Marc Faber Warns: “Wake Up, People Of The World! Greece Will Come To You …Very Soon”

Stock-Markets / Eurozone Debt Crisis Jul 07, 2015 - 01:26 PM GMTBy: Bloomberg

- World is “over-indebted”, Mark Faber tells Bloomberg

- World is “over-indebted”, Mark Faber tells Bloomberg

- “Defaults will follow or they will have to create very high inflation rates”

- Greece will leave EU or Troika will take 50% “haircut”

- Leaving EU may be Greece’s best option

- Anti-Austerity groups in other countries will be bolstered by Greek defiance – may have negative impact on bonds

- Recent stock market weakness due to weak global economy rather than Greece

- Chinese economy weak, markets could fall further

- Central banks to use Greece and China as excuse to maintain loose policy

- Faber is long-time advocate of holding physical gold

“Wake up, people of the world and investors! Greece will come to your neighbourhood very soon, maybe not this year but next year or whenever…because the world is over-indebted and defaults will follow or they’ll have to create very high inflation rates”.

This was Mark Faber’s message to Bloomberg viewers in an interview yesterday.

In the course of the interview the editor of the Gloom, Doom and Boom report said that if Greece were to leave the EU it would “suffer badly for a few months, maybe longer” due to a shortage in cash but that ultimately it might be in its interest to do so because they would be “basically debt free”. The economy would crash “but the economy has already plunged as a result of the measures and the over indebtedness they have”.

The alternative, as he sees it, is that the Troika will have to make a significant compromise. “Tsipras has proposed a haircut of something like 30%. I don’t think that’s enough, i think they will need a haircut of at least 50%”, he said. He believes that there should be debt forgiveness but the “bloated” Greek government needs to be trimmed or the problem will resurface in the future.

Bonds of weaker nations in Europe have weakened following the Greek referendum because it is believed anti-austerity groups in Spain, Italy and Portugal will be emboldened by the Greek display of defiance. “Greece may be the first country to actually oppose the measures imposed on them by the ECB, by the EU and also by the IMF and more countries may follow”. He points out that “where you have a borrower you also have a lender” and criticises the ECB’s reckless lending to Greece “partly to bail out its own banks”.

He also points out that he thinks recent stock market weakness is more a function of a weakening global economy, particularly in China, than events in Greece. Chinese markets have plunged over 30% since June 12th having doubled in the preceding year. Faber predicted a 40% correction prior to the crash and still holds that view. He believes export figures from its local trading partners into China indicate that Chinese economic growth is now around 4% – “but that’s the maximum”.

He believes that the Fed and the ECB will use the problems in Greece and China to delay raising rates and to print “even more money” respectively although he does not see their actions as having any benign effect on the real economy.

Marc Faber is a long-time advocate of owning physical gold which action he describes as being “your own central bank”. If his predictions are correct – that defaults and/or very high inflation are on the horizon globally an allocation to gold is academically proven to serve as vital financial insurance.

Must Read Guide: Gold Is A Safe Haven Asset

MARKET UPDATE

Today’s AM LBMA Gold Price was USD 1,166.25, EUR 1,063.22 and GBP 752.10 per ounce.

Yesterday’s AM LBMA Gold Price was USD 1,164.25, EUR 1,053.43 and GBP 748.43 per ounce.

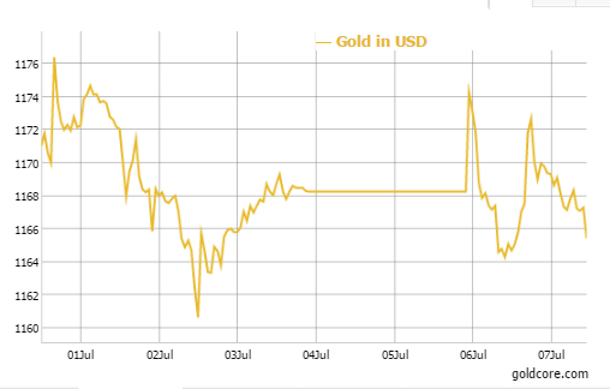

Gold in USD – 5 Day

Gold climbed $3.30 or 0.28 percent yesterday to $1,168.90 an ounce. Silver rose $0.04 or 0.26 percent to $15.69 an ounce.

Gold in Singapore for immediate delivery edged down 0.1 percent to $1,168 an ounce near the end of the day.

Gold remained firm in spite of the lack of strong safe haven bids despite the Greek “no” vote.

Greece will be given yet another chance to propose new reforms to their creditors today in Brussels.

A failure to meet an agreement means an exit from the euro.

German Chancellor Angela Merkel has stated that time is running out for the Greeks.

In late morning trading gold is down 0.35 percent at $1,165.23 an ounce. Silver is down 0.70 percent at $15.60 an ounce and platinum is also down 0.75 percent at $1,053.00 an ounce.

This update can be found on the GoldCore blog here.

Stephen Flood

Chief Executive Officer

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.