Stock Market Wild Swings Coming!

Stock-Markets / Stock Markets 2015 May 31, 2015 - 05:39 PM GMTBy: Brad_Gudgeon

Last time I wrote, the market looked toppy and I was anticipating a 2.5 week low Tuesday (which used to be the dominant 5 week lo). We rallied Wednesday after the expected selling then sold off the rest of the week. I had said that I expected a June 1 top, but after careful study realized that the top would be June 3 instead.

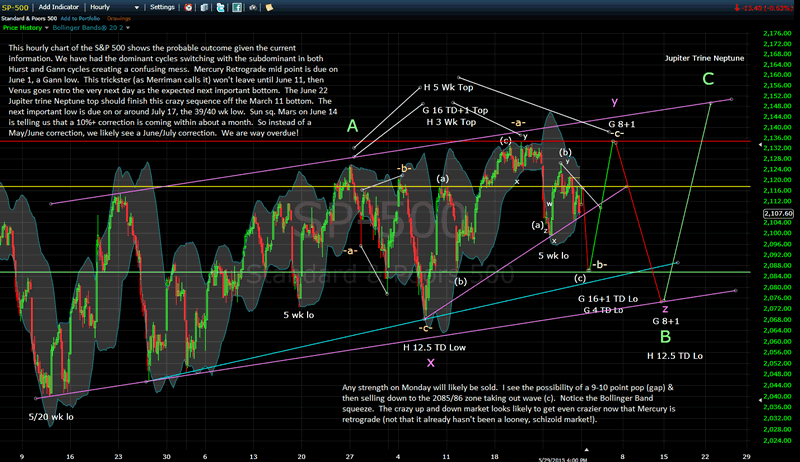

The Mercury Retrograde mid-point low is due 12 calendar days after the initial retrograde point May 18-19, which points to May 30/31 for the low. That means the low will be on June 1 because May 30/31 falls on a weekend. There is also an adjusted Gann 16 TD low due Monday too. I expect initial buying (9/10 pts) on a possible gap up followed by selling down to about SPX 2085/86.

Things look to get wild as we likely rally to slight new highs by June 3 near 2134/35 SPX! This means that after an initial top to bottom drop of about 30 points on Monday, we should see a 50 point rise in less than 2 trading days! Then to make things crazier, we should fall all the way to the 2074/75 area by June 12, interrupted with a huge rally June 8 to June 10. This is the way things have been going with this schizoid market: "I have no place to put my money; stocks are too expensive; buy-sell-buy-sell-buy-sell ad naseum."

I have been expecting a May-June correction, but I no longer think that will be the case. After a huge C Wave rally from June 12 to 22 (Jupiter trine Uranus, not Neptune as I stated in the chart below), we should then begin the long awaited 10% correction into around July 16/17, the actual 39/40 week low from the October 15, 2104 bottom (things may get back to normal yet!). Sun Conj. Mars (not Sun sq. Mars) on June 14 portends the correction within about a month (sorry, I get these planets all mixed up!).

Below is an hourly chart of the S&P 500 with e-wave/cycle denotation (plus lines of resistance):

Silver still looks to be in a down trend that could last into June 8/12. We made good money on a short last week.

I keep saying (and at the risk of being rude I repeat) this is no longer a buy and hold market, but a traders' market. The easy money has been made. There is more risk right now to the down side than potential gain to the upside.

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.