Stock Market New Uptrend Underway?

Stock-Markets / Stock Markets 2015 Jul 11, 2015 - 07:39 PM GMTBy: Tony_Caldaro

Volatile week. The market started the week at SPX 2077. On Monday it traded down to SPX 2057 before rallying to 2079, only to drop to 2044 on Tuesday before rallying to 2084. On Wednesday the market headed down to SPX 2045, before rallying to 2074 and then dropping to 2051 on Thursday. Friday the market rallied to SPX 2081, then closed the week unchanged at 2077. One to two percent swings nearly every day, after weeks and weeks of less than one half percent daily swings. For the week the SPX/DOW were mixed, the NDX/NAZ were -0.25%, and the DJ World was -0.8%. On the economic front negative reports outnumbered positive ones for the first time many weeks. On the uptick: ISM services and wholesale inventories. On the downtick: consumer credit, the WLEI, the MMIS, plus the trade deficit and weekly jobless claims both increased. Next week’s reports will be highlighted by Industrial production, the CPI/PPI, Retail sales and the Beige book.

Volatile week. The market started the week at SPX 2077. On Monday it traded down to SPX 2057 before rallying to 2079, only to drop to 2044 on Tuesday before rallying to 2084. On Wednesday the market headed down to SPX 2045, before rallying to 2074 and then dropping to 2051 on Thursday. Friday the market rallied to SPX 2081, then closed the week unchanged at 2077. One to two percent swings nearly every day, after weeks and weeks of less than one half percent daily swings. For the week the SPX/DOW were mixed, the NDX/NAZ were -0.25%, and the DJ World was -0.8%. On the economic front negative reports outnumbered positive ones for the first time many weeks. On the uptick: ISM services and wholesale inventories. On the downtick: consumer credit, the WLEI, the MMIS, plus the trade deficit and weekly jobless claims both increased. Next week’s reports will be highlighted by Industrial production, the CPI/PPI, Retail sales and the Beige book.

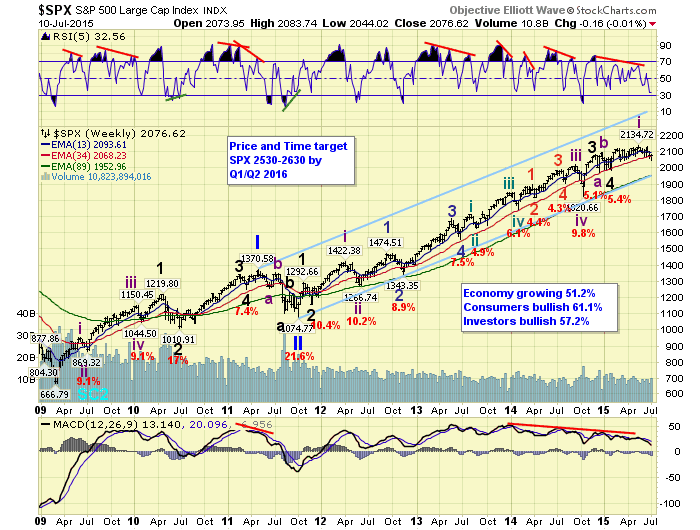

LONG TERM: bull market

As the correction in the SPX/DOW hit new lows this week, and the NDX/NAZ confirmed downtrends, the bearish market pundits were out in force. On Wednesday the CBOE put/call ratio hit its highest level since the 9.8% October correction. While this correction is down only 4.3%. Plus the VIX, more a measure of volatility, hit its highest level since the more moderate 5+% January correction. Usually, the more the daily MACD drops the more bearish traders become. The daily MACD hit its lowest level since October on Thursday. A multi-month trading range market has a tendency to reset momentum indicators closer to neutral. Then any correction easily forces them into negative territory.

Longer term we do not see any reason to change the current count nor the long term projections. We continue to label this market as a five Primary wave, Cycle [1] bull market. Primary waves I and II completed in 2011, and Primary III has been underway since then. Primary I divided into five Major waves with a subdividing Major wave 1. Primary III is also dividing into five Major waves, but with a subdividing Major wave 3 and an expected subdividing Major wave 5. Major wave 5 has been underway since the double bottom Major wave 4 low in late-2014 to early-2015.

When Primary III does conclude we would expect the largest correction since 2011 for Primary IV. Then a Primary wave V to new highs. With the ECBs EQE program underway until at least late-2016, Primary III is not likely to top until Q1/Q2 2016. Our target for Primary III is SPX 2500+ during that timeframe.

