Economy is heading deeper into recession, but a tremendous amount of money is being created. The system is broken, and desperate repairs are attempted. Old theory must be adapted to total financial chaos.

When inflation is WINNING the battle, the monetary spigot flows fast. Inflation floods the financial system, as much of the money flow comes OUT of the long end in response to price inflation deep concerns. At the same time, the US Fed Mounties the short end so as to keep it close to the current Fed Funds rate. They purchase short-term USTBills with printed money, plainly told.

When deflation is WINNING the battle , the destruction of asset values occurs faster than newly created money can replace it. Inflation still floods the system, but its directed locations are not where needed, rather where power controls it. Inflation has occurred more so on the cost side, as economic distress becomes a huge issue. Profit margins are squeezed or vanish. Money flow comes into the long end from recession concerns as the inflation effects hit the cost side, which destroys businesses. At the same time, the US Fed does not have to monetize the short end much, since the market takes care of that task. Funds move from stocks to bonds.

Pressure is acute on the US Fed itself on interest rate policy. The 3-month TBill yield remains near 2.0%, but the 2-year TBill has moved to 2.9% on its yield. With the official Fed Funds rate at 2.0%, the bond market is pulling the US Fed into a rate hike, when the opposite is needed for aiding mortgage rates, housing, and easier credit conditions for the strained US Economy

One could describe the internal conditions of the Untied States are the best living example of what Ludwig Von Mises described as a CRACK-UP BOOM. The term will soon enter the active lexicon of financial media writers, anchors, and pundits, but they will make it sound like a positive development. Intense political pressure will next push the US Fed to restore the steeper slope in the US Treasury yield curve. They will be urged to lower the Fed Funds rate, but before such action, an experiment will be conducted. They will attempt to push down the 2-year TBill yield back toward 2.0% when it now threatens the 3.0% level. Their success is uncertain.

In the last few months, since the US Fed opened its Lending Facilities, the US Treasury yield curve has the 10yr/2yr ratio sliding lower. Big banks lend long and borrow short. So their profit margin on lending is being strained, even as the US Fed has been giving them a reprieve on their impaired bonds. What an irony! This cannot continue! Wall Street applauds the rescue of banks, which by the way are still in dire straits. Lehman Brothers is in the process of implosion, as predicted. Wall Street has trumpeted a very false message that the bond swaps conducted by the US Fed have fixed the problem. Not only are they dead wrong, but the US Fed actions have ensured a deeper US Economic recession, since they refuse to deploy PURE MONETIZATION. US Fed officials are scared to death at the cost inflation problem sweeping the nation, led by energy and food prices. The dire situation with Bear Stearns coincides with a faltering of the US Treasury yield curve steep slope. Few have noticed, probably because Wall Street enjoys the largesse and socialist medicine. My patience continues as news is hoped eventually for criminal indictments and convictions of Wall Street executives. Instead, they are on planning boards for USGovt-led rescues.

The next round of largesse will be more complicated and difficult to pull off. Lehman Brothers is doomed not to survive as an independent corporate entity. Their business lines are shriveling. Investment banking? What investment banking? After selling lemonade laced with subprime rat poison, the lemonade market has surprisingly vanished. Lehman Brothers might be better diversified than Bear Stearns, but almost all those diversified business lines are simultaneously suffering major losses.

The Lehman story will drive home the point that contagion in the banking crisis extends far beyond mortgages. The kill job of Lehman Brothers is now being planned. It will be much more difficult for JP Morgan to devour them, to raid their assets and to discard their rubbish bonds into the secret JP Morgan‘Garbage Can' that eludes all accounting requirements. The US Congress might wish to investigate the actions by JP Morgan, but those sessions are mere window dressing, a charade to satisfy the public, to dupe them into believing that officials are scrutinizing the matter. A grand consolidation of banking power is in progress. Most people are totally unaware. They are such fools that they probably still believe Bear Stearns was rescued!!! They could not recognize a burial site and tombstone.

TIME OUT

Let's correct one of the biggest misconceptions out there. Fast rising energy costs worsen the US Economic recession, forcing more asset deflation. Sure, they lift some prices, but they are costs. Money to pay for the higher costs are nowhere, with falling home values, vanishing home equity credit, tighter bank lending, ruined banks, restricted credit cards, and lost jobs with income. Bank destruction will worsen. Job loss will worsen. Wages do not keep pace, as long as China is a competitor. The Clinton Congress accepted the Trojan Horse, when they granted China Most Favored Nation Status in 1999. The maneuver betrayed American workers, sent jobs to China . The globalization movement dovetails as part of an elite plan. Did anyone notice that the SARS and Avian Flu epidemics ended at the same time as the initial public stock offerings began for big Chinese banks? See ICBC and other giant Chinese banks, and Wall Street fees. Surely just a coincidence? A smart fellow taught me 20 years ago that there are no billion$ coincidences! A grand chess game is underway among the United States , China , Russia , and Europe . Add the Middle East since all the above have an entrant in the Iran ***** fight pit.

