Gold Still Waiting

Commodities / Gold and Silver 2015 May 30, 2015 - 06:12 AM GMTBy: Jordan_Roy_Byrne

Gold has been frustrating for bulls and bears since its crash in Q2 2013. In the two years since it has traded in a wide range, frustrating traders and investors. The net result has been nothing but the passing of time. Until Gold breaks above $1300 or breaks below $1150, we will remain in waiting mode. Personally, I believe Gold is far more likely to break lower in the weeks and months ahead. In any case, we are still waiting.

Gold has been frustrating for bulls and bears since its crash in Q2 2013. In the two years since it has traded in a wide range, frustrating traders and investors. The net result has been nothing but the passing of time. Until Gold breaks above $1300 or breaks below $1150, we will remain in waiting mode. Personally, I believe Gold is far more likely to break lower in the weeks and months ahead. In any case, we are still waiting.

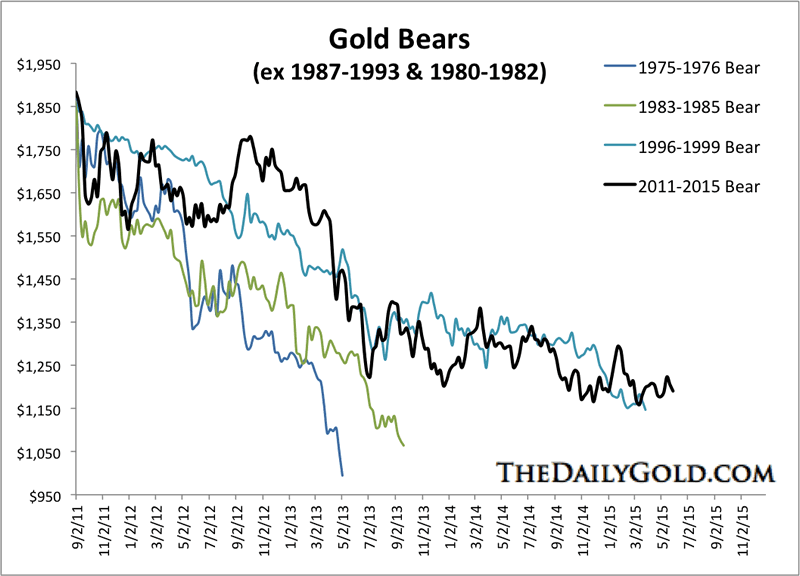

Below is the updated Gold bears analog chart. The chart excludes the extreme bear in terms of time (1987-1993 bear) and the extreme bear in price (1980-1982 crash). The other three bears in the chart provide good context for the current bear which has closesly followed the 1996-1999 bear. Considering only this chart, the $1050 area is a reasonable target.

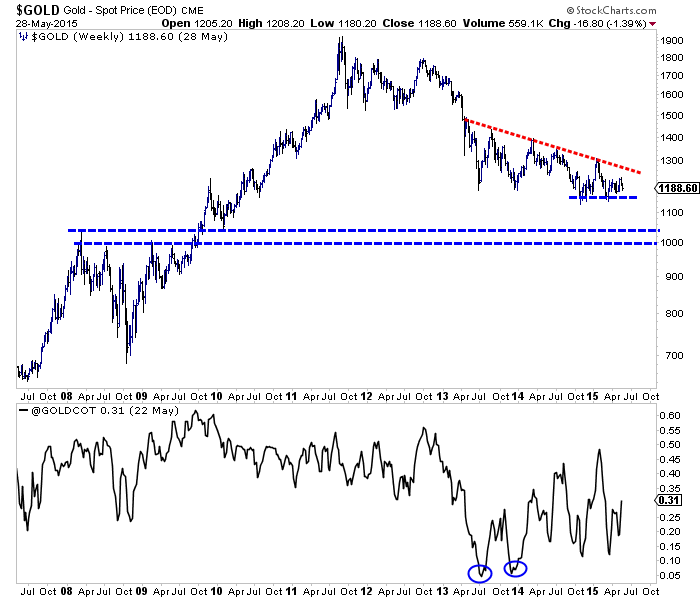

The next chart shows a weekly bar plot for Gold and its net speculative position (as a percentage of open interest) at the bottom. Gold has strong weekly support at $1150 but if that breaks then we can anticipate a move down to stronger support at $1000 to $1050. The net position is at 31% (as of last week) which is very high considering Gold is not yet in a bull market. Too many speculators are left. Two years ago Gold made a low around the same price (~$1200) with

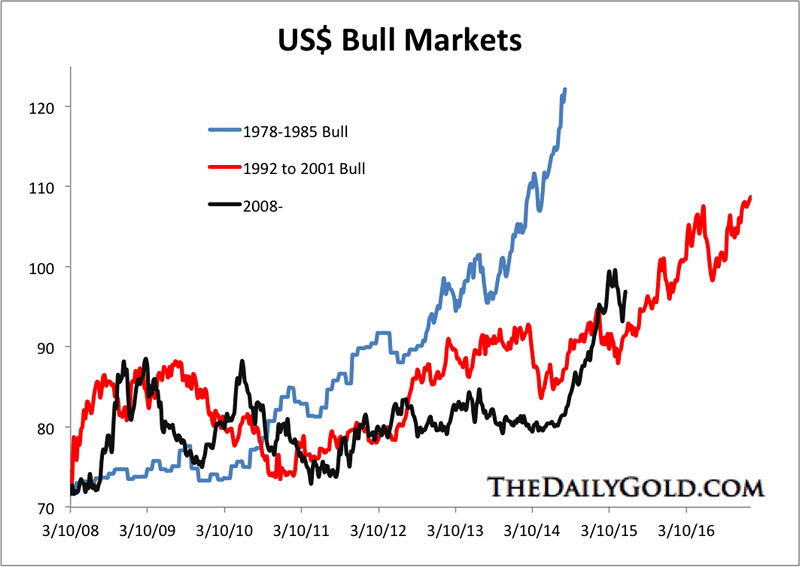

Another reason Gold likely has more downside ahead is the US$ bull market may not be finished. While Gold has held in very well with the rising US$, it failed to rally when the US$ corrected from 100 to 93. If the US$ had put in a major top then precious metals would have surged. This chart argues that the US$ has another push to the upside before it makes a major peak.

We are still waiting for Gold to make its final break lower. In considering history, technicals and sentiment, we have little reason to think Gold will break to the upside. Mind you, we are huge gold bulls and expect a very sharp rebound from the $1000-$1050 area. If and when Gold reaches that area it will do so in a very oversold state with very negative sentiment. The combination of those factors (very oversold, very negative sentiment) meeting with very strong support can produce big rebounds. If metals are heading to new lows then it would likely create one last chance to buy quality junior miners at fire sale prices.

Consider learning more about our premium service including our current favorite junior miners which we expect to outperform in the second half of 2015.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.