You Don’t Know Where the Stock Market is Heading!

Stock-Markets / Stock Markets 2015 Jun 02, 2015 - 05:20 PM GMTBy: Bob_Loukas

I’ve been of two minds recently regarding the current Cycle picture in equities. So this week I focused more attention on finding secondary evidence to support a more definitive position ondirection. As I suspected it might, my research provided an almost endless array of contradictory evidence and facts.

I’ve been of two minds recently regarding the current Cycle picture in equities. So this week I focused more attention on finding secondary evidence to support a more definitive position ondirection. As I suspected it might, my research provided an almost endless array of contradictory evidence and facts.

The internet and social media are a mixed blessing to researchers – they can lead to a huge number of hypotheses and points of view, but the quality of information is generally pretty low. At its best, however, the internet can lead to ideas and links to compelling analysis and primary sources. The point is that there exists online a mass of data points, ideas, opinions, analyses and thesis that can occasionally help to bring real clarity of thought, but more often, the information serves only to confuse, and even obfuscate. From a trader’s perspective, the information is generally unable to answer the questions that are of greatest import.

This lack of clarity is especially pointed today. We are faced with an equity environment where it is impossible to know what the next 3, 6 or 12 months will hold. The FED and other central banks are meddling in the market in unprecedented ways and at unprecedented levels, all while the market is at its most unpredictable. Equities are in the late stage of a cyclical move, significantly overvalued, but without the huge “blow off” that typically marks the end of a bull market. So the S&P could drop like a stone or rally for 300 points, and neither would be a surprise.

The upshot is that we don’t need, and should not attempt, to predict the next move. Instead, we need to understand and accept the different possibilities that emerge from the market’s position in its cycles. There is power, and peace, in understanding the different possibilities and being ready to take advantage of them.

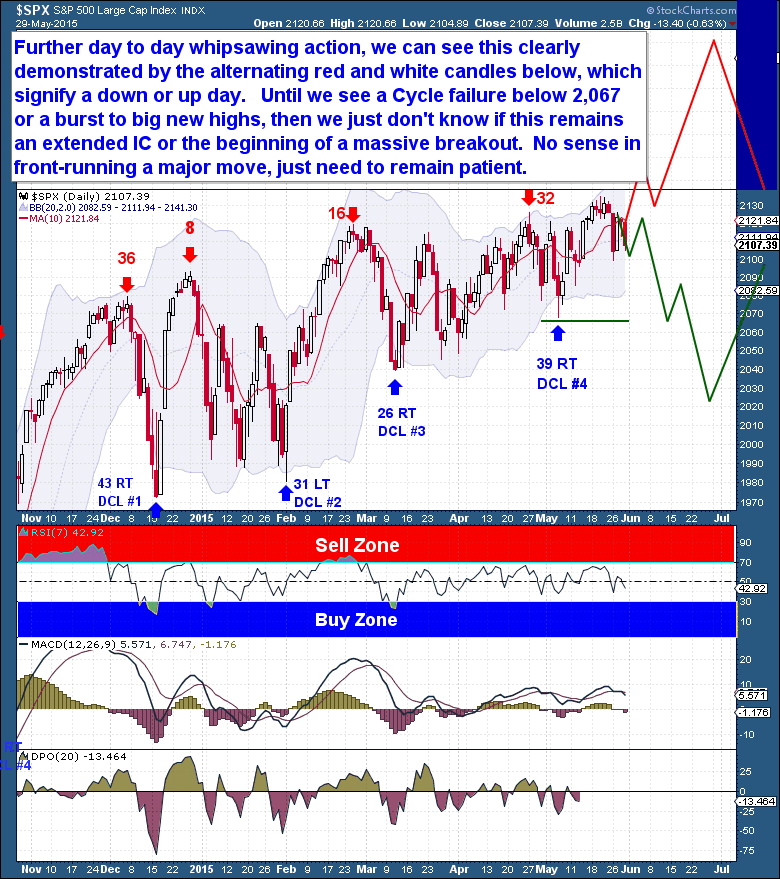

On the daily chart, the whipsawing action has continued. It is demonstrated clearly by the alternating red and white candles (below), each of which signifies a single day, down or up. The market will remain trend-less until we see either a) a Cycle failure (price moving below 2,067) or b) a burst to a convincing new high. Until one of these happens, we won’t know if this remains an extended (declining) Investor Cycle, or the beginning of a massive breakout. There is no sense trying to front-run a major move in either direction. It’s better that we simply remain patient.