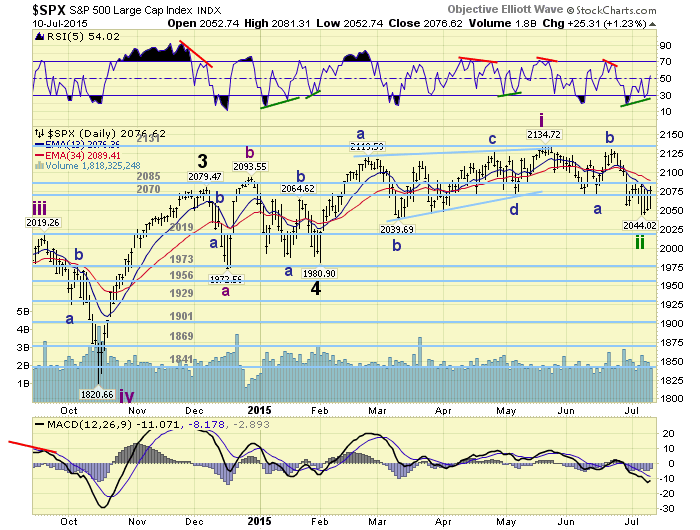

MEDIUM TERM: uptrend trying to get going

This volatile week displayed a couple of events we had been expecting for this downtrend. First the SPX did decline into the 2040’s on Tuesday and Wednesday. Second the NDX/NAZ finally confirmed a downtrend this week as well. Typically, during this bull market, downtrend confirmations are often within days of the downtrend low. This is the reason we thought it was important that the NDX/NAZ confirm a downtrend. Even though the SPX/DOW confirmed their downtrends a month ago. The NDX/NAZ had their lows for the downtrend on Tuesday/Wednesday. Let’s see if they hold.

We counted the downtrend in the SPX as an a-b-c Intermediate wave ii. The uptrend from early-February to mid-May appears to be a leading diagonal triangle Intermediate wave i. The low hit this week at SPX 2044 was within four points of a 0.618 retracement of that entire uptrend, and within four points of the B wave of that triangle. With an oversold condition on the MACD, and a positive divergence on the RSI, it looks like a good setup to start the next uptrend. Notice the last two downtrends, December and February, spent a few days bouncing off the lows before kicking off to the upside. This downtrend appears to be doing the same. Medium term support is at the 2070 and 2019 pivots, with resistance at the 2085 and 2131 pivots.

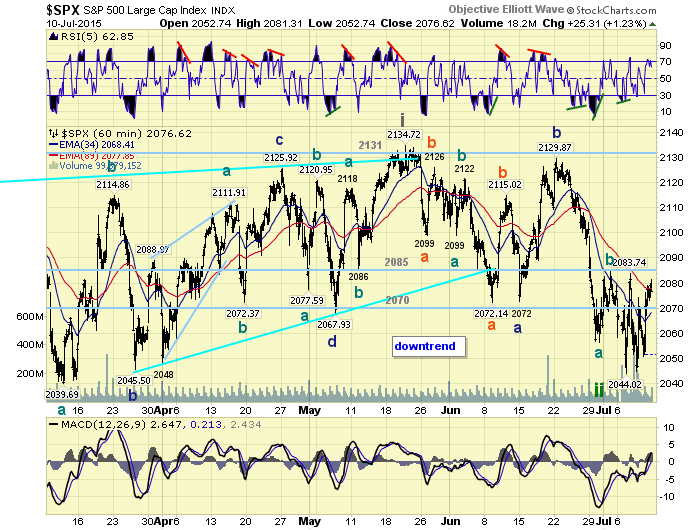

SHORT TERM

After months and months of choppy sideways to upward market activity it might be time for an impulsive uptrend again. Especially since we are expecting this potential uptrend to be a third wave: Intermediate iii. During the correction we counted a complex zigzag Minor wave a to SPX 2072, a sharp simple Minor b zigzag to SPX 2130, then another complex zigzag for Minor c at the recent low of SPX 2044/45.

After that low the market remained volatile, which is often the case. Rallying to SPX 2074 on Thursday, after a gap up opening, then dropping to 2051. Friday offered another gap up opening, which took the market to SPX 2081. Thus far we count three waves off the low: 2074-2051-2081. Should an uptrend indeed be underway we would expect the market to clear the OEW 2085 pivot next (2078-2092). If the downtrend needs more time to complete, a retest of the SPX 2040’s would be next or worse case the 2019 pivot. Thus far we favor an upside breakout. But with all the economic events next week one can never be completely certain. Best to your trading!

FOREIGN MARKETS

Asian markets were all lower for a net loss 0f 2.6%.

European markets were all higher for a net gain of 1.6%.

The Commodity equity group were all lower losing 2.0%.

The DJ World index continues to downtrend and lost 0.8%.

COMMODITIES

Bonds remain in a downtrend but finished the week flat.

Crude is also in a downtrend and lost 6.7% on the week.

Gold continues to downtrend and lost 0.6%.

The USD is in an uptrend but lost 0.2%.

NEXT WEEK

Monday: the Treasury Budget at 2pm. Tuesday: Retail sales, Export/Import prices and Business inventories. Wednesday: the PPI, NY FED, Industrial production, the FED’s Beige book and Congressional testimony from FED chair Yellen. Thursday: the ECB, weekly Jobless claims, the Philly FED, NAHB housing, and Senate testimony from FED chair Yellen. Friday: the CPI, Building permits, Housing starts and Consumer sentiment. Best to your weekend and week!

CHARTS: http://stockcharts.com/public/1269446/tenpp

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2015 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.