BETRAYAL OF US WORKERS

Put aside the betrayal of worker savings from the premeditated, calculated, persistent policy of monetary inflation. Savings in deposits pay 4% when price inflation rages over 10%, resulting in erosion and corrosion and implosion of savings. What makes the current US Treasury yield curve confusing right now is that the US Federal Reserve is draining the banking system as it attempts to balance its bond portfolio. The US Fed is not an altruistic firm, but rather a monolith parasite. All the Lending Facility swaps to relieve badly damaged bond impairment have put them on the US Fed's balance sheet, while the many troubled banks hold the more valued Treasury's.

The US Fed has been reacting since late March by selling USTreasurys into the market, alongside their own accumulation of those USTreasurys. Thus, bond yields have risen. The US Fed is essentially draining the private sector in order to bail out the Wall Street bank sector. This is blatant elite socialism, putting the Middle Class in a vise, since the primary directive for over two decades has been TO PREVENT SECONDARY INFLATION EFFECTS IN THE FORM OF WAGE GAINS. Today is a time of desperate need for better wages, as people cannot handle higher costs in their lives. Without higher wages, companies cannot raise prices. Higher wages mean greater ability to pay higher prices. The system is dissolving before our eyes. USGovt officials continue to claim the Untied States has strong fundamentals, and a strong US Dollar is in our best interest. One is reminded of murder movies where the killer tells the victim that he is enabling a better life.

Steadfast refusal to permit higher wages, the dreaded secondary inflation effect, is a vivid betrayal by the US Fed to pursue strong and stable employment conditions. They are defending the US Treasury Bond yields from rampant systemic inflation, no more. They are aiding and abetting the historical kill of the US Middle Class and US Corporate environment outside the protected, coddled, and corrupt financial sector. Then again, is this not the Rockefeller New American Century plan installed??? They quietly are working within US institutions, media included, to return a concentration of economic and banking power to the hands of a few multi-billionaires. The evidence is everywhere, but the recognition is nowhere. The movement occurs side by side with the gradual implosion of the financial system, whose downward spiral is led by the dissolution of the risk pricing model. The mortgages\ arena is only the tip of this iceberg. And subprime mortgages are only the tip of the mortgage iceberg.

CONSOLIDATION OF BANKING POWER

The Second American Revolution has architect John D Rockefeller III, scion of the powerful Standard Oil and Chase Manhattan Bank, with support from his three brothers David, Nelson, and Laurance. They were also key architects of the global reconstruction after 1945 known as the American Century. Rockefeller has openly declared the resolve of the powerful establishment to roll back concessions grudgingly granted by the wealthy and powerful during the Great Depression, the call issued in 1973. He called for a “deliberate, consistent, long-term policy to decentralize and privatize many government function, and to diffuse power throughout the society.” By the latter is meant clearly to concentrate that economic and banking power into the hands of the Ruling Elite, and to promote an impoverished society.

The Rockefeller agenda intends to reverse the processes established often with great social agitation and political pressure during the difficult crises of the 1930 decade. It has seen the removal of Depression Era government regulations on many aspects of economic life in America , even banking strictures. Labor union power is nonexistent anymore. The Glass Steagall Act limited merger of banks, brokerages, and insurance firms. Its fall by the wayside set the stage for a powerful concentration of power, perhaps at the tail end of a planned collapse. Watch the consolidation of Federal Reserve banks, led by JPMorgan. Crisis actually enables structural change and that power concentration. What is described is the agenda of the Neocon wing in power since 2001. A Hat Trick Letter Special Report was just published last week, entitled “Banks, War , US Power, East vs West” for subscribers. Vast geopolitical shifts are occurring in foreign lands, even as power is shifting to the US state and large corporations.

