Why the Stock Market Will Crash

Stock-Markets / Financial Crash May 26, 2015 - 06:40 PM GMTBy: James_Quinn

“Things always become obvious after the fact” – Nassim Nicholas Taleb

“Things always become obvious after the fact” – Nassim Nicholas Taleb

“Facts do not cease to exist because they are ignored.” – Aldous Huxley

The S&P 500 currently stands at 2,126, fractionally below its all-time high. It is now 300% above the 2009 low and 34% above the 2008 and 2001 previous highs. Most people believe this is the new normal. They are comfortably numb in their ignorance of facts, reality, the truth, and the inevitability of a bleak future. When the herd is convinced progress and never ending gains are the norm, the apparent stability and normality always degenerates into instability and extreme anxiety. As many honest analysts have proven, with unequivocal facts and proven valuation measurements, the stock market is as overvalued as it was in 1929, 2000, and 2007.

Facts haven’t mattered, as belief in the infallibility and omniscience of Federal Reserve bankers, has convinced “professionals” to program their high frequency trading supercomputers to buy the all-time high. If central bankers were really omniscient and low interest rates guaranteed endless stock market gains, then why did the stock market crash in 2000 and 2008? The Federal Reserve’s monetary policies created the bubbles in 2000, 2007 and today. There was no particular event which caused the crashes in 2000 and 2008. Extreme overvaluation, created by warped Federal Reserve monetary policies and corrupt Washington D.C. fiscal policies, is what made the previous bubbles burst and will lead the current bubble to rupture.

Benjamin Graham and John Maynard Keynes understood how irrational markets could be over the short term, but eventually they would reach fair value:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Graham

“The market can stay irrational longer than you can stay solvent.” – Keynes

Graham’s quote reflects the difference between hope and reality. This explains the ridiculous overvaluation of Amazon, Shake Shack, Twitter, Linkedin, Tesla, Google, and the other high flying new paradigm stocks. Story stocks soar because the herd believes the stories peddled by Wall Street and company executives. Five of these six stocks don’t have a PE ratio because you need earnings to calculate a PE ratio. In the long run the market will weigh the value these companies based upon profits and cashflow. It is the same story for the market as a whole. There is no question who is to blame for what now amounts to a three headed hydra of bubbles poised to burst.

The Federal Reserve has simultaneously blown bubbles in the stock, bond, and real estate markets by keeping interest rates at 0% for the last six years, three rounds of QE money printing that created $3.6 trillion out of thin air to prop up the insolvent Wall Street banks, and unending jawboning about inflation being too low as real middle class wages stagnate at 1989 levels. There isn’t a question about whether the bubbles exist, only about how much bigger they will become before bursting again. As John Hussman points out, the financial stability of the world will be endangered when the bubbles burst this time.

“Unfortunately, the Federal Reserve has now created the third financial bubble in 15 years. Focusing on two variables – inflation and unemployment – the Fed has missed the most important consideration: the risk to financial stability. It is the same mistake the Fed made during the housing bubble. This mistake will ultimately end just as tragically. The only question is how much worse the Fed makes the situation in the interim.”

The mouthpieces for the vested interests on Wall Street and slithering around the halls of Congress, roll out their tired storylines about low interest rates supporting ridiculous valuations and corporate profits remaining permanently high because we’ve entered a new paradigm. We’ve heard it all before. Taking extreme risks based upon false economic beliefs, the infallibility of Ivy League educated academic bankers, and delusions of never ending gains produced by Wall Street HFT computers will end in tears for the third time in fifteen years.

The Federal Reserve began lowering interest rates in late 2007 from 5.25% to 2% by September 2008, and then .25% by January 2009. Did that prevent a 50% collapse in stock prices? Did it prevent national housing prices from plummeting by 35% between 2006 and 2010? The main reason stocks bottomed in March 2009 was the FASB bowing down to their masters and revoking mark to market accounting, allowing the insolvent Wall Street banks to pretend they were solvent. The combination of fraudulent accounting, zero interest rates and round after round of QE money printing has propelled this mal-investment mania to epic proportions. Total stock market valuation of $36 trillion now exceeds 200% of GDP. Prior to the Fed bubble blowing era, the total stock market valuation averaged about 50% of GDP.

