Gold Price Target of USD 2,300

Commodities / Gold and Silver 2015 Jun 26, 2015 - 02:24 PM GMTBy: GoldCore

- “Gold remains in secular bull market”

- “Gold remains in secular bull market”

- System is addicted to unsustainable debt

- Persistent deflationary forces threaten system

- Monetary authorities to take increasingly risky measures to engender inflation

- Debt based monetary system is crux of problem

- “All available means” deployed to prevent global government bond bubble from bursting

- Aversion to owning any gold whatsoever displays “ignorance of monetary history”

- Gold’s qualities as store of value and medium of exchange to be “rediscovered”

- Have “gold price target of USD 2,300” in three years

The bull market in gold remains intact and may soon reassert itself according to Asset Managers Incremental in their must read yearly “In Gold We Trust” report.

“We are firmly convinced that gold remains in a secular bull market that is close to making a comeback” the report states.

Incrementum list the most important arguments in favor of diversifying into gold

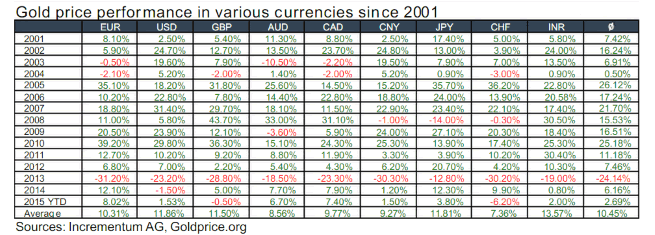

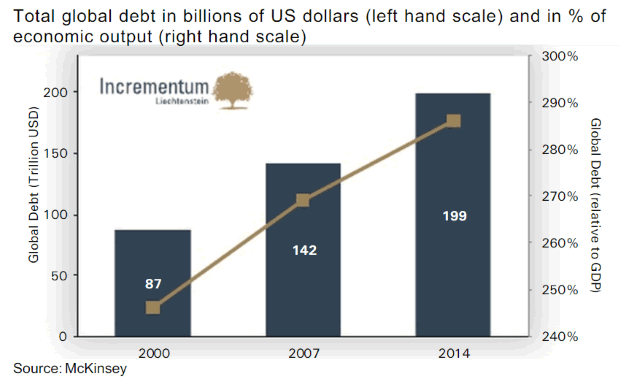

- ► Global debt levels are currently 40% higher than in 2007

- ► The systemic desire for rising price inflation is increasing

- ► Opacity of the financial system – volume of outstanding derivatives

- by now at USD 700 trillion, the bulk of which consists of interest rate

- derivatives

- ► Concentration risk – “too big to fail” risks are significantly higher than

- in 2008

- ► Gold benefits from periods of deflation, rising rates of price inflation

- and systemic instability

- ► Gold is a financial asset that has no counterparty risk

The persistent deflationary pressures we have witnessed since 2011 caused by “widespread, chronic over-indebtedness” threaten the system which requires ever more borrowing to bring cash into being to pay down interest on existing debt.

Relative to the monetary base, the gold price is currently at an all time low. In our opinion, this is a temporary anomaly, which we believe provides an extraordinarily favorable buying opportunity.

Gold’s position is assured because of the total reliance of our debt-based monetary system on unsustainable inflation. The report states that “we have all become guinea pigs of an unprecedented attempt at re-inflation.” QE and negative interest rates “are a direct consequence of a systemic addiction to inflation.”

Low interest rates, the only conventional weapon available to central banks to tackle deflation are no longer adequate as individuals and businesses simply cannot afford to take on more debt.

Therefore, “ever more dubious” measures are being taken – beginning with QE and then negative interests but which Incremental see as possibly leading to financial repression and even a ban on cash.

Incremental point out that it is our current “uncovered debt” monetary system which is at the heart of the problem. “This system requires exponential inflation of the supply of money and credit”. However, given the problem outlined above “the financial system finds itself in an increasingly unstable situation.”

Government bonds are at the heart of this system. The majority of assets held by central banks and institutions are government bonds and therefore the political commitment to prevent the bursting of the enormous bubble in those bonds and the unwinding of the system is unbreakable.

Incremental believes “all available means” will be deployed to prevent a crash.

The report states that gold bullion’s time honoured qualities as a store of value and medium of exchange will be “re-discovered” in coming years.

