Stock Market Set up for a Flash Crash

Stock-Markets / Stock Markets 2015 Jun 05, 2015 - 10:08 AM GMT As I had suggested, SPX impulse down to the double Megaphone trendline. It appears ready for a retracement, but it is hard to tell if it will go much beyond the 50-day Moving Average.

As I had suggested, SPX impulse down to the double Megaphone trendline. It appears ready for a retracement, but it is hard to tell if it will go much beyond the 50-day Moving Average.

Remember, this is the start of a Minute Wave [iii]. Things may get interesting from here, even though it is only less than 2% off the market high. Yesterday’s high may be the top of point 7 in the Orthodox Broadening Top pattern. The opportunity for a flash crash is very high…about 96% once SPX makes its 2nd decline through the trendline.

The next Pivot low may be between June 11 and June 18, which would be 10.75 days and enough for a smaller flash crash (7-8%). Should SPX make it to 1980.00 or lower by then, we may see a sharp rally followed by a deeper crash into the Master Cycle low due on or near July 2 after options expiration.

VIX made a credible show today, closing up nearly 9%, even after a pullback. Again, it is hard to say whether the pullback was sufficient to allow the VIX to immediately resume its ramp in the morning, but the monthly Jobs Report is due at 8:30 am, so further consolidation may be restricted to the overnight futures.

Volatility was up worldwide today. We will be watching the Asian and European markets in the morning for indications of what may come next here.

WTIC wasted no time resuming its decline. It still needs to cross the 50-day Moving Average at 56.50 to confirm the new trend, but all indications are for a continued decline into mid-June with more substantial lows in late July.

Gold declined less than a percent today, but the Head & Shoulders formation suggests another 50 point decline by mid-June.

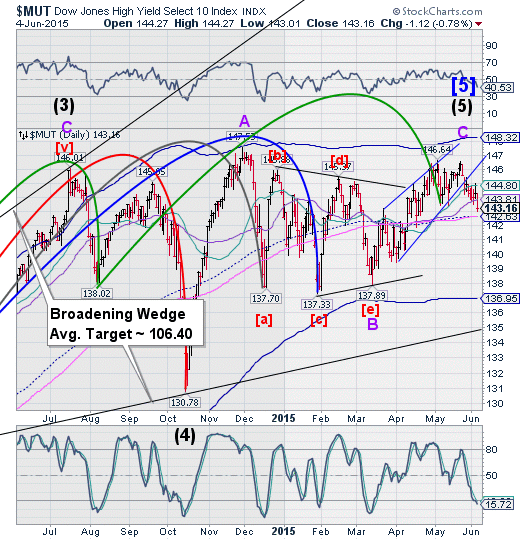

MUT lost its 50-day Moving Average support today as well. Mid-Cycle and the 200-day are just beneath it. It won’t take but another 5% decline to challenge its Cycle Bottom and Broadening Wedge formation.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.