Gold “Less Sexy” Than Bitcoin … For Now - GoldCore on CNBC

Commodities / Gold and Silver 2015 May 21, 2015 - 02:01 PM GMTBy: GoldCore

- “There is a global financial bubble”

- “There is a global financial bubble”

– Stock markets and bond markets at all time record highs

– Medium to long term, gold’s “fundamentals look very sound”

Wilfred Frost of CNBC:

Do you think markets are adequately pricing in the risks that are present around the world today, particularly in Europe and the gold price itself?

Mark O’Byrne of GoldCore:

No, I don’t think so. I think in light of the “Grexit”, which you just mentioned, and also the “Brexit” and the overall debt positions globally — we would have a concern that there is a global financial bubble with stock markets at all time record highs, bond markets at all time record highs.

Meanwhile, gold prices have traded sideways, as you said, for a long period of time. We have had a serious correction and we believe there is consolidation. It looks undervalued. At the same time it could go lower before it goes higher. I think technically there is a weakness there and I think there is support at $1140 so short-term there is weakness, quite possibly, but medium to long term the fundamentals look very sound.

Wilfred Frost of CNBC:

Do you think that’s because we have had a breakaway from the idea that gold remains a great hedge towards any risk that’s out there — whether that’s inflation, deflation or just big geopolitical crises or is it just because markets don’t understand that those risks are present and they are ignoring them?

Mark O’Byrne of GoldCore:

I think the latter…for the moment.

I think it’s very like the 2003 to 2006-2007 period. The imbalances were building up in the system – meanwhile stock markets kept gallivanting higher and gold was a very under-owned asset and there wasn’t an appreciation of gold as a safe haven asset.

I think you are right.. I think that perception of gold … it has fallen out of favour. Sentiment towards gold is as bad as we have seen it since the 2003/2004 period.

Bitcoin is the more sexy thing. People want to talk about bitcoin and anything with “bit” in the name seems to be doing very well.

Whereas gold is very much less sexy. It’s less on the radar because it has performed quite badly in the short term. But, I suppose past performance is no guarantee of future returns and you have to look at the long-term store of value characteristics of gold as a proven hedging instrument and safe haven asset… over the long term. Not in the short term, obviously.

Carolin Roth of CNBC:

Mark, there simply is no inflationary pressure… I don’t see why gold should be moving higher at all. We are in a disinflationary or low inflation world. I don’t see why gold should be moving past the $1200 level that we’ve been bumping around over the last couple of months. And then we’ve got a dollar that’s moving higher. It’s a bit of a rough patch for the dollar right now but it’s still moving higher. I don’t see why anything we are seeing in gold is more than a dead cat bounce, essentially…?

Mark O’Byrne of GoldCore:

You’re right — there [are] no inflationary pressures … right now.

The question is “is that inflation building up?” And I think it probably is.

At the same time gold is not just a hedge against inflation — it’s actually not a really a hedge against inflation per se, it’s more of a hedge against serious inflation and stagflation. It’s also a hedge against deflation.

So when you have a Lehman Brothers moment or a potential “Grexit” there is that significant counterparty risk. And gold — because it has no counterparty risk if you own the actually physical asset — it is actually a hedge against deflation as well.

There is a huge body of academic research that shows that.

The CNBC interview, “Is Gold Becoming ‘Less Sexy’?” can be watched on CNBC here and on Yahoo Finance here

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,209.60, EUR 1,084.36 and GBP 772.60 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,206.75, EUR 1,085.33 and GBP 777.57 per ounce.

Gold climbed $2.00 or 0.17 percent to $1,210.20 an ounce on yesterday, and silver remained unchanged at $17.12 an ounce. Overnight, gold in Singapore continued to flatline and near the end of day trading was steady at $1,209.60 an ounce.

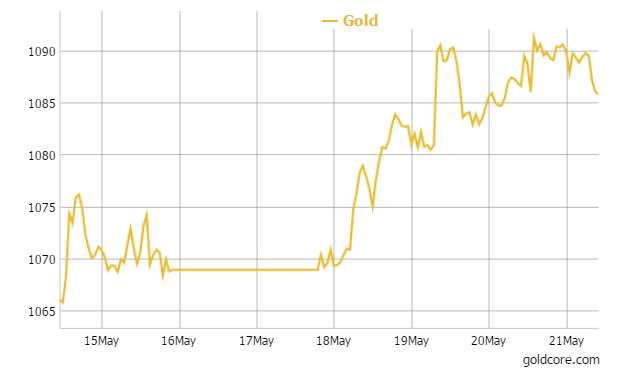

Gold in EUR – 1 Week

Gold remained firm above $1,200 an ounce as yesterday’s Fed minutes contained no new information and showed that a June rate hike would be premature.

In spite of the news, outflows in the world’s largest gold-backed exchange-traded fund, New York-listed SPDR Gold, showed bearish sentiment. The fund holdings fell 0.41 percent to 715.26 tonnes yesterday its lowest in four months. Holdings fell another 2.98 tonnes yesterday, bringing its total outflow for the month to just over 24 tonnes

Recent dollar strength after some positive U.S. economic data has capped gold’s recent rise. A strong dollar makes gold more expensive for holders of other currencies reducing its role as a hedge.

The government of India has released a discussion paper on the gold monetisation scheme that the finance minister had proposed in his budget. The paper outlines that citizens can benefit from a tax-free interest on gold that is deposited with the banks. It proposes individuals and institutions to deposit gold as low as 30 grams.

In the past gold deposit scheme the government only allowed a minimum quantity of 500g of gold. This allows Indians to use their wedding jewellery or other gifts to finance other business endeavours, family loans etc. However, Indians like to take possession of their gold and wear it and keep it in the house due to a distrust of banks.

The new scheme to relieve the Indians of their gold is unlikely to succeed due to their cultural preference to possess their gold — be that coins, bars and especially jewellery.

On the Comex in New York gold futures for June delivery tacked on $1.50, or 0.12%, to trade at $1,210.20 a troy ounce and futures were in a tight range between $1,207.70 and $1,212.30. Silver futures on the Comex for July delivery climbed 9.9 cents, or 0.58%, to trade at $17.21 a troy ounce.

In mid morning European trading gold is up 0.07 percent at $1,210.83 an ounce. Silver is up 0.53 percent at $17.19 an ounce and platinum is unchanged at $1,155.00 an ounce.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.