"Glinda the Good" Deflation Isn't Looking So... Good

Economics / Deflation May 07, 2015 - 08:01 PM GMTBy: EWI

Cold weather, falling wages, bizarre fluke? The real reason consumers aren't spending is... defensive, deflationary psychology

Cold weather, falling wages, bizarre fluke? The real reason consumers aren't spending is... defensive, deflationary psychology

Editor's note: You'll find the text version of the story below the video.

Learn What You Need to Know NOW About Deflation

Get Your Free Report Now »

When 2015 began, the mainstream financial experts were certain of one thing: Even if the United States economy were sliding into deflation (which, they said, was open to discussion) that particular kind of Glinda the Good deflation, characterized by plunging energy and food prices, was going to be a boon for consumer spending:

"Good deflation a tax cut for working families," affirmed a February 2 Huffington Post. "Cheaper gas means more flying, more driving, more hotel occupancy, more use of restaurants and leisure facilities. In short, deflation driven by the rapid decline in oil prices is good news for America."

So, what's happened since?

Well, according to an April 16 article in the Chicago Tribune, the sharpest annual decline in oil prices since 2008 somehow translated into not more, but less non-essential consumer spending. In March, U.S. retail sales clocked their third straight monthly decline -- which doesn't make sense, said the Tribune:

"This is puzzling. Why would consumers spend less when the economy picks up steam, and why haven't consumers gone shopping with the 1% extra income that collapsing oil prices have handed them?"

The piece then offers a few possible reasons -- such as cold weather, stagnant wages, business cuts, and so on. But none of them feel adequate, leading back to the initial shock:

"Consumers have defied expectations. Investors who anticipated purchasing-power gains would lead to greater consumer spending must be sadly disappointed."

We absolutely agree. Consumers have defied expectations -- those of the mainstream experts, that is. But they have completely complied with our long-standing expectations of a shift toward thrift, as laid out in chapter 9 of Bob Prechter's business best-seller Conquer the Crash.

There, Prechter explained how, in times of deflation, the trend toward non-spending is not a rational decision; it's an emotional one:

"The psychological aspect of deflation cannot be overstated. When the social mood trend changes from optimism to pessimism... consumers change their primary orientation from expansion to conservation. As consumers become more conservative, they save more and spend less. These behaviors reduce the 'velocity' of money, i.e. the speed with which it circulates to make purchases, thus putting downside pressure on prices."

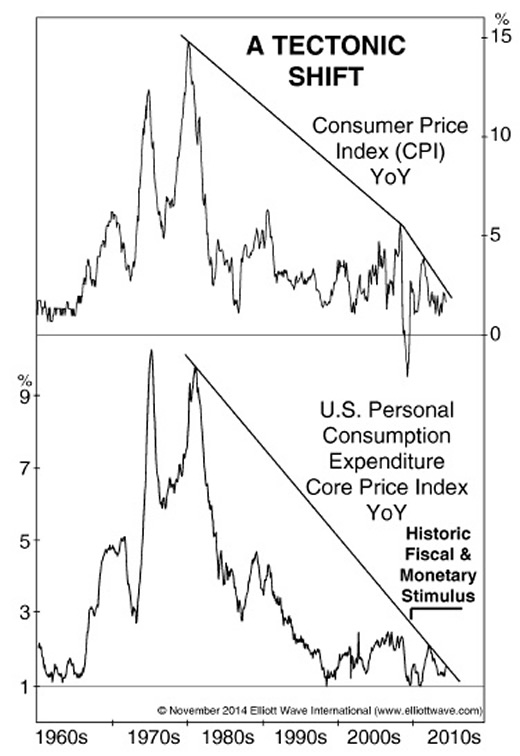

Then, in November 2014 Elliott Wave Financial Forecast, we showed definitive proof that deflation -- not the "good" kind -- was set to arrive in the United States:

In other words, the conservatism called for in Conquer the Crash arrived in 2006-2008, and it continues to restrain consumers and corporations.

For years now, the Fed along with most economists have anticipated the imminent return of inflation, but it continues stubbornly subdued. This long-term chart of the CPI shows a succession of lower highs since the early 1980s, as inflation turned into disinflation, which is on the cusp of leading to outright deflation. Some argue that the CPI is rigged to show milder levels of inflation, but the bottom graph shows the same steady move toward the zero line in the Personal Consumption Expenditures Index, an alternate inflation measure favored by the U.S. Fed.

As it approaches, deflation will introduce itself to people in subtle and not-so-subtle ways.

The first way was consumer spending. Now, our brand-new May 2015 Elliott Wave Financial Forecast shows you an equally compelling chart of U.S. consumer credit since 1980 that confirms: deflation is now "playing catch up" to debt.

|

This article was syndicated by Elliott Wave International and was originally published under the headline "Glinda the Good" Deflation Isn't Looking So... Good. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.