One of Europe's Latest Debt Nightmares

Stock-Markets / Eurozone Debt Crisis May 22, 2015 - 12:08 PM GMTBy: EWI

Elliott Wave International's European markets expert Brian Whitmer often cautions his subscribers to beware of the pitfalls that will accompany the developing deflation in Europe.

Elliott Wave International's European markets expert Brian Whitmer often cautions his subscribers to beware of the pitfalls that will accompany the developing deflation in Europe.

On May 20-27, Brian is hosting a free 5-video event at elliottwave.com: Investing in Europe: 5 Critical Insights.

"Europe seems to be leading the way on important global trends, so even if you don't invest in Europe, knowing about these trends in advance can help you determine your investment strategy." -- Brian Whitmer

Read some of Brian's recent analysis of Europe's latest debt nightmares from the April issue of his European Financial Forecast, and then register here to join his free 5-video event.

Excerpted from the April 2015 European Financial Forecast (pub date: March 27.)

One big clue to the size of the oncoming debt deflation is the central bank's ongoing policy shift away from bail-outs -- where taxpayers shoulder the losses at a failed bank -- and toward so-called bail-ins, where the losses are dumped onto bondholders. In February 2015, we commented that "the days of unconditional financial rescues are clearly over," and it took almost no time for this forecast to become another hard-hitting reality. Indeed, "Europe's latest debt nightmare" (UK Telegraph, 3/7/15) quickly thumped bondholders in Austria, as its Financial Market Authority refused to cover €10.2 billion in bond guarantees at Heta Asset Resolution (Heta). Heta, itself, was the so-called bad bank created in 2009 to absorb the soured assets of another failed lender, Hypo Alpe Adria. It's the first major banking failure under Europe's new Bank Recovery and Resolution Directive, and it displays nearly every pitfall that we've spent months cautioning subscribers to avoid. Here, for instance, was our September 2014 admonition to senior debtholders at Banco Espirito Santo, who only narrowly avoided losses when the Portuguese conglomerate went belly up (emphasis added):

The terms of the rescue call for BES's junior bondholders to share in the losses with stockholders.... For now, the rescue won't affect senior bondholders or bank depositors, but, like before, this arrangement should change at some point in the near future.

--European Financial Forecast, September 2014

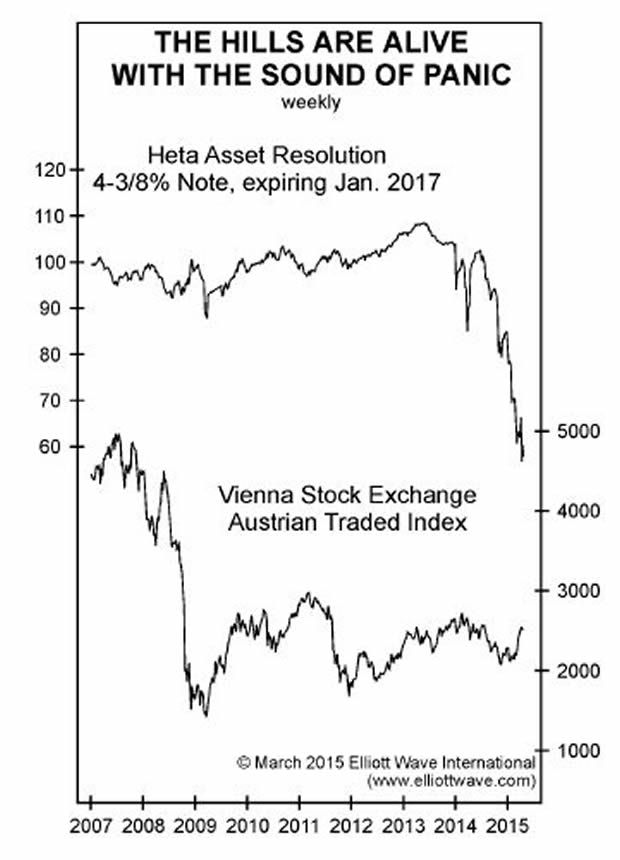

In Austria's case, the near future proved to be closer than we thought, as sources in Vienna tell the Telegraph that "even senior bondholders are likely to face a 50% write-down." The top panel on the chart depicts a 50% nosedive in Heta's 4-3/8% note, expiring in January 2017. These bondholders have become the "first victims of the eurozone's tough new 'bail-in' rules," according to the Telegraph, but they won't be the last. The bottom panel on the chart depicts the long-term decline in Austria's ATX index, and Bloomberg reports that Europe is "awash with interlinked banking and public liabilities, many of which will never be repaid and basically need to be written off."

In fact, financial ripples from the Heta debacle started spreading immediately. On March 16, Germany's association of private banks stepped in to rescue Duesseldorfer Hypothekenbank AG, a real estate lender with €348 million in exposure to Heta. Property lender NordLB reported €380 million in exposure, while BayernLB, the German bank with the largest known exposure, reported €2.35 billion in unsecured credit lines to Heta. Germany's Commerzbank (€400 million in Heta bonds) is considering legal action against Austria's decision, but the potential lawsuit provides little comfort for investors sitting on major losses now.

A Simple Fight Over Money

Austria's debt write-down uncovered more than the weak assets that pervade the books of European banks; it exposed the political rifts that divide the country itself. Indeed, most of Hypo's original bonds were underwritten by the southern Austrian region of Carinthia. When Fitch ratings stripped Austria of its AAA credit rating in early March, finance minister Jorg Schelling took to public radio demanding that Carinthia pay its full share. The following day, Carinthia's premier Peter Kaiser shot back. "Carinthia cannot pay," said Kaiser, observing that the €10.2 billion in debt guarantees amounted to more than five times the region's annual budget. (Deutsche Welle, 3/4/15)

It's true. And with nearly €1 billion in Heta bonds coming due, Austria's Der Standard anticipates that a "flood of lawsuits" will inundate the Austrian courts. The problem is that these floodwaters will keep rising in an environment of sustained deflation. In February 2015, the EU commission revealed that national governments are backstopping more than €1.2 trillion of various forms of debt. At €113 billion (35% of GDP), Austria is one of the biggest users of state guarantees. But Ireland, too, has contingent liabilities that amount to 32% of its economy, and Germany is backstopping debt that equals 18% of national output. Last month, GMP warned about the dangerous interdependence between European banks and their respective sovereign governments. The hazard is fast getting real now.

FREE Event, May 20-27 at elliottwave.com:

|

This article was syndicated by Elliott Wave International and was originally published under the headline One of Europe's Latest Debt Nightmares. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.