8 Unprecedented Extremes Indicate a Stock Market Bubble in Trouble

Stock-Markets / Stock Markets 2015 Jul 17, 2015 - 02:40 PM GMTBy: EWI

This article was adapted from Robert Prechter's June 2015 Elliott Wave Theorist. For more charts and detailed commentary, analysis and forecasts from Prechter's latest issues, click here for the extended subscriber version of this report -- it's free.

This article was adapted from Robert Prechter's June 2015 Elliott Wave Theorist. For more charts and detailed commentary, analysis and forecasts from Prechter's latest issues, click here for the extended subscriber version of this report -- it's free.

It is amazing to read assertions from the Fed and others that the stock market is nowhere near being in a bubble. Several aspects of the financial environment are actually so extreme as to be unprecedented. Some indicate a bubble, and others a bubble in trouble.

Below are eight indicators we are watching closely, among others.

1) Record debt in U.S. dollars

Total dollar-denominated debt peaked at $52.7 trillion in early 2009. At the end of Q1 2015, it stands at $59 trillion, an unprecedented amount.

2) Margin Debt at All-Time Highs

Never have more trading-account owners owed so much money, and never have they had such a low level of available funds from which further to draw.

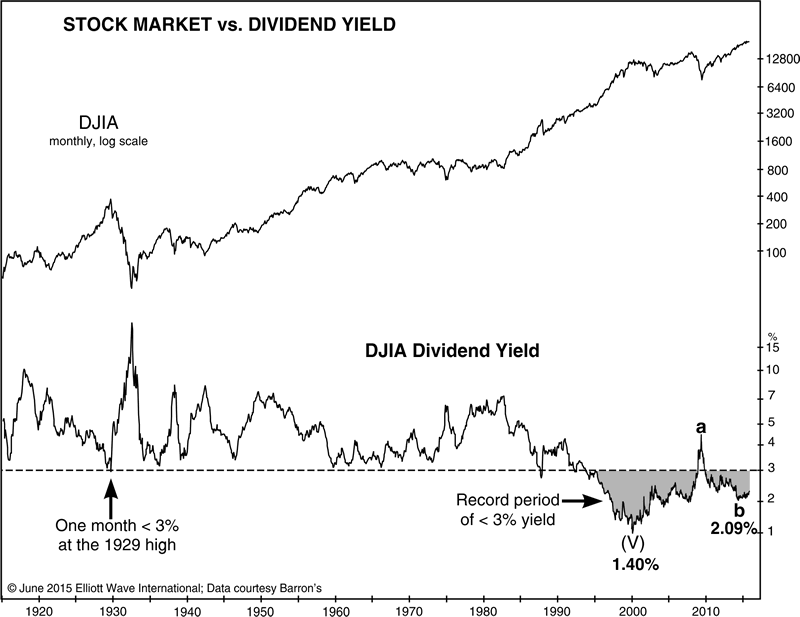

3) Stocks Are Overvalued (based on dividend yields)

The Dow's annual dividend payout has been less than 3% for 235 out of the past 246 months. Prior to the bull market that started in 1982, the longest duration under 3% was just one month, at the top in 1929.

4) Fund Managers Are Maxed Out

The percentage of cash in mutual funds has been below 4% for all but one of the past 70 months (a period of nearly six years). Prior to this time, the longest such duration was only nine months, a streak that ended in October 2007.

5) Stocks are at a Triple Extreme

Previous triple manias occurred in 1901/1906/1909 and 1965/1968/1972, and both led to severe bear markets. This one is even bigger and has lasted longer.

6) Stocks Rose on Low Volume for Six Straight Years

Such a thing has never occurred before -- one year, maybe, but not six.

7) Unprecedented Divergence Among Major Indexes

On May 20, we published an interim issue of The Elliott Wave Theorist to tell subscribers:

Today something amazing happened: The Dow Transports closed at a 6-month low on the same day that the S&P 500 made an all-time intraday high. I doubt this has ever happened before.

The Dow Theory non-confirmation between the Dow Industrials and Transports is now [more than] six months old. This big a divergence, for this long a time, is very bearish.

8) Advisor Bearishness at 38-Year Low (optimism near record high)

The 30-week moving average of the percentage of bears among stock market advisors is at a 38-year low. (Investors Intelligence data is inverted to show optimism.)

This article was adapted from Robert Prechter's June 2015 Elliott Wave Theorist. For more charts and detailed commentary, analysis and forecasts from Prechter's latest issues, click here for the extended subscriber version of this report -- it's free.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.