Your Best Way to Profit from the Narrowest Market in 20 Years

Stock-Markets / Stock Markets 2015 May 21, 2015 - 04:39 AM GMTBy: ...

MoneyMorning.com  Keith Fitz-Gerald writes: If you’ve been frustrated by the markets lately, I’ve got some good news for you. You’re not alone – and more importantly, you’re not imagining things.

Keith Fitz-Gerald writes: If you’ve been frustrated by the markets lately, I’ve got some good news for you. You’re not alone – and more importantly, you’re not imagining things.

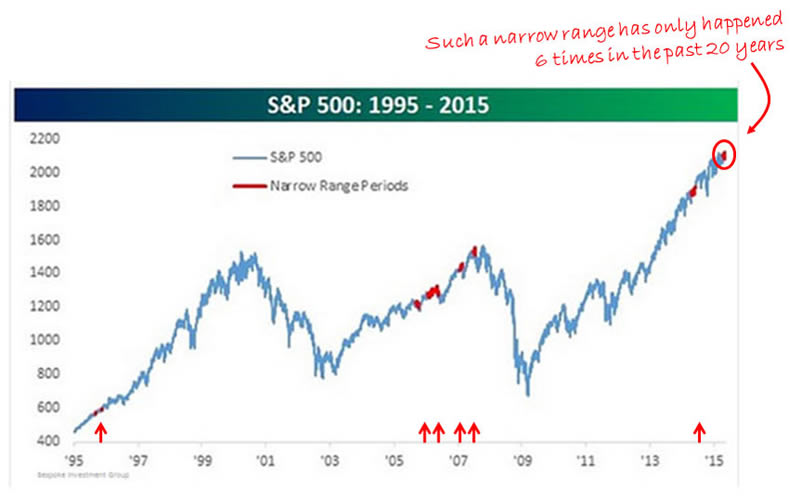

But there’s a good reason for the confusion – the markets are demonstrating behavior that’s so rare that we’ve only seen conditions like these six times in the last 20 years.

For most people, what happens next is going to be a bust. Yet, for a precious few – you included – it can be a bonanza.

Today I want to give you a look at the conditions I’m describing. Not one investor in 100,000 understands the perspective I’m going to share with you. Let alone what to do about it.

Then we’re going to talk about what all this means, how it affects your money and, of course, what you can do about it. As usual, I’ve got three specific Total Wealth Tactics you can put to use immediately to maximize profits, minimize risk, and give you an edge.

Here’s what millions of investors are missing…

For some time now you and I have been talking about how “narrow” the markets have become.

What I mean by this is very specific – the number of companies leading the charge higher has fallen significantly, while the range of the price increases they’re achieving has dropped off.

This is why the markets are going “nowhere” and why you’re getting all sorts of contradictory information in the media. One moment, there’s a headline warning you that the markets will fail miserably. The next, there’s a headline inciting you to buy “sure thing” investments.

The frustration is palpable and that, in turn, is prompting many investors to make increasingly risky decisions in an attempt to second guess the fact that the markets seem stuck in the mud. They’re letting their emotions get the better of them which, as you know, is absolutely the last thing you want to have happen right now.

I realize that this is hard to imagine. So in my best Ross Perot voice, “let me show ya a chart.” A picture, as the old expression goes, is worth a thousand words.

If you’ve been puzzled and stumped by the recent flatness of the markets, what this chart is telling you is that you aren’t imagining things. The markets and the S&P 500, in particular, are quite literally going nowhere.

There are a few reasons to explain this tightness.

First is that, according to Bloomberg, trading volumes are at lows we haven’t seen in 10 years. That means even the big boys on Wall Street are not buying and selling like they used to. That takes a lot of juice out of the markets.

Second, all that quantitative easing (and you knew this was coming) really is a bad influence. That’s because it offers an artificial stabilization that wouldn’t otherwise be present in truly free markets. Consequently, you don’t have the need to switch positions or readjust your portfolio as often as was the case in the past.

And third, Wall Street is under tremendous pressure, which, to my way of thinking, is a good thing because it means ultimately they’ll behave themselves. But in the meantime, it means that commissions have dropped, as has the propensity to turn proprietary accounts against their own customers. So volatility has dropped to the lowest levels in a decade, even though the value of stocks traded every day has risen.

Now for the fun part – what you can do about all this.

Three Steps to Help You Harness the Markets’ Pent-Up Energy

Most investors believe these influences are a bad thing. I know it’s tempting to fall into that line of thinking, but there’s no reason for you to succumb to it.

In reality, the markets are like a huge spring in that the longer they are compressed, the more energy they build up. You just have to learn to harness it if you want to be profitable… and who doesn’t?

Practically speaking, a narrow range always leads to more activity.

There’s a direct correlation, in fact, between how long a market is compressed and the strength of the movement that follows. It doesn’t matter what time frame you’re talking about, from tick level data, to intraday, daily, monthly… even yearly.

So what you want to do is position your portfolio accordingly. That way you can capitalize on the chaos that’s going to send other investors to the poor house.

The best way to do that right now is to make sure you have these Total Wealth Tactics in your “top drawer.”

- Confine your money to the six Unstoppable Trends we follow. Doing so gives you a huge advantage, because while markets comes and go, trillions of dollars will be spent on each of these trends no matter what. The Fed, slowing growth, China, Greece, ISIS… not one of these things can screw that up. In fact, in many cases, they enhance your profit potential. Anything else is a risk you simply don’t want.

- Stick to the “must have” companies rather than “nice to have” companies. That way you are tapped into growing revenues, growing earnings, savvy management and, ultimately, higher prices that reflect those things. Not only are these types of companies more resistant to any market downturn, but they’re frequently the first to power up when things calm down. Examples we’ve covered include: Raytheon Co. (NYSE:RTN), Williams Co. Inc. (NYSE:WMB), and Becton, Dickinson and Co. (NYSE:BDX).

- Manage your risk carefully using trailing stops, options, or inverse funds – all of which we’ve talked about in the past. If you’ve got your core investments covered, per #2, slice off 2-5% for next generation Rocket Riders like Ekso Bionics Holdings Inc. (OTC:EKSO) that are creating entirely new value propositions where they didn’t exist before.

At the end of the day, remember that growth is never undervalued. Not 100 years ago, and not now.

Only people’s inadvertent perspectives might be.

Until next time,

Keith

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.