Why Corporate Earnings Season Is the Most Wonderful Time of the Year for Traders Like Us

Companies / Corporate Earnings Jul 20, 2015 - 01:15 PM GMTBy: ...

MoneyMorning.com

If you've traded for more than a few months, you've seen how earnings season can really move share prices – in both directions.

If you've traded for more than a few months, you've seen how earnings season can really move share prices – in both directions.

If you hold, say, a blue chip and it hits on earnings, you can book some nice single- or double-digit gains. Or, if there's a miss, you might take a loss.

In fact, earnings season trading is one of the most volatile strategies you can use. It's not for the faint-hearted.

But I'm going to show you a simple trade that you can use to leverage earnings news – good or bad – to make fast (and safe) triple-digit gains. And you can do it with some of the biggest, most liquid stocks on Wall Street.

Now is the perfect time to do it. My "money calendar" is flush with opportunities coming up this trading week ending July 24.

So, let's "scout" my earnings chart to see exactly where our next winning trade is…

The Most Profitable Time of the Year

For the past 25 years, as an author, radio and TV personality, and co-founder of one of the biggest financial education companies in the world, I've been in the trenches.

I spend earnings season "deep in the data," including data that virtually no one else has, like how earnings affect share prices before and after the report. And you can bet I spend entire weekends before earnings releases poring over the numbers.

That might sound boring, but the truth is, for traders like me, earnings season is like Christmas, the Fourth of July, and a birthday, all rolled into one. The excitement is palpable, because I know action and profits are just around the corner.

Let's have a look at some of that data I was talking about…

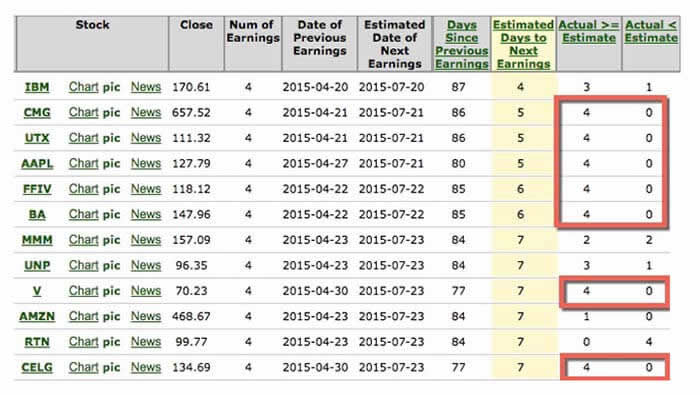

This chart above is ranked by the estimated next days to earnings, taken on July 16, 2015.

The boxes that I have highlighted in red are the past reports when companies have either hit or beaten the estimate. Data like that is easily obtainable with a bit of work.

But this next chart is where things get quite a bit more interesting…

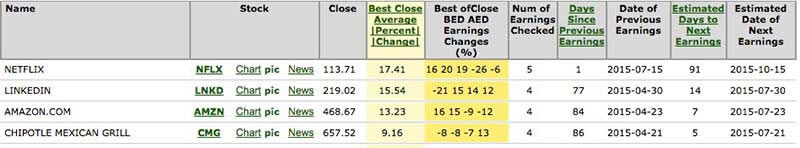

This small list above is the top stocks that have the best closing average immediately following earnings.

For instance, Netflix Inc. (Nasdaq: NFLX), which has already reported, now averages a 17% change through its last five reports.

The next three are due up next week. Now, remember when I said it wasn't the earnings number so much as the reaction following the number?

Our Triple-Digit Earnings Season Trade

Have a look at what's happening with Chipotle Mexican Grill Inc. (NYSE: CMG)

This stock has had an average 9.16% move in the last four quarters, and the most recent three quarters has seen the stock drop after earnings.

That means the pattern is down, so I see a 9% target.

Here's how the pros trade on that information.

Now, as an options trader I like to buy low volatility and sell high volatility, but in this case it looks as if volatility will already be high before I put the trade on.

That's where the "loophole trade" comes in.

Remember, we are looking for a downward move with Chipotle's shares.

Look how expensive these puts are. That price gives us an idea of just how much traders are looking for CMG to move after earnings.

The CMG July 24 $650 (CMG150724P00650000) puts Friday are trading for a whopping 18.10, that's $1,810 for a one-week option!

But… if CMG shares roll over again to the tune of -9%, that would easily double this option's value.

However, we want to take a more conservative approach to earnings trading, which is why I love the loophole trade. It allows us to finance the option we are buying with an option we are selling.

So we want to create a loophole that profits from a move down.

The trade above involves buying the higher strike CMG July 24 $650 (CMG150724P00650000) puts…

…And selling the lower strike CMG Jul 24 $640 CMG150724P00640000) puts that expire this week – but not for $1,810, only for $410.

Now, even if Chipotle moves down just 5%, it could represent a 143% gain!

Trades (and profits) like that are why I think earnings season and all that data is so exciting.

You don't have to wait for earnings season to make triple-digit winning Power Profit Trades like this. In fact, Tom publishes his research twice every week, and you can get it at no charge. Just Click here. You'll even get his latest pro trading report on how to make a 100% gain on one of the world's biggest companies in less than a month.

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.