Are Free Markets The Solution?

Stock-Markets / Financial Markets 2015 Jul 22, 2015 - 08:55 AM GMTBy: Harry_Dent

You’ve probably seen the Jack Link’s Beef Jerky commercials where unsuspecting campers think it would be fun to mess with Sasquatch – an eight-foot tall, 400-lb. freak of nature.

You’ve probably seen the Jack Link’s Beef Jerky commercials where unsuspecting campers think it would be fun to mess with Sasquatch – an eight-foot tall, 400-lb. freak of nature.

I like these commercials. What kind of idiot thinks they can get away with that?

When you mess with Mother Nature, she knocks you out with a fist to the face or a kick in the ribs.

And yet it’s a lesson the financial markets are setting themselves up for today – you can’t manipulate the free markets without very serious ramifications.

The latest installment in this much-dragged-out drama is the Chinese. They’ve created a $486 billion fund to buy their own stocks to keep them from crashing. And that’s on top of telling major investors and pension funds they can’t sell their stocks for six months. Oh, and threatening to jail short sellers.

How can they possibly think they can create a 159% stock bubble in one year without Mother Nature showing up to remind them who’s boss?

It’s like central banks think they can keep the economy and a bubble going on short-term life support forever.

This is not an economy. This has become a mutated freak of nature. I might actually start calling it “Sasquatch.” Or Frankenstein.

Of course, many still think governments and central banks can keep this mutant freak of an economy in check.

And that means when the free markets finally take control and start bursting these bubbles and deleveraging our debt, they’ll do it through a means governments can’t control, and with an even greater vengeance.

Outright Perversion!

Central banks have been manipulating and outright perverting the free markets since 2008 (and to a lesser degree for decades prior).

When the financial crisis emerged, they began printing money on an unprecedented and massive scale.

When Wall Street started taking major losses on failed loans, we suspended the rule of “mark to market” for loans. That to me is worse than QE – no one has to take losses for their bad loans! What type of take risks and learn, free market system is that?

This has been the strategy since 2008 – do anything necessary so financial institutions don’t have to take responsibility for their bad loans.

Not only does this save them, it helps them get rich for doing nothing!

When money is free, financial institutions and investment managers can generate high returns up to 20 or 30 times for low costs – and with central banks there to bail them out, there’s no risk!

Then EVERYBODY thinks there’s no risk!

They start speculating. They fuel gargantuan bubbles in financial assets. And all the gains further enrich the top 20% – especially the top 0.1% to 1%.

They run away with the gains, while the average households sucks wind.

How does this happen?

QE.

When central banks print money, it lowers interest rates, and raises the value of financial assets like stocks.

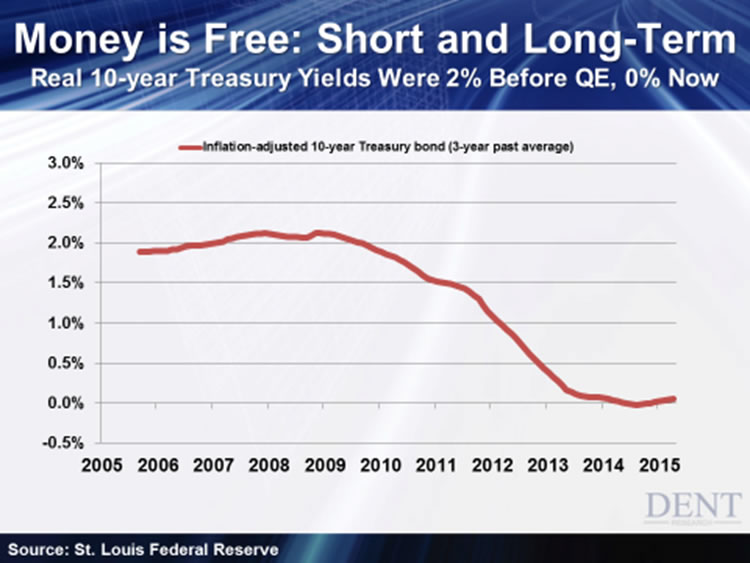

That’s because every financial asset is priced off the long-term, risk-free rate of bonds like the 10-year U.S. Treasury.

That’s why the Fed tried so hard to push long-term rates down to zero by buying their own bonds. Imagine an economy where you borrow money to pay for things you can’t afford and then you buy your own debt with free money created out of thin air!

It took a lot of QE, but Bernanke & Friends made it happen. And long-term rates are still at zero adjusted for inflation. Look:

It's one thing to set short-term rates at zero. Central Banks have complete and total reign to do that. But it's another to inject so many drugs into the financial system that suppress long-term rates as well.

However, the drugs are starting to wear off.

Central Banks Won't See This Coming

I’ve already explained that the markets are starting to sober up because long-term interest rates are beginning to tick higher. It’s a sign QE is finally failing as it always takes more of a drug to create less effect until it kills you.

But as central banks are so busy fighting the free markets with what they can control, they’re going to get completely blindsided by what they can’t.

It’s 100% clear central banks won’t back down. That just means Mother Nature – i.e., the free market – has to find another way in.

And one thing governments can’t do jack about – is oil.

Like it or not, Saudi Arabia owns that game. They’re the largest player, and they can pump oil cheaper than anyone else.

More importantly, they’re going to keep pumping even at low oil prices until they’ve truly built a corner on the market. They’re going to wipe out the competition. When you take the emotion out of it, it’s precisely what a dominant company or country should do in an economic winter season – like the mafia did during the Great Depression… and General Motors.

That means lower oil prices ahead – through the next support of $43 and ultimately the 2008 low of $32. It's one of my six signs that this global bubble is finally ready to burst.

And that means death to the frackers. They’ll end up defaulting on their $600 billion worth of junk bonds and leveraged loans.

To get an idea of what that feels like, just remember that the subprime mortgage crisis that developed into a full-blown financial crisis was triggered by an $800 billion debt. $600 billion may be a ways off that, but oil prices are falling much faster and harder than home prices did.

This won’t just hit the U.S. Low oil prices and the resulting default crisis will spread to Canada’s tar sands, Venezuela, Iran, Mexico, even Russia.

But oil isn’t the only thing governments can’t control.

They’re also kidding themselves if they think they can stop everybody from selling their stocks. (I’m looking at you, China.)

The people who largely caused the Shanghai stock bubble were small, everyday investors who were too uneducated to understand what was happening. China has essentially bought them off by maintaining order and letting them think everything is okay by telling the big investors and short-sellers that they can’t sell! But the recent correction has the little guys shell-shocked. They’re spooked. If China thinks it can stop an army of mom-and-pop investors from selling when more bad news scares them further, I wish them luck.

Look for falling oil prices and another scare in China to spook the really dumb and inexperienced speculators out there, followed by a series of growing defaults like in 2008, but worse.

And expect the global crash that follows to be even more brutal thanks to all the financial manipulation in the system.

That’s what happens when you mess with Sasquatch.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2015 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.