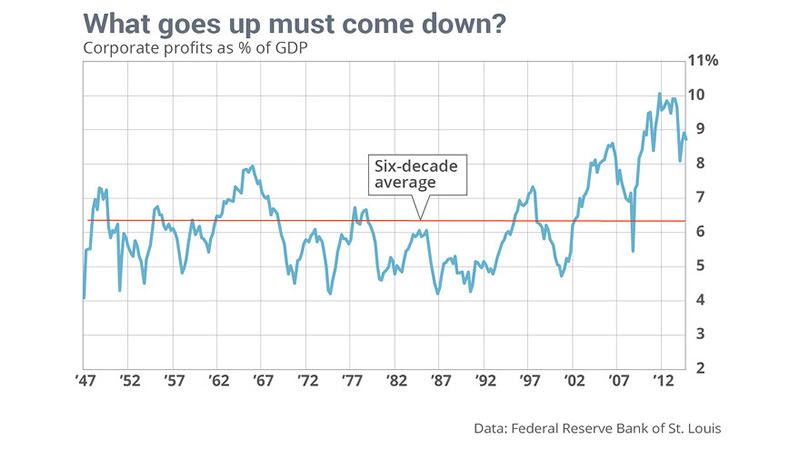

Mark Hulbert, whose job at Marketwatch appears to be writing alternating bullish and bearish articles to keep the public confused, disoriented, and dependent upon hope and central banker heroine injections, produced the chart below showing corporate profits as a percentage of GDP. Corporate profits always revert to their mean. The capture of our economic system by Wall Street and mega-corporations is glaringly obvious in the increasingly higher peaks in corporate profits since the late 1990’s, as the Federal Reserve has provided the Greenspan/Bernanke/Yellen Put for the reckless Wall Street gambling casino and dangerously low interest rates encouraging corporations to issue record levels of debt in order to buy back their stock, fire workers, and ship jobs to low wage slave factories in the Far East.

Corporate profits as a percentage of GDP have averaged 6.3% over the last six decades. They deviate wildly above and below this mean, with peaks attained near stock market highs and valleys at stock market lows. The current level of 8.7% is two standard deviations above the 6.3% long-term average, meaning it is above 95% of all instances in history. Based on history, what are the odds of corporate profits rising to three standard deviations above the mean (99.7% above all instances)? Not good. They have already fallen from the 10.1% high in 2012.

Corporate profits have been juiced by Wall Street using mark to fantasy accounting, loan loss reserve manipulation, risk free Wall Street casino gambling with free money provided by the Federal Reserve, corporations refinancing debt, suppression of wages through global arbitrage by mega-corporations, government entitlement deficit spending, never ending wars in foreign lands enriching arms dealers, and expansion of the surveillance police state throughout every city, town, and hamlet in the good ole USA.

Over the last six decades, when corporate profits edged above 6.3% of GDP, competition from new companies taking advantage of the high profits would result in price drops and eventually lower profits. It was called capitalism. The Great Deformation created by the Federal Reserve Politburo dictates and monetary machinations have disconnected corporate profits and stock market gains from the real world of everyday Americans. The propping up of insolvent banks and allowing poorly run corporations (Sears, Rite Aid, GM) to survive by refinancing debts at insanely non-risk adjusted interest rates, has delayed the creative destruction that is part an parcel of a capitalist system.

Crony capitalism rewards connected corporations and damages the small businesses which are the true jobs creators. Large corporations don’t create jobs, they ship them overseas. More small businesses are closing than opening for the first time in modern U.S. history. Thank the Fed, the feckless politicians in Washington DC who are about to put a final nail in the small business/American jobs coffin with passage of TPP, mega-corporation CEOs, and the billionaire oligarchs pulling the strings behind the curtain, for destroying a once healthy, job creating economic system.

The game is up. The accounting games are over. There are no loan loss reserves left to relieve. Americans with no wage growth are running out of money they don’t have. Corporate revenues are flat or falling. The Fed liquidity machine has been shutdown. Interest rates are likely to rise sometime this year. A global recession is in progress. It’s only a matter of time before Greece officially defaults. Inflation in healthcare costs, food, rent, and other daily living expenses have sapped the vitality from a deteriorating US economy.

Young people are enslaved in student loan debt, priced out of the housing market, and left with burger flipping jobs as Boomers cling to their jobs like grim death. An economy built upon consumer spending and an ever increasing level of debt has run out of consumers capable of spending and has reached the saturation point of debt expansion. The corporate titans of industry, in a last gasp to keep the party going, are buying back their own stocks at all-time highs to the tune of over $300 billion in order to boost their EPS and goose their own bonuses. The best part is they are borrowing to do so, boosting corporate debt to all-time highs. They would not and could not do this if the Federal Reserve wasn’t incentivizing them to do so with phenomenally low interest rates. These financial shenanigans can’t hide the fact that corporate profits are now falling and will continue to fall.

