Volatility and Sleep-Walking Markets

Stock-Markets / Stock Markets 2015 Jun 29, 2015 - 02:16 PM GMTBy: Raul_I_Meijer

It is with immense pleasure that I can introduce the return to The Automatic Earth of my friend and co-founder Nicole Foss. If only because I myself can now retire to a beach chair…. (not).

It is with immense pleasure that I can introduce the return to The Automatic Earth of my friend and co-founder Nicole Foss. If only because I myself can now retire to a beach chair…. (not).

With the violent swings that have started and been amplified in Asia overnight, as well as in European and US futures, Nicole’s piece on volatility is quite pertinent.

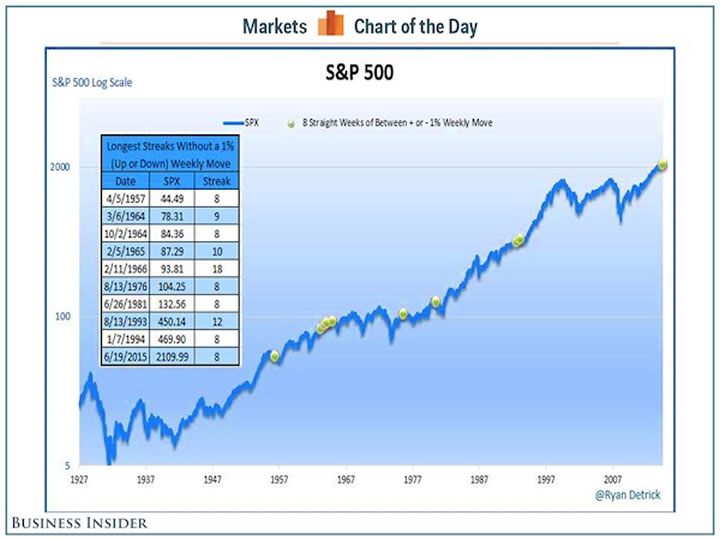

Nicole Foss: A recent Business Insider chart of the day feature was particularly interesting. Called The stock market is asleep, it observed that the US market has been in a period of very low volatility:

Market technician Ryan Detrick noted that it’s been 8 weeks since we’ve seen a weekly move of at least 1% up or down in the S&P 500. That’s the longest such streak we’ve seen in 21 years.

The suggestion in the article is that the market will go on rising until the economy enters a recession, the implication being that a long period of low volatility is a sign of market health. In fact it is quite the opposite. A sleep-walking market is a reflection of complete disregard as to risk.

Markets enter such periods of complacency when there has been a long uptrend, with periods of very low volatility reflecting where the market has come from, not where it is going. Such periods are far more likely to be a sign of an impending trend reversal than of a continued uptrend.

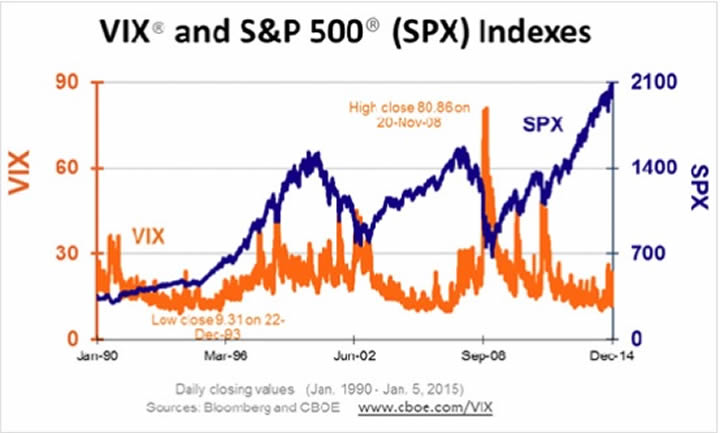

Under normal circumstances, markets can be expected to show more variation, with regular inhalation and exhalation indicative of healthy risk perception. The loss of that pattern, indicating extreme complacency, is a leading indicator of a rude awakening. The VIX index, or volatility/fear index, is at extreme lows, indicating a historic level of complacency. It is no surprise that this coincides with a market extreme.

In short, market sentiment is a very effective contrarian indicator. When fear and volatility are low, there are typically few opportunities left and investors are openly flirting with danger they fail to perceive or acknowledge in their search for returns. Leverage balloons as riskier and riskier bets are made, along with bets on top of bets on top of bets.

Continuance of the prevailing uptrend becomes received wisdom as the combination of optimism and leverage drive the market higher in a self-fulfilling feedback loop. Bears capitulate over time, and as the last holdouts capitulate, the trend reversal become imminent. Risk typically returns with a vengeance, taking market participants by surprise.

The perception of risk shifts dramatically, from complacency to extreme risk aversion, and it can do so very quickly. In fact there already appears to be a shift underway, a mere two days after such an expression of complacency. Volatility and fear go hand in hand, and as increasing fear drives financial contraction and deleveraging, volatility goes through the roof.

The increasing and cumulative risks previously taken begin to manifest, piling on top of each other on the way down. A flood of margin calls overwhelms a mountain of IOUs, rendering them largely worthless. Excess claims to underlying real wealth are destroyed. Ironically, it is at this time that opportunity increases dramatically, for the relatively few who perceive it and are in a position to take advantage of it.

We are approaching just such a juncture at the moment. The long uptrend appears to be finally coming to an end. It is at extremes when it pays most to be a contrarian. Apart from the misinterpretation of low volatility as being good news for the stock market, another misconception is that market corrections are driven by recession.

Causation runs in the other direction. It’s not that a recession causes the markets to fall, but that a market trend change to the downside is a leading indicator of economic recession. Changes in finance, which is largely virtual, happen far more quickly than changes in the real economy.

When the trend change comes in finance, a similar direction change in the real economy can be expected to follow, with a time lag thanks to the longer time constant for change in the real economy. If the downward shift of the last couple of days does indeed mark the long-awaited trend reversal, then economic recession is sure to follow.

There is a substantial potential for the reversals in both finance and the real economy to be very large, as we have been predicting here at TAE for some time. This is yet another high risk juncture. Be careful.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2015 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.