“Lengthy periods of rising price inflation and negative real interest rates are the main catalyst” for a loss of confidence in paper currencies among the wider public and this is what we can expect in the coming years.

People will then seek something tangible as a store of value.

“Gold is quite cheap relative to stocks and bonds, but also relative to a number of hard assets. As a result, widespread assertions that gold continues to be exorbitantly overvalued are not tenable.”

“Even if one does not share our bullish assessment, an overly critical attitude towards any gold investment whatsoever in our opinion displays ignorance of monetary history.”

Conclusion

The report does an excellent job of bringing together all the empirical data and distilling and crystallizing the bullish case for gold today. Not surprisingly, we share the views of Ronald Stoeferle and Mark Valek and have in recent months highlighted many of the angles they bring together so well.

We also are very close to their price target and have long held the view that gold prices would rise to over $2,400 per ounce, the real, inflation adjusted high from 1980, before this secular bull market is over.

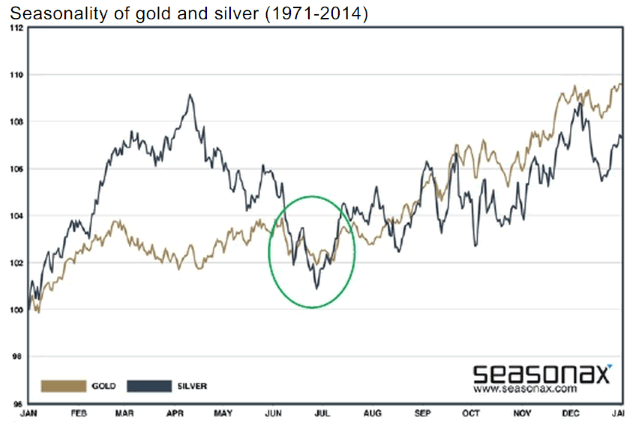

As ever, the report is well worth taking the time to read. It includes many excellent charts that are well worth taking the time to look at in order to better understand the excellent fundamentals of the gold market.

Any open and fair minded individual would have to concede that the report makes an extremely compelling case for a diversification into gold today.

Must Read Guide: Gold Is a Safe Haven Asset

Must Read Report: In Gold We Trust (2015)

MARKET UPDATE

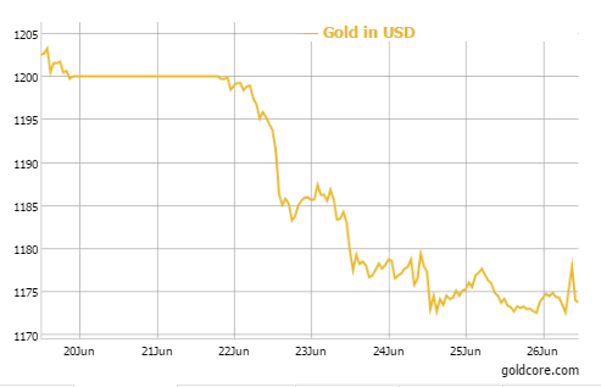

Today’s AM LBMA Gold Price was USD 1,174.40, EUR 1,048.38 and GBP 745.89 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,174.60, EUR 1,052.51 and GBP 748.80 per ounce.

Gold fell $1.30 or 0.11 percent yesterday to $1,173.10 an ounce. Silver slipped $0.03 or 0.19 percent to $15.87 an ounce.

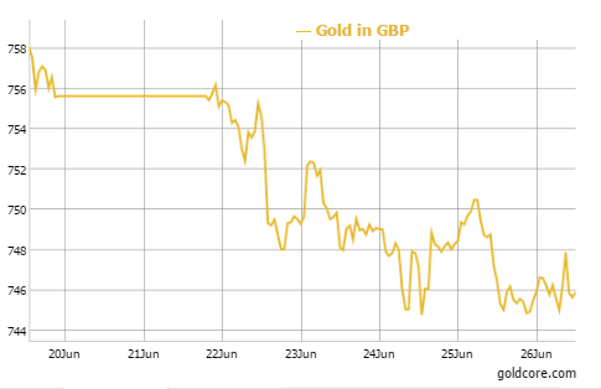

GOLD in USD – 5 Day

Gold in Singapore for immediate delivery inched up 0.3 percent at $1,177.20 an ounce near the end of the day, while gold in Switzerland went a few dollars higher prior to selling pressure capped the gains and saw another correction.