GOLD & SILVER FINISH RETEST

A very significant period of gold price consolidation has lasted longer than most analysts anticipated, me included. The 20-week moving average stands at 853. That level coincides with the 850 critical support line. The gold correction since the March high has endured multiple impulse lows. After a magnificent rise from the desperate news on the US bank implosion and insolvency in August, the gold price has corrected many times. Are USFed actions, auctions, swaps, and rebalancing inflationary or deflationary? Lately, they are deflationary, as they drain the private sector to subsidize the financial sector. Gold is completing a complex correction process. The daily chart shows several positive signs. With gold at or near 863 on noon Thursday, clearly the May 1st low has held in support. A rounded bottom can be seen. A possible reversal pattern might be showing through. The gold price on a daily basis is near the oversold cyclical point again. An A-B-C correction seems near an end. The USDollar DX index must contend with upside resistance of a powerful nature. That is covered in the Hat Trick Gold & Energy Report due out this weekend.

The bigger picture for gold is well viewed on the weekly chart. The correction steps have dampened enthusiasm, but they have not changed the bull uptrend. The hyperbolic rise from last August to March has not seen any move below the 850 impulse high in November. Thus, the long-term bullish picture is intact. A retest of the May low at 855 is in progress. The USDollar support is bizarre, given the astonishing persistent horrendous negative fundamentals that pervasively worsen with each passing month within the USEconomy and US bank system.

In the entire financial world, the two biggest enemies are gold and USTreasurys, the trading instrument of the USDollar. Given that the US banking officials are up against the wall right now, they will continue to inflate, and in doing so, they will work to bring down the long-term USTBond yield via direct monetization actions. To be sure, a strong rise in the 10-year USTreasury yield well past 4% toward 5% and beyond would create forces for credit derivative explosions and the total ruin of the US and Western world banking systems. The JPMorgan machinery has kept the long-term rates down far below prevailing price inflation levels. However, monetary inflation on an even grander scale, as is coming next, will be directed into USTBonds, regardless of price inflation. A profound irony, or conundrum, has been that long-term USTBond yields are a reflection of USFed, Euro Central Bank, Bank of Japan, and Bank of England monetary inflation. The USFed has cut the official interest rate several times. The market response has been to contradict. The USFed has lost control.

CRUDE OIL SPECULATORS ARE BIG BANKS

Lastly, a comment on crude oil and the concern over speculators. Some of the biggest speculators are the Wall Street bankers. As policy have been discussed toward more speculator control, some of the biggest violators are Goldman Sachs, Morgan Stanley, and Deutsche Bank. This group has been very active in buying and leasing enormous storage tanks for holding crude oil. They have been active in recent months in securing a vertical integration of control, from owning oil storage centers, oil pipelines, electrical power plants, and gasoline refineries. They even purchased some future North Sea oil production. All this without a single peep in the subservient US financial press networks! Details are provided in the June Hat Trick Letter. They destroyed the housing & mortgage industry. The have set their sights on the energy industry next. Tighter control of speculators would enable them to control the energy market much more effectively. JPMorgan taught Enron everything they ever learned.

The new rules will not apply to Wall Street firms. Why? Because they make the rules, and when they break the rules, the regulators do not enforce rule violations. Why? Because they serve on agencies as regulators. The system is broken, and the grand fissures are extending to the energy market. Has anyone asked whether the crude oil price is rising in response to failed confidence in the US custodians and concerns over a wider disastrous war in the Middle East ? Perhaps a few inside the US and the majority outside the US . Has anyone asked if the crude oil price is rising as a Lame Duck president effect? Not really. Has anyone noticed that the crude oil price rose sharply after further belligerent comments came from the US Military and its MidEast small nation ally against Iran ? A few did last week, but their voices have not been invited back onto financial media stages. Take a closer look at Wall Street banks and their crude oil storage, their arbitrage, and their urges to Congress to limit competition. The Mussolini Fascist Business Model might be extending its lethal tentacles from banking into the energy market.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“I am astonished at the level and depth of your writing. There is, to my knowledge, no one who comes close to your commitment to finding the truth and putting it out there for us. I am hooked. You tower above your competition. Keep it up.” - (DavidP in Florida )

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street .” - (GeorgeC in Minnesota )

“You are able to consume and regurgitate complicated information into layman's terms. It shows that you understand your subject well. It is very easy to take complicated material and repackage it as complicated material. You, however, have the ability to take the complicated and make it understandable to the common man.” - (RickS in Californiaa)

“Keep up the good work, and stay safe. The world needs your interpretative skills. From your radio interviews, I know that your quick wit and conviction are genuine. Your confidence and eloquence comes across just as strongly. You make specific, seemingly outrageous predictions with specific timing, and you are very often right. Really, can one offer any higher praise to an analyst?” - (TomH in California )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retaicl forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.