Twitter Earnings Leak Fiasco: A Payday for Wall Street's Relentless Data Pursuit

Companies / Corporate Earnings May 07, 2015 - 10:51 AM GMTBy: EconMatters

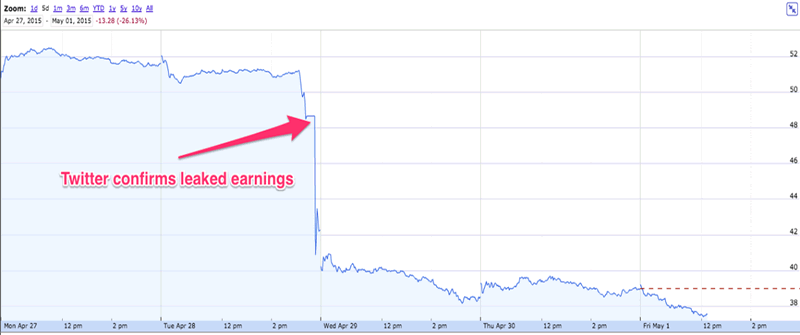

Twitter's had a very bad week when its stock tanked ~ 27% in 5 trading days. It all started when its weak 1Q earnings was posted early by Nasdaq on Twitter's IR web page. Twitter originally planned to release earnings after market close on Tuesday (so investors may have time to digest the not-so-impressive 1Q numbers to perhaps arrive at a more rational course of action).

Twitter's had a very bad week when its stock tanked ~ 27% in 5 trading days. It all started when its weak 1Q earnings was posted early by Nasdaq on Twitter's IR web page. Twitter originally planned to release earnings after market close on Tuesday (so investors may have time to digest the not-so-impressive 1Q numbers to perhaps arrive at a more rational course of action).

Press-release earnings after market-close followed by earnings call the next morning is a popular standard operational procedure of Investor Relations (IR) at many publicly traded companies. Twitter's best laid plan was totally destroyed first by the big Nasdaq goof posting earnings about 2 hours before market-close, then by Selerity, a little-know cyber data sleuth that found and twitted Twitter's disappointing 1Q results to the whole world. Investors jumped on the early 'leaked' info and rushed for the exit. Twitter had to halt trading briefly and wound up officially releasing the earnings shortly before the closing bell. The stock continued to drift lower and closed at $37.84 on Friday, down more than 27% or $14 for the week.

|

| Chart Source: Business Insider, May 1, 2015 Fox Business reported that Nasdaq (NDAQ) has confirmed that its Shareholder.com unit was responsible for the Twitter (TWTR) earnings leak by publishing the 1Q results before the close of trading Tuesday. “At 3:07pm, Shareholder.com inadvertently made an early version of Twitter’s earnings release publicly accessible. We are investigating the root cause. It did not impact any other Shareholder.com clients,” said Joe Christinat, a Nasdaq spokesperson.Our understanding is that part of the service offered by Shareholder.com is managing the entire content of the IR section of company's web site including press release, SEC filings, etc. A lot of Nadsaq-listed companies outsource the IR content management to Shareholder.com. Business Insider quoted one trader saying "They [Twitter] post the report but think if they don't have a link to it on the website, no one can see it." |

The deeper issue, however, is that the incident highlights the relentless pursuit of data/info by Wall Street to gain any trading edge. The fact that companies like Selerity (there's got to be 'competitors'), even exist (with clients) just proves there's huge demand to justify the resource and capital to develop this kind of technology and service in the first place. But this is actually something smaller players do, the real big players use other means such as Co-location (which costs a boatload of money) to just gain milliseconds of advantage to front run the market.

What Selerity did of course is totally legal and Twitter has only itself to blame. Our observation is that Twitter stock started selling off even before Selerity leaked the earnings (albeit on a smaller scale than the landslide after the leak). The leak by Selerity triggering selloff by the wider market most likely only enhanced these early positions.

The scary thing is this is just one example that made the big headline due to Twitter's social media icon status. The fact is that DOJ, SEC and CFTC have no idea or simply choose to ignore the various market manipulations going on day in and day out. Going after a few small-fry traders like Navinder Singh Sarao is a mere gesture to justify their 6-figure tax-payers-funded paychecks.

Bag Holders

In the aftermath, it looks like the only winners coming out of this fiasco are (1) Selerity who gained some street cred and probably picked up a few new clients along the way, and (2) The big players who acted before the rest of the market mass rushed in.

Business Insider reported that one options trader estimates "the money made from those that sold calls and bought puts in response to the leak made roughly $80M." Twitter co-founders have amassed huge fortune during the IPO and the later tech hype and stock run-up despite this recent vertical drop. Who's left holding the bag? The typical buy-and-hold retail investors who jumped in to catch the 'high growth prospect' at the near-peak of a tech bubble.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.