The ‘Real’ Reason the Fed Wants to Raise Interest Rates

Interest-Rates / US Interest Rates Jul 23, 2015 - 03:27 PM GMTBy: Gary_Tanashian

In case you thought you were smart enough to know why the Fed wants to do what it supposedly wants to do [1] MarketWatch sets you straight with the real scoop. We’ll use this as a talking point and see what comes of it…

In case you thought you were smart enough to know why the Fed wants to do what it supposedly wants to do [1] MarketWatch sets you straight with the real scoop. We’ll use this as a talking point and see what comes of it…

Here’s the real reason the Fed wants to raise rates

Policy makers want to give themselves some room to maneuver

That is the commonly held belief and who am I to dispute it? A big part of the problem is and has been their refusal to begin a journey toward normalization 2 years ago, when the economy began to visibly (we noted the seeds of that improvement in January of that year) improve. They had no confidence and I was left to wonder (aloud here, frequently and I am sure, sometimes obnoxiously) why Grandma [2] (and her 0% savings account payout) had to continue to bear the brunt of this non-action despite a recovering economy.

The best conclusion I could come up with is that the entire scheme, from day 1, has been to reward asset owners and risk takers. Now the Fed is still stumbling and bumbling with the questions of ‘when?’ and even ‘if?’. We noted that in the span of the last 3 weeks, when things got just a little dicey during the Greek drama (a cut rate ‘b’ production I might add) some Jawbone could not wait to trip all over himself gulping down a mic, talking about rate hikes being pushed to 2016. Here we recall Hawk-in-drag Bullard last October giving the ‘tell’ to anyone who still believed these clowns were in control of some kind of normal economy, as he titillated the market with the likes of ‘we can always do QE 4 ya know’.

That preamble behind us, let’s see what MarketWatch thinks we should know about “real” reasoning…

Federal Reserve policy makers are hoping, even praying, that no unexpected domestic development or international crisis intervenes to prevent them from taking the first baby step to normalize interest rates at the Sept.16-17 meeting.

US interest rates have nothing to do with these global occurrences that are a fact of life in a leveraged, credit propped global construct. It’s the economy, stupid.

Why? Fed officials point to a number of reasons: the unnatural state of a near-zero benchmark rate; the potential risk of financial instability; an improving labor market; diminishing headwinds; and yes, expectations of 3% growth just over the horizon.

Fed Chairman Janet Yellen, usually considered a member of the Fed’s dovish faction, sounded determined to act when she testified to Congress last week.

“We are close to where we want to be, and we now think that the economy cannot only tolerate but needs higher interest rates,” Yellen said during the Q&A. “Needs,” as in the patient needs his medicine.

Yey Janet, you think we are finally at the point where it is safe to raise the Federal Funds by a lousy 1/4 point. You’ve finally come around! You have put the “patient” years further out on the ledge than he needed to be (you know, assuming this is a normal economic recovery). But what’s a few Trillion more for asset owning pigs at the trough among friends? You have simply increased the divide between the asset owning ‘haves’ and the ends barely meeting ‘have nots’.

What’s the urgency with an economy chugging along at 2-something percent and low inflation? I suspect Fed officials are terrified of being caught with their pants down, in a manner of speaking. Should some unforeseen event come along to upend the economy, the Fed’s arsenal would be dry. They’d like to put some space between their policy rate and zero.

Chugging along, eh? Dood, 1/4 or 1/2% in ammo is not gonna do squat if some “unforeseen” event comes along. Why do you talk in this language, anyway? There is no event. Greece was not an event. Greece was a symptom. If the US economy is symptom free, the Fed should not be “terrified” of anything. The problem is that it is not symptom free. This economic cycle’s very creation was its initial symptom. The ongoing disgrace known as ZIRP has been a symptom for 6.5 years now.

Sure, the Fed has a balance sheet that can be expanded almost without limit. But policy makers are the first to tell you they have little experience with the extraordinary measures taken in response to the financial crisis.

The great experiment. Sit quietly and we will control all that you see and hear for the next…

The goal of QE was to ease financial conditions. As explained by Bernanke in a November 2010 Washington Post op-ed, the Fed buys long-term Treasuries, which lowers risk-free rates and drives investors into riskier assets: stocks, corporate bonds and mortgage-backed securities. The rise in stock prices boosts consumer wealth, raises confidence and encourages spending, while the decline in corporate bond and mortgage rates stimulates investment and makes housing more affordable.

At least he was honest about it. I am going to take every last one of you out of prudent investments and asset allocations and you are going to eat a big chunk of risk. And guess what, some of you are going to get rich beyond your wildest dreams. We are now a casino, not an economy.

He was by the way, very honest about his master stroke (Operation Twist) as well. The Fed used the word “sanitize” when talking about