Gold is lower in all major currencies this week. Today, gold is marginally higher over uncertainty with the Greek debt crisis as safe haven investors returned, equity markets dipped and Chinese stocks crashed.

Silver briefly hit a three month low at $15.50 an ounce. Palladium crashed to nearly a two-year low, seeing its largest one day fall since September, on demand concerns.

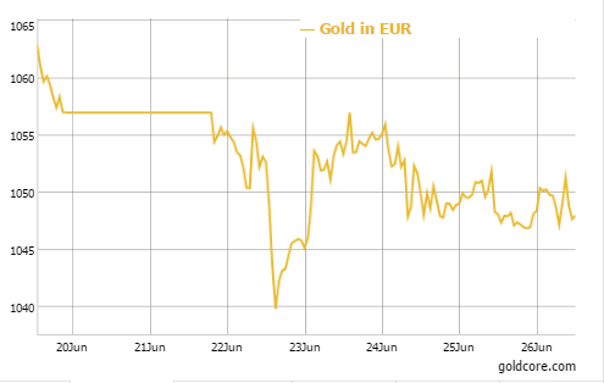

GOLD in GBP – 5 Day

On a weekly basis, palladium is down 4.7%, its biggest weekly loss since mid January and its seventh in a row. Platinum’s actually posted the smallest weekly drop, of just 1%.

Asian and European stocks have fallen sharply. The Chinese stock market crashed 7.4% overnight. They have had the biggest two-week loss in more than 18 years and are close to entering a bear market after extending losses from their June 12 peak to 19 percent in less than three weeks.

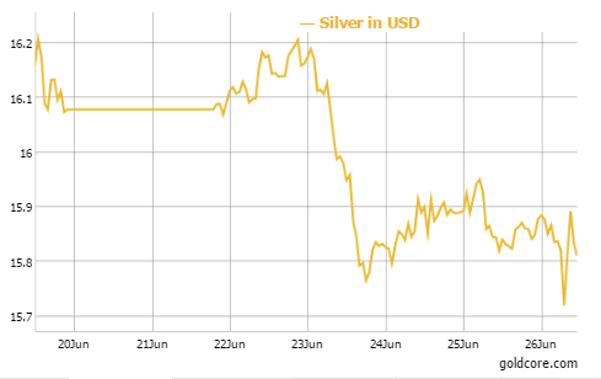

GOLD in EUR – 5 Day

European stocks are down 1%, with investors getting more and more nervous about the complete lack of progress and increasingly entrenched positions in the Greek debt crisis negotiations. We are heading into crunch talks at the weekend and last ditch, ‘make or break’ discussions by euro zone finance ministers will resume on Saturday,

Financial authorities and the Troika have prepared a “Plan B” to protect the euro zone from financial market turmoil. Creditors are trying to force Greece to repay the International Monetary Fund 1.6 billion euros ($1.79 billion) on Tuesday.

Some European bonds also saw losses. Italy’s 10-year bond yield rose four basis points to 2.13 percent, trimming its drop for the week to 15 basis points. The yield on equivalent-maturity Spanish debt increased two basis points to 2.09 percent.

SPDR Gold Shares, the world’s largest gold backed ETF climbed 6.9 metric tonnes yesterday, its biggest one-day increase since February 2nd. That has brought the fund’s weekly inflow to 11.3 tonnes for far, also the biggest since the first week of February

SILVER IN USD – 5 Days

The London Bullion Market Association (LBMA) said on Friday it had granted the Tokyo Commodity Exchange (TOCOM) a licence to use its Good Delivery List as part of TOCOM’s accreditation procedures. The agreement is effective from Friday, the LBMA said, adding that it has had similar deals in place with NYSE Liffe and NYMEX/CME for a number of years. More

Shanghai Gold Exchange volume climbed to a record today as prices declined incentivizing value driven Chinese buyers as Chinese stocks crashed 7.4%.

Volumes for bullion (99.99% purity) traded on SGE rise to a record 48.325m grams from 36.356m a day earlier, according to data compiled by Bloomberg. This exceeds the previous record of 45.717m on March 26.

In late morning European trading, gold is down 0.04 percent at $1,173.95 an ounce. Silver is off 0.47 percent at $15.81 an ounce and platinum is also down 0.36 percent at $1,077.49 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.