Grexit or No Grexit, Get Ready for The Next Big Move in The Markets

Stock-Markets / Financial Markets 2015 May 21, 2015 - 04:48 AM GMTBy: Rajveer_Rawlin

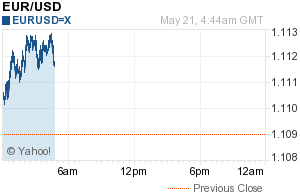

It is increasingly looking like a Greek IMF default is on the cards. Regardless some key markets are poised for big moves. Let us take a look at the Euro first. The Euro has been breaking down from it's recent highs near the 1.15 zone. It appears to be poised for a big move and could head towards either 1.08 or 1.13 depending on Greece.

Trading Idea: Euro 1.09, 1.13 strangle

Next let us look at oil which has also started correcting lower from its highs near 62$.

Can play the next big move likely to 55$, with an outside chance to $60 via the oil 57,60 strangle or via a strangle on the oil ETF USO:

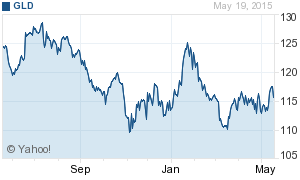

Moving onto gold, Gold seems to be consolidating in the 1200 zone but could easily move to either 1100 or 1250 on news flow out of greece. Like the 115.5, 116.5 strangle on the Gold ETF GLD:

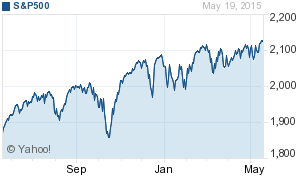

Not to forget the S and P 500, which has been consolidating near its recent highs of 2130. A big move either to 2050 or 2175 appears on the cards and can be played via a 2100, 2150 strangle.

By Rajveer Rawlin

rajveersmarketviews.blogspot.in

http://www.linkedin.com/pub/rajveer-rawlin/3/534/12a

Rajveer Rawlin received his MBA in finance from the University of Wales, Cardiff, UK. He is a Associate Professor in Finance in the Department of Management Studies Acharya Bangalore Business School. His research interests includes areas of Capital Markets, Banking, Investment Analysis and Portfolio Management and has over 15 years of experience in the above areas covering the US and Indian Markets. He has 9 publications in the above areas. The views expressed here are his own and should not be construed as advice to buy or sell securities.

© 2015 Copyright Rajveer Rawlin - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.