First Strike Capability - Gold or War

Commodities / Gold and Silver 2015 Jun 23, 2015 - 11:52 AM GMTBy: DeviantInvestor

We’ll circle back to the first strike later. Let’s frame the problem:

We’ll circle back to the first strike later. Let’s frame the problem:

- The War on Cash: Charles Hugh Smith brings clarity to the issue:

“Why are governments suddenly so keen to ban physical cash? The answer appears to be that the banks and government authorities are anticipating bail-ins, steeply negative interest rates and hefty fees on cash, and they want to close any opening regular depositors might have to escape these forms of officially sanctioned theft. The escape from bail-ins and fees on cash deposits is physical cash, and hence the sudden flurry of calls to eliminate cash as a relic of a bygone age—that is, an age when commoners had some way to safeguard their money from bail-ins and bankers’ control.”

“The benefits to banks and governments by eliminating cash are self-evident:

- Every financial transaction can be taxed

- Every financial transaction can be charged a fee

- Bank runs are eliminated”

- There is a cliff dead ahead: Charles Hugh Smith

“Investors in stocks, bonds, and real estate are being herded off the cliff by the Federal Reserve. The name of the game in the New Normal is to force investors large and small into risk assets. When the risk assets blow up, the herd plunges headlong over the cliff en masse.”

- Officially Sanctioned Nonsense:

From the Wall Street Journal and the IMF:

“The wisest course for some countries – the U.S. among them – would be to do nothing at all to reduce their debt burdens.”

- A Drastic Need For “Greater Fools:”

From the Burning Platform and John Hussman:

“When everyone on Wall Street is using the same algorithms in their HFT supercomputers, and John Q. Public isn’t even in the market, who will these supercomputers sell to when they all get the sell signal at the same time?”

“Investors have responded to zero interest rates by driving stock valuations up to the point where expected market returns over the coming decade are also zero.”

“Once market internals have deteriorated, the exit rule for bubbles is that you only get out if you panic before everyone else does.”

“Frankly, history suggests that a rather ordinary completion to the present market cycle would involve the S&P 500 losing more than half of its value.”

SUMMARY OF THE PROBLEMS:

The stock and bond markets are steeply over-valued, thanks to QE and massive bail-outs. The supercomputers or valuations could crash the market. (If it can happen, it will happen…) When the inevitable correction/crash occurs, the exits will be crowded, the herd will fall over the cliff, a few financial “dead bodies” will float to the surface, and banks will need bail-ins from depositors, so the “war on cash” is designed to force more assets into banks in anticipation of coming bail-ins. Further, the repression of cash will increase bank revenues and government taxes. Banks win, government wins, and the herd loses via: increased taxes, market crashes, bank bail-ins, higher fees on cash and accounts, negative interest rates, and more.

Further, the US dollar is losing international credibility and market share, Asia is creating systems to bypass the dollar in trade transactions, and nobody expects the US dollar or the US military to “go quietly into the night.”

CONCLUSIONS: Since the financial system, stock markets, bond markets, and currencies are primed for a correction/crash, expect severe disruptions (we don’t know when) and eventual market imposed discipline upon global governments and over-leveraged banks. Those governments, banks, and individuals with excessive debt are highly vulnerable while those with the largest stockpile of PHYSICAL gold will weather the storm. War may be “necessary” to create a plausible diversion.

The herd is running toward the cliff, bubbles and mal-investment are ubiquitous, corrections and crashes can’t be delayed forever, and it is better to proactively address the problems rather than react to the inevitable crisis.

Yes, I know. What politician or government wants to admit they lied, spent tax receipts foolishly and created an unsustainable mess? Hence they will probably wait for the crisis, find someone to blame, strip-mine assets from citizens, and continue bad economic policy.

It would be more sensible to admit:

- Yes, mistakes have been made, but let’s move forward in a positive and productive fashion.

- Yes, the current system favors the political and financial elite, but rather than destroy a generation, let’s minimize the damage by reforming now.

- Yes, the tax policy is ridiculous, so let’s reform it.

- Yes, deficit spending and the central bank are at the center of the problems, so let’s fix or abandon both.

- And finally, let’s return to honest money – a modified gold standard.

Let’s Make The First Strike!

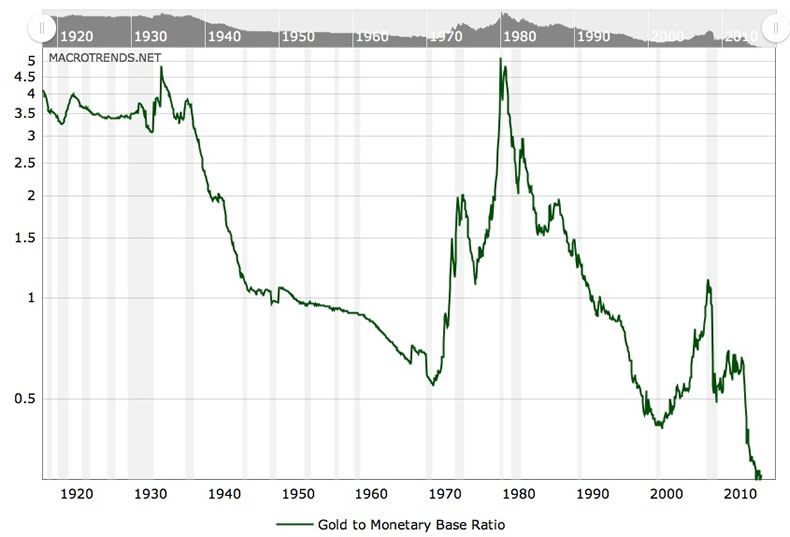

Before the U.S. and the world are FORCED back to honest money, through massive financial and economic trauma, LET’S MAKE THE FIRST STRIKE, revalue the price of gold much higher, back the dollar with gold, and not wait for China or Russia to force the issue on their terms. The gold to monetary ratio shows that gold could be revalued MUCH higher.

Consider the benefits:

After the initial trauma, which would be considerable, economies would adjust, become more efficient, and recover much faster than if we suffer through the inevitable crisis.

A proactive return to a modified gold standard would be more favorable to western powers than if the Asian countries or the IMF forced the west to return to a gold standard. ASIA HAS ACCUMULATED GOLD FOR A GOOD REASON…

If the US made the first move to a modified gold standard, perhaps the US and the UK could avoid an audit of (fictional) gold inventories and not be forced to admit the shortages. The gold imported into Russia, China, and India since 1995 did not entirely come from current mine production. One additional source was almost certainly western sovereign and central bank gold.

There will be blood, inflation, anger, riots, and much more when the financial system resets, but the trauma will be far worse if economic reform is externally imposed by global economics and market conditions.

(And no, I don’t think the US political system, which occasionally can’t even pass a budget, will VOLUNTARILY return to a gold backed currency in the near future. But a return to honest money would be far better than a relapse into global war.)

Paraphrasing Churchill, the US government and the Fed will always do the right thing, after they have exhausted all other alternatives. Sooner would be better than later. A gold backed dollar would be better than most alternatives. It IS possible.

Asian Gold Demand and Attitudes:

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.