Gold and Silver All Eyes on The Half-Year

Commodities / Gold and Silver 2015 Jun 19, 2015 - 04:21 PM GMTBy: Alasdair_Macleod

Window-dressing or the management of prices for a favourable mark-to-market valuation at year-ends, half-years and quarters has long been a distorting feature in financial markets. And, with bank capital adequacy ratios at stake, not to mention traders' bonuses, it has been an increasing feature. With the onset of June 30th it seems reasonable to expect this factor to be a reason why gold and silver prices have generally failed to reflect escalating systemic risk in the face of Greece's insolvency and a developing bear market in bonds. Indeed, losses from bonds are bound to encourage window-dressing of banks' short positions as an off-set, and they are generally short of gold and silver futures contracts.

Window-dressing or the management of prices for a favourable mark-to-market valuation at year-ends, half-years and quarters has long been a distorting feature in financial markets. And, with bank capital adequacy ratios at stake, not to mention traders' bonuses, it has been an increasing feature. With the onset of June 30th it seems reasonable to expect this factor to be a reason why gold and silver prices have generally failed to reflect escalating systemic risk in the face of Greece's insolvency and a developing bear market in bonds. Indeed, losses from bonds are bound to encourage window-dressing of banks' short positions as an off-set, and they are generally short of gold and silver futures contracts.

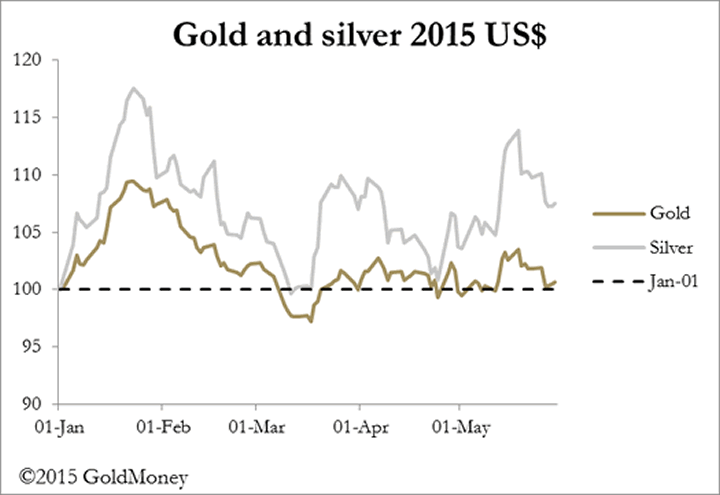

However, the window dressers did not have it all their way this week with gold rallying $30 from last Friday's lows and silver by $0.55c. A look at the markets' internals indicates that commercial traders have instead lowered their short exposure in recent weeks, particularly in silver, potentially limiting the damage from a "Grexit'."

The Fed, which released its monthly FOMC statement on Wednesday, has been forced to back off from an early rise in interest rates. The reason, though not explicitly stated, is bond market weakness last week, which threatened to undermine bank capital adequacy ratios. While US banks can absorb further moderate falls in bond markets, the Eurozone banking system is especially fragile. Short-dated bonds enjoyed a rally from last week's lows, and so have equities and precious metals. In the case of gold and silver it has the look and feel of a bear squeeze forcing wrong-footed hedge funds to cover their shorts.

Greece is now becoming a serious worry. Last night, according to Reuters, ECB Executive Board member Benoit Coeure raised the possibility that Greece's banks might not open on Monday, with the pace of withdrawals by depositors accelerating. This being the case, gold may move decisively above the $1200 level as Europeans are brutally reminded of the risks to their deposits in Italy, Spain and Portugal. On the other hand, a last minute compromise would obviously be bearish short-term for both metals.

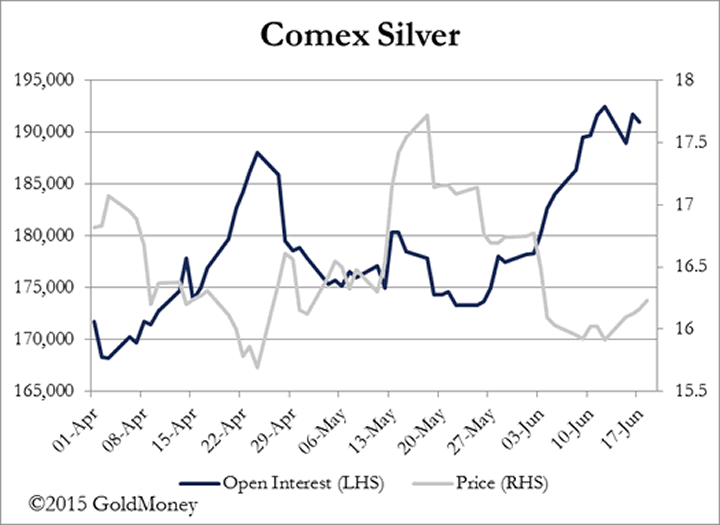

If gold does move sharply higher the effect on silver could be electric. Open Interest on Comex is at record highs, having climbed on a falling price, as shown in the chart below.

In late-May when the price fell from over $17.50 to $16.25, Open Interest started to rise, reflecting increasing accumulation of contracts on further price falls. The short interest has come from hedge funds, which sold down 33,908 contracts (169,540,000 oz), supplied by commercial dealers balancing their positions. This strategy for the hedge funds looked good price-wise until silver refused to stay under $16, but could turn out to be a trap to be sprung by a rising gold price.

In summary, prices in the very near term are going to be decided by Greece this weekend. If a compromise is found, gold and silver will be marked down to the point where physical buyers step in. If Greek banks remain closed on Monday it will be an epiphany for the shorts.

Next week

Monday. Eurozone: Flash Consumer Sentiment. US: Existing home sales

Tuesday. Eurozone: Flash Composite PMI, Flash Manufacturing PMI, Flash Services PMI. UK: CBI Industrial Trends. US: Durable Goods Orders, FHFA House Price Index, Flash Manufacturing PMI, New Home Sales.

Wednesday. UK: BBA Mortgage Approvals., GDP Annualised (3rd Est.). Japan: BoJ Minutes.

Thursday. UK: CBI Distributive Trades. US: Core PCE Price Index, Initial Claims, Personal Income, Personal Spending. Japan: CPI Core, Real Household Spending, Unemployment.

Friday. Eurozone: M3 Money Supply.

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.