Market Bubble in Trouble? Rinse & Repeat

Interest-Rates / Liquidity Bubble Jul 22, 2015 - 09:26 AM GMTBy: EWI

Our new, FREE report shows you specific areas of the U.S. stock market that have become dangerously frothy

Our new, FREE report shows you specific areas of the U.S. stock market that have become dangerously frothy

When I was in college, I had this weekly ritual. I'd drive home to my parents' house every Friday, run inside to say hello, grab some food, and leave several bags of dirty laundry to be picked up the next morning.

One Friday during my sophomore year, though, the music stopped. I set out on my usual "drop and dash," returning the next day to find my bags of laundry unopened. And there, attached to the washer and dryer, my father had installed token machines. Each token represented a different favor: Cook dinner, clean house, carry on an adult conversation that doesn't include the words "like" or "dude."

Since the dawn of higher education, parents everywhere have pondered similar solutions to this age-old problem: How to turn a profit out of doing their college kids' wash!

Now, according to a June 18 Bloomberg article, the ultimate answer has arrived: Bonds backed by dirty laundry.

What it is: "$400 million of asset-backed securities (ABS) from Alliance Laundry Systems."

How it works: "The deal is backed by a pool of equipment loans used to finance the purchase of washing machines." THUS -- The more clothes you clean, the bigger the bonds' payment.

Sound crazy? Well, no crazier than the current surge of other "esoteric ABS" being sold to the market, one's backed by restaurant franchises, music royalties, or the rights to a 2012 Peanuts cartoon strip.

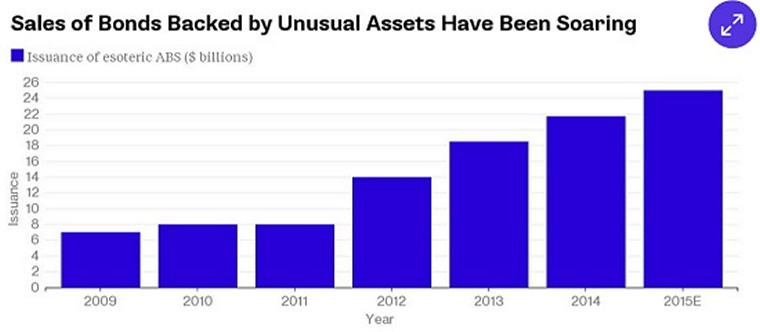

In fact, according to the Bloomberg article, "Sales of esoteric ABS are now higher than at any point since 2008," having doubled in the first quarter alone from a year ago -- seen here on the following chart (source: JPMorgan estimates):

So, should you be worried?

Well, according to the mainstream experts, the only bubble they see forming here is in the rinse cycle. To wit: Standard & Poor's expects to assign dirty laundry loans an investment-grade A-rating.

We respectfully disagree. In our new, free, three-part Club EWI report titled "A Bubble in Trouble," we identify EIGHT "unprecedented extremes" indicating that the U.S. stock market is in trouble -- with one additional sign: The "current rash of oddball loans." Here, the report has this to say:

According to the Wall Street Journal (5/25), in 1999 the U.S. government guaranteed 45% of all U.S. financial debt, and today it guarantees 60% of it. This is one reason why prices for stocks and bonds have been floating so persistently at historically high levels despite their precarious nature. And those loans in turn support other, more risky loans and derivatives. Most of the government's guarantees are in the form of bank-deposit insurance and mortgage-agency backing. But they are not really guarantees. They are just promises. The government is incapable of bailing out all the losers in a financial implosion.

Find out what the EIGHT "unprecedented" extremes are that a U.S. stock market bubble has not only formed, but is perilously close to bursting -- FREE! This three-part report is available for a limited time to all free Club EWI members.

You'll get instant-access to all three parts when you sign up to join Club EWI, the world's largest Elliott wave community -- and it's free!

Follow this link now to get free access to this free report, A Bubble in Trouble, now >>

This article was syndicated by Elliott Wave International and was originally published under the headline Market Bubble in Trouble? Rinse & Repeat. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.