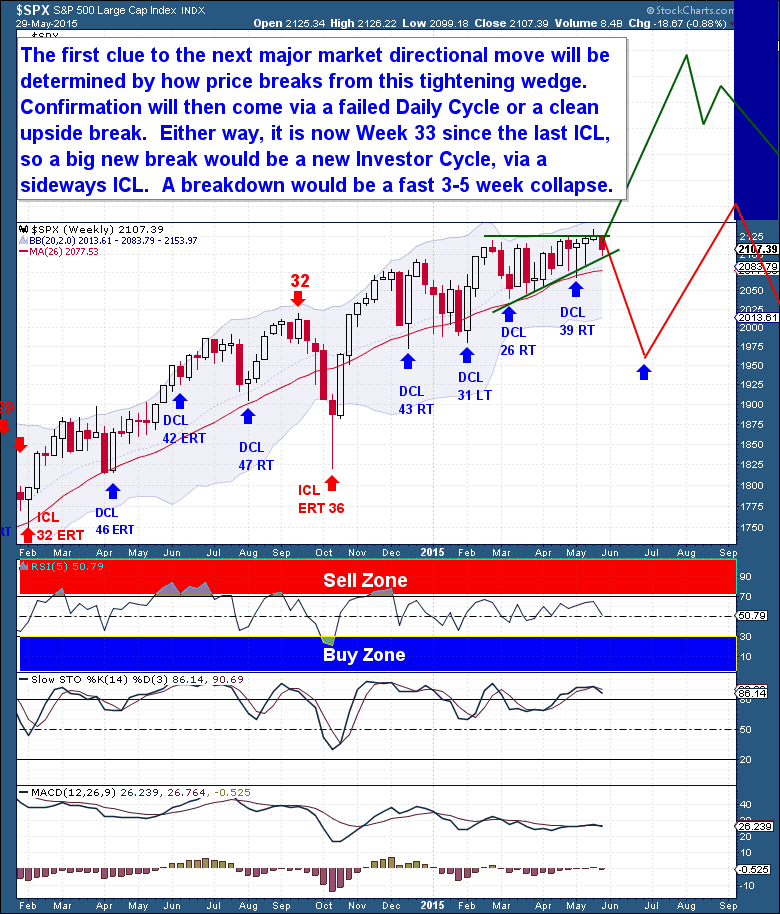

The weekly chart is much more interesting than the daily because it shows that time appears to be running out for this sideways move. Price is being contained by a narrowing wedge, and I’d expect the S&P to begin its next significant move within 1-2 weeks. The first clue on direction will be how price breaks from the tightening wedge, whether it breaks up or down. Confirmation of the move will come via a failed Daily Cycle (< 2,067) on the downside, or a clean break and rally on the upside.

Either way, with Oct 2014 as the last Investor Cycle Low, equities are on Week 33 and (well past) due for an Investor Cycle Low. Therefore, any upside break and rally from this point must mark a new Investor Cycle, and would support the idea that the S&P has been in a sideways consolidation for the past 2 months. They occur rarely, but those are very powerful Cycle Lows, so an upside break, if it comes, should not be expected to top quickly. Alternatively, a breakdown from this point would be a continuation of the October Cycle, likely resulting in a fast 3-5 week collapse into a long and extended ICL.

Possible Trading Strategy

I am convinced that if the market breaks higher it will mark a new Investor Cycle. A breakout would be a sign of a massive new move in a new Investor Cycle, and I would consider buying it with decent size.

Alternatively, a failed Daily Cycle (Below 2,067) would mean that the current Investor Cycle is on week 33 and just 3 to 6 weeks from an extended Investor Cycle Low. The downside will likely be capped, so I don’t expect the October Low to be threatened. There would, however, be plenty of downside potential to warrant taking a Short position.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit: http://thefinancialtap.com

By Bob Loukas

© 2015 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.