Mark Hulbert does the usual mainstream media faux analysis and concludes it will take five years for corporate profits to fall to their long term average, resulting in a 20% decline in the S&P 500 by 2020. His assumptions are laughable in their cluelessness about how the world really operates. If he analyzed his own chart he would see corporate profits plunge in a one to two year time frame and never stop at the long-term average. Averages are created by data points above and below the mean. As a corporate media pawn dependent on a paycheck from an employer that depends upon Wall Street advertising revenue, Hulbert couldn’t possibly tell the truth.

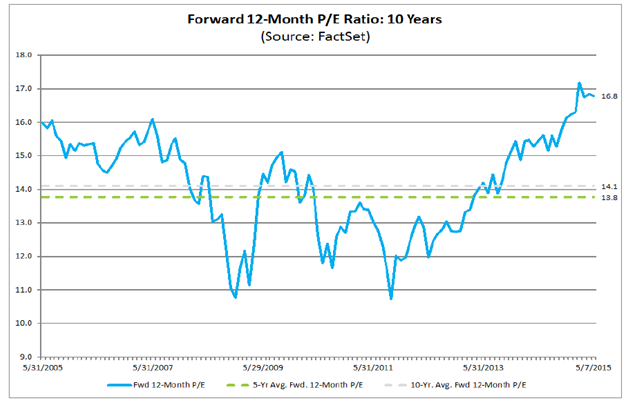

Not only are corporate profits as a percentage of GDP near record highs, P/E ratios are also at record highs (excluding the internet bubble when there was no E). The Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) is now 27, versus a long-term historical norm of 15 prior to the late-1990’s bubble. Importantly, the profit margin embedded into the Shiller P/E is currently 6.7% versus a historical norm of just 5.4%. Hulbert’s assumption that P/E ratios would remain constant as earnings fell, is asinine in its concept. That has never happened in history.

The forward 12 month P/E Ratio, which is always lower because stock analyst “experts” always overestimate earnings, is well above the previous bubble high in 2007. This P/E Ratio will also revert to its mean over the long-term. In the short-term, P/E ratios will also plunge well below the ten year average of 14.1, just as it did in 2008 and 2011 before the Fed re-inflated them with liberal doses on QE. With the QE spigot turned off, interest rates not going lower, and earnings already falling, all that is left is for prices to adjust to reality. Everything done by our leaders in government, banking and the corporate world since 2008 has been wrong. They’ve done the exact opposite of what needed to be done to purge the system of corruption, mismanagement, reckless use of debt, and the men responsible for destroying our financial and economic system. The public has come to believe these people have saved us, when they have really condemned us to a future of chaos, turmoil, pain, default, debasement, and war. Time will prove those who used reason to be right.

“A long habit of not thinking a thing wrong, gives it a superficial appearance of being right, and raises at first a formidable outcry in defense of custom. But the tumult soon subsides. Time makes more converts than reason.” ― Thomas Paine, Common Sense

When the tumult subsides and the herd is forcefully converted to reason through an onslaught of reality and the revelation that the Federal Reserve bankers behind the curtain are nothing but academic puppet hacks for the vested interests, the S&P 500 will be back in the triple digit realm. That may seem like crazy talk, but it is simply basic math and reversion to the mean. When corporate profits as a percentage of GDP fall from the extreme 8.7% level of today to a slightly under average level of 5%, and P/E ratios fall from the extreme level of 16.8 today to previous recent lows of 11 reached in 2009 and 2011, basic math shows the S&P 500 will be trading in the 900 range. That would be a 58% decline. For some perspective, it would still be 35% HIGHER than the March 2009 low. So this certainly isn’t the worst case scenario.

Anyone using logic, reason, historical precedent, facts, and utilizing basic mathematics is declared a doomer in today’s world. The sheep would rather follow assertive idiots than an introspective wise person. We are awash in assertive idiots in control of Congress, government agencies, Wall Street, mainstream media, and the corporate world. The psychopathic lemmings will meet their demise in due time. It will be obvious after the fact.

“It has been more profitable for us to bind together in the wrong direction than to be alone in the right one. Those who have followed the assertive idiot rather than the introspective wise person have passed us some of their genes. This is apparent from a social pathology: psychopaths rally followers.” – Nassim Nicholas Taleb, The Black Swan: The Impact of the Highly Improbable

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2015 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.