Crude Oil Weakness is Not Gold Friendly

Commodities / Gold and Silver 2015 Jun 30, 2015 - 10:19 AM GMTBy: Dan_Norcini

Amidst all the talk about "Grexit" (are the rest of the readers as sick of hearing about this as I am at this point?), one thing being overlooked, especially by those who keep calling for some sort of rip roaring surge higher in gold and silver, is the fact that crude oil is weakening.

Amidst all the talk about "Grexit" (are the rest of the readers as sick of hearing about this as I am at this point?), one thing being overlooked, especially by those who keep calling for some sort of rip roaring surge higher in gold and silver, is the fact that crude oil is weakening.

In short, with many looking at the situation in Greece as contributing to a hit on economic growth, and with the fact that China is struggling, crude oil is moving lower as traders are concerned over a SLOWDOWN IN DEMAND.

US Dollar Futures Continuous Contract Chart

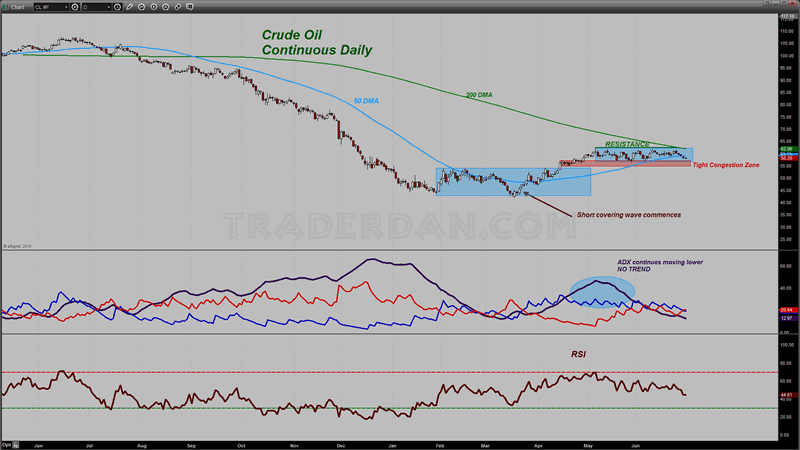

While the market has not broken down as it continues trading within a tight congestion zone, it has fallen down below the 50 day moving average. That is the first time it has done so since its recovery above that key technical indicator since in late March/early April.

Both of the technical indicators I am using on this market are neutral to bearish at this time.

The RSI has been meandering in a sideways pattern below the 60 level since late May. It did manage to hit the 70 level in early May but has since floundered.

I like to key in on this market, much more so than gold, when it comes to getting a sense of what the deflation/inflation battle is shaping up to be. I am also on record as stating that unless inflation is in the forefront of traders' minds, silver is going nowhere.

Without support from a rising crude oil market, which would signify the return of an inflationary bias to the commodity sector, those assets that require an inflationary environment in which to thrive, are going to struggle to sustain rallies.

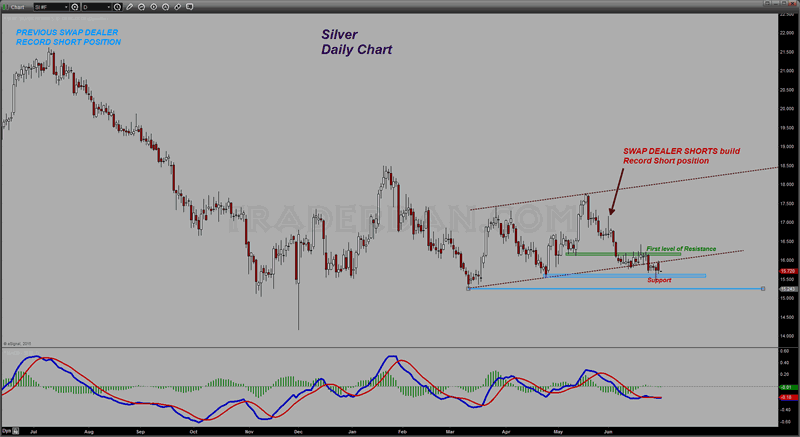

That is being borne out by the silver chart, which in spite of the near-daily breathless comments about record open interest heralding the advent of some sort of stratospheric rally according to the gold (and silver) bugs, continues to go in the path of least resistance, namely down.

Silver Daily Chart

It is barely clinging to support near $15.50 after falling below the rising channel. A close below that level targets the March low near $15.25.

Silver needs an inflationary bias to have any hope of embarking on some sort of bull move. It is that simple. Without such, all of the hot air being expended by the gold bugs about silver this and silver that, all on account of record open interest, would be much better spent powering turbines to produce electricity instead of masquerading as intelligent market analysis. That way, something constructive might actually be produced instead.

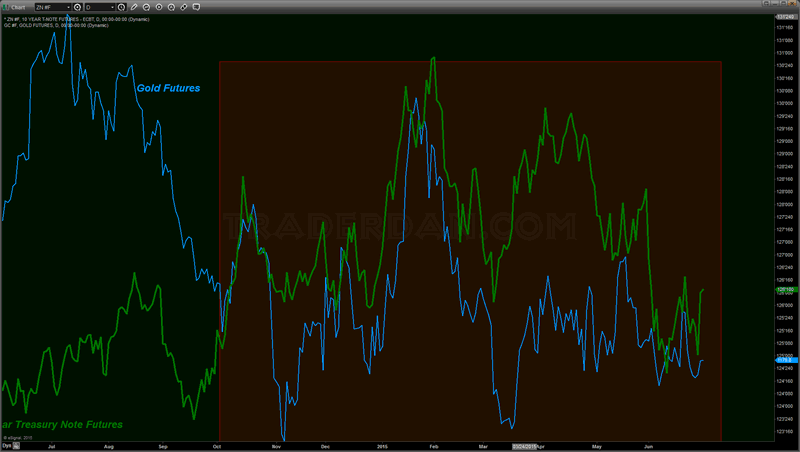

I will leave you with the same chart we have been using here since October of last year to get a sense of the direction for gold.

It continues to mirror the Ten Year Treasury Note futures contract.

Gold Futures and US Treasury Note Futures Chart

Good trading to you all!

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2015 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.