Consumer Price Index: Official US Inflation is Running at 10%

Stock-Markets / Financial Markets Jun 14, 2008 - 07:59 AM GMT

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in May, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The May level of 216.632 (1982-84=100) was 4.2 percent higher than in May 2007.

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.8 percent in May, before seasonal adjustment, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The May level of 216.632 (1982-84=100) was 4.2 percent higher than in May 2007.

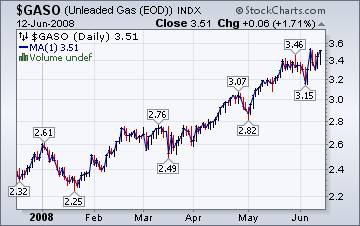

This amounts to an inflation rate of nearly 10%. But the reality of it all is that our costs have gone significantly higher than the “official rate.” The wholesale cost of gasoline has gone up by 45.8% in the last year, yet the Bureau of Labor Statistics claim only 17.4%. The press isn't any help, either, because they publish the chained index, which is the lowest rate that suggests a .6% inflation rate. And they claim that, “ The core CPI is up 2.3% in the past year, and has risen at a modest 1.8% annual pace over the past three months.” Get real!

Consumer sentiment in the pits.

NEW YORK (Reuters) - U.S. consumer confidence tumbled more than expected in June, hitting another 28-year low as high inflation and rising unemployment added to the gloom, according to a survey released on Friday. And more consumers than ever before in the survey's 62-year history said their financial situation had worsened, according to the Reuters/University of Michigan Surveys of Consumers.

"Consumer sentiment was much worse than expected. Consumers are definitely not feeling good about the economy," said Gary Thayer, senior economist at Wachovia Securities in St. Louis , Missouri . "They see rising gas prices, falling home prices and higher unemployment."

Support brings temporary relief.

(MarketWatch) -- U.S. stocks rallied Friday, boosted by a rising dollar and a drop in crude-oil prices, while investors looked past a big gain in consumer inflation, which, excluding food and energy, came in line with expectations in May.

For those who have good observation skills, do you think that the market rallied today because of the hype about inflation being “in line with expect-ations,” or does it make just as much sense that the market found temporary technical support and was overdue for a relief rally?

Treasury Bonds are having their worst week since 2001…

…and it might just be the right time for a buying opportunity in treasuries. “ Treasurys (sic) were little changed early Friday, capping the biggest increase in short-term yields in nearly seven years, after a government report showed consumer prices last month accelerated more than economists forecast.”

…and it might just be the right time for a buying opportunity in treasuries. “ Treasurys (sic) were little changed early Friday, capping the biggest increase in short-term yields in nearly seven years, after a government report showed consumer prices last month accelerated more than economists forecast.”

" If inflation keeps moving higher, it may motivate Fed governors to make the case for hikes," said George Goncalves, chief Treasury and agency debt strategist at Morgan Stanley. "Bonds have suffered such a bloodbath over the last week." Could this be a buy signal in bonds?

Should we be surprised?

The price of gold fell Friday, with the precious metal facing its largest weekly drop in three weeks, as declining crude prices and a strengthening U.S. dollar curbed investors' appetite for an inflation hedge. In recent trade on the New York Mercantile Exchange, gold futures for August delivery fell $3.5 to $868.50 an ounce . Didn't I recommend “dancing near the door” last week? I am still outside the dance hall.

The price of gold fell Friday, with the precious metal facing its largest weekly drop in three weeks, as declining crude prices and a strengthening U.S. dollar curbed investors' appetite for an inflation hedge. In recent trade on the New York Mercantile Exchange, gold futures for August delivery fell $3.5 to $868.50 an ounce . Didn't I recommend “dancing near the door” last week? I am still outside the dance hall.

The Nikkei is looking ominous.

( Bloomberg ) -- Japanese stocks dropped, reversing gains, led by banks and property developers after a report the government will say the nation's economic recovery is decelerating.

Rising costs of raw materials have crimped profit margins, while there is fear that the U.S. will raise interest rates and slow down the economy, impacting Japan 's export driven industries.

China index makes a new low.

( Bloomberg ) -- China 's stocks had the biggest weekly decline on record, dragging the benchmark index below 3,000 for the first time since April 2007, on concern government policies to curb inflation will hurt profits.

( Bloomberg ) -- China 's stocks had the biggest weekly decline on record, dragging the benchmark index below 3,000 for the first time since April 2007, on concern government policies to curb inflation will hurt profits.

"The market expectation is now getting worse about the economic outlook,'' said Zheng Tuo , who manages $790 million at Bank of Communications Schroders Fund Management Co. in Shanghai. ``With high inflation and tightening measures, we don't see any sign of an improvement. There's lots of uncertainty about corporate earnings.''

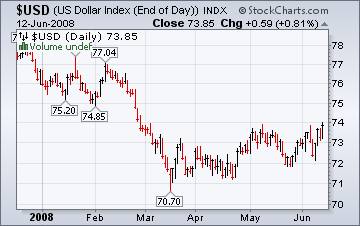

G-8 is satisfied with the rising dollar?

( Bloomberg ) -- The dollar headed for its biggest weekly gain versus the euro since 2005 as traders speculated the Federal Reserve will increase borrowing costs this year and Irish voters rejected a treaty promoting European Union unity.

( Bloomberg ) -- The dollar headed for its biggest weekly gain versus the euro since 2005 as traders speculated the Federal Reserve will increase borrowing costs this year and Irish voters rejected a treaty promoting European Union unity.

French Finance Minister Christine Lagarde , before meeting with her G-8 counterparts today and tomorrow in Osaka, Japan, told reporters that the U.S. dollar's increase versus the euro is ``very satisfying.'' The group comprises the U.S. , Japan , Germany , the U.K. , France , Italy , Canada and Russia .

“No money down” mortgages still being offered.

Just what are Fanny and Freddie thinking? As housing prices plummet, they are still offering “ piggyback mortgages ” for up to 105% of the purchase price of a home. The FHA had to withdraw $4.6 billion from its $21 billion capital reserve fund in May to cover losses, according to the New York Times . These losses stem from programs that offer mortgages with “no money down.”

Just what are Fanny and Freddie thinking? As housing prices plummet, they are still offering “ piggyback mortgages ” for up to 105% of the purchase price of a home. The FHA had to withdraw $4.6 billion from its $21 billion capital reserve fund in May to cover losses, according to the New York Times . These losses stem from programs that offer mortgages with “no money down.”

No relief in sight!

The Energy Information Administration's This Week In Petroleum tells us that; “For the eleventh consecutive week, the U.S. average retail price for regular gasoline increased to another record high, this time exceeding $4 a gallon for the first time. The price rose 6.3 cents to $403.9 cents per gallon, 96.3 cents higher than last year at this time.”

The Energy Information Administration's This Week In Petroleum tells us that; “For the eleventh consecutive week, the U.S. average retail price for regular gasoline increased to another record high, this time exceeding $4 a gallon for the first time. The price rose 6.3 cents to $403.9 cents per gallon, 96.3 cents higher than last year at this time.”

Low stockpiles and speculators keep prices high.

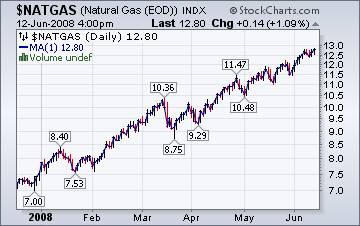

The Energy Information Agency's Natural Gas Weekly Update states, “ Natural gas spot prices increased on the week (Wednesday-Wednesday) at most market locations, climbing between $0.13 and $1.02 per MMBtu, or between 1 and 11 percent. The price increases over the period likely can be attributed to hot temperatures and rising crude oil prices. As the heat wave subsided somewhat on Wednesday, June 11, prices eased at virtually all market locations; however, the declines were not sufficient to offset the earlier gains.”

The Energy Information Agency's Natural Gas Weekly Update states, “ Natural gas spot prices increased on the week (Wednesday-Wednesday) at most market locations, climbing between $0.13 and $1.02 per MMBtu, or between 1 and 11 percent. The price increases over the period likely can be attributed to hot temperatures and rising crude oil prices. As the heat wave subsided somewhat on Wednesday, June 11, prices eased at virtually all market locations; however, the declines were not sufficient to offset the earlier gains.”

There's an attitude shift coming…

…and it won't be easy to make the adjustment, since we have been living the life for so long. Dr. Housing Bubble has some insights that make anyone sit up and take notice. Would it shock you to know that American consumers have $1.384 trillion in debt obligations? Where is the money going to come from to pay it off?

This simple conversation is the tip of the iceberg of the challenge that is now confronting our nation. In the past few decades, Americans have arrived to the current distorted point in reality where alternate universes collide and somehow debt is now the equivalent to wealth. I should actually clarify that last statement in light of the above conversation about home equity lines being shut down:

“Wealth in the last decade isn't how much you save or your net worth. Wealth is determined by your ability to have access to large amounts of easy debt via credit lines and maximum leverage.”

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week we debate what the market is telling us, near-term. It should be fascinating. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Thursday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.