The Dark Side Of The Shale Oil Bust

Commodities / Shale Oil and Gas Jun 17, 2015 - 07:18 AM GMTBy: OilPrice_Com

The fallout of the collapse in oil prices has a lot of side effects apart from the decline of rig counts and oil flows.

The fallout of the collapse in oil prices has a lot of side effects apart from the decline of rig counts and oil flows.

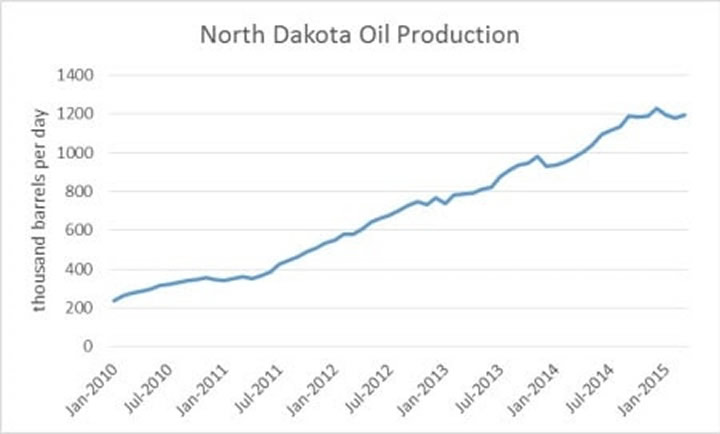

Oil production in North Dakota has exploded over the last five years, from negligible levels before 2010 to well over a million barrels per day, making North Dakota the second largest oil producing state in the country.

But the bust is leaving towns like Williston, North Dakota stretched extremely thin as it tries to deal with the aftermath. Williston is coping with $300 million in debt after having leveraged itself to buildup infrastructure to deal with the swelling of people and equipment heading for the oil patch. Roads, schools, housing, water-treatment plants and more all cost the city a lot of money, expected to be paid off with revenues from oil production that are suddenly not flowing into local and state coffers the way they once were.

Williams County Commissioner Dan Kalil says that a lot of unemployed people who flocked to North Dakota are left in the wake of the bust, something that the local government has to sort out. "We attracted everyone who had failed in Sacramento, everyone who failed in Phoenix, everyone who failed in Las Vegas, everybody who had failed in Houston, everyone who failed in Florida," Kalil said in a June 3 interview with WHQR.org. "And they all came here with unrealistic expectations. And it's really frustrating for those of us left to clean up the mess."

Output is still only slightly off its all-time high of 1.2 million barrels per day, which it hit in December 2014. But more declines are expected with drillers pulling their rigs and crews from the field. Rig counts in North Dakota have fallen to just 76, as of June 12, far below the 130 or so that state officials believe is needed to keep production flat.

Image URL: http://cdn.oilprice.com/images/tinymce/ada2900-min.jpg

But North Dakota was experiencing a lot of the negative side effects of an oil boom even before prices crashed. The massive increase in drilling brought a huge wave of cash and people to once sleepy towns, fueling a boom not only in oil, but also in violent crime, prostitution, and drug trafficking.

Now the state and the federal government are playing catch up with the crime wave.

A joint effort by the federal government and the state of North Dakota is seeking to crack down on crime in the Bakken. The U.S. Justice Department, in conjunction with North Dakota's Attorney General, announced the creation of a "strike force" on June 3 that would target organized crime in the oil producing state. The Justice Department stated that the strike force would be targeted at "identifying, targeting and dismantling organized crime in the Bakken, including human trafficking, drug and weapons trafficking, as well as white collar crimes."

The effort is a direct response to the rise in crime in North Dakota and Montana, which has been fueled by "dramatic influxes in the population as well as serious crimes, including the importation of pure methamphetamine from Mexico and multi-million dollar fraud and environmental crimes."

The Justice Department says that it has had success in Montana with Project Safe Bakken, a 2013 program under which federal and state authorities prosecuted hundreds of cases. The Strike Force in North Dakota is expected to yield similar results, the feds believe.

With the state's economy now almost entirely hitched to the fortunes of the oil industry, they are hoping for a rebound. With several smaller drilling companies having been forced out of the market, the discount that Bakken oil traded for relative to WTI has all but vanished, shrinking from several dollars per barrel down to just cents on the barrel. That could provide a floor beneath the price of Bakken crude, which, in the absence of a dramatic price rebound, is at least helpful for some companies.

The bust may not turn to boom again anytime soon, but with WTI now in the $60 territory, many are hoping the worst is over.

Source: http://oilprice.com/Energy/Oil-Prices/The-Dark-Side-Of-The-Shale-Bust.html

By Nick Cunningham of Oilprice.com

© 2015 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.