Global Stock Markets Low Expected Towards End of June

Stock-Markets / Global Stock Markets Jun 17, 2008 - 09:54 AM GMTBy: Donald_W_Dony

On April 29, I wrote a research report called "Loaming low in June for equity markets. It is time for increased caution". This article was about the expected major market trough that develops approximately every five to six months. Now that June has arrived, what has happened to the markets? After a weak rise in the first half of May, global stock markets began selling off sharply in the second half of the month. With downward pressure continuing into early June, world financial markets have dropped approximately 7% since mid-May. And with the technical low anticipated by late June, lower numbers can be expected over the next two weeks.

On April 29, I wrote a research report called "Loaming low in June for equity markets. It is time for increased caution". This article was about the expected major market trough that develops approximately every five to six months. Now that June has arrived, what has happened to the markets? After a weak rise in the first half of May, global stock markets began selling off sharply in the second half of the month. With downward pressure continuing into early June, world financial markets have dropped approximately 7% since mid-May. And with the technical low anticipated by late June, lower numbers can be expected over the next two weeks.

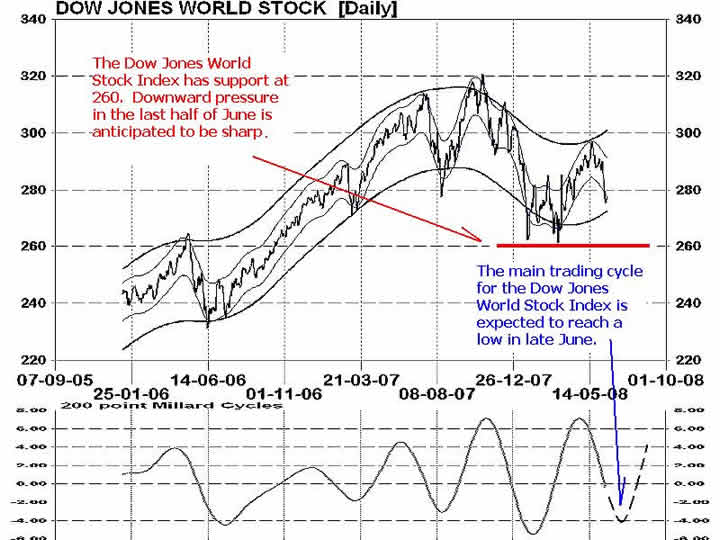

The Dow Jones World Stock Index is a composition of 3,000 companies from 120 countries. This index is an excellent gauge to measure global market movements. Since the forecast in April for the major late June low, world markets (Chart 1) have slowly advanced up to solid resistance levels by mid-May and then started a waterfall drop. Technical models are indicating that this anticipated late June trough will not go below the March lows of 260. In fact, support is likely to occur slightly higher. This expected action suggests a base is building for capital markets which should provide the foundation for a summer rally. Models also indicate that this expected rally in July and August is likely not a spring board to new highs but rather part of a broader consolidation under stiff upper resistance levels. Once this late June low has arrived, the next major trough is not expected until December or January.

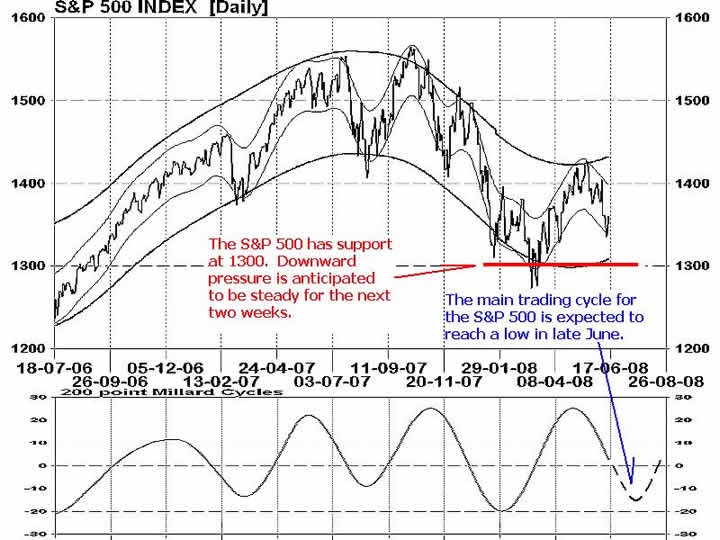

The S&P 500 (Chart 2) has a similar trading pattern to the Dow Jones World Stock Index. After an advance up to the 1420 resistance level in April and early May, selling pressure resumed and began driving the index downward toward the late June low. The target support level is about 1300. Continued weak unemployments numbers, renewed inflationary concerns coupled with declining consumer sentiment and housing prices have removed much of the recent buying from the markets. However, technical models have a similar outlook for the S&P 500 over the summer as the Dow Jones World Stock Index. Upward pressure can be expected into August. This rally is expected to be capped under the resistance line of 1500.

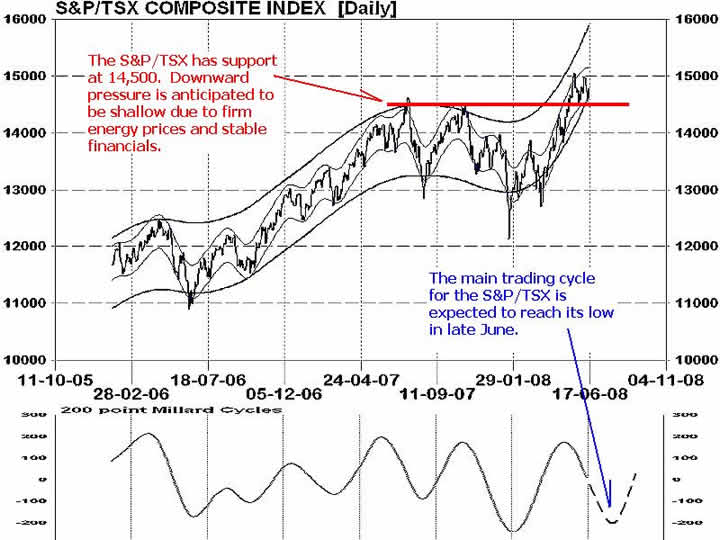

Though the global average in capital markets points to a low in June followed by a limited rally over the summer, not all stocks are created equal. There are four equity markets in the world that have climb to new highs and they are all commodity-based. Canada's S&P/TSX Composite Index is one of those world leaders in performance and it is mainly due to its ability to produce oil and gas. Chart 3 illustrates that, though a June low is still anticipated, support during the next two weeks should develop at 14,500. This high level of price support, compared to the S&P 500 and global markets in general, is generating from world demand for Canada's wealth of natural resources. The upside target for the TSX is 15,500. This number should be achieved cover the summer months. The S&P/TSX Composite, though expected to climb to news highs in 2008, should still move instep with other world stock markets and create another major low in December or January.

Next week's article will be on the banks and forecasting the anticipated bottom.

The April 29th article "Loaming low in June for equity markets. It is time for increased caution" is posted under the Past Weekly e-News Reports. This can be found on the homepage. More research analysis is available in the June newsletter. Go to www.technicalspeculator.com and click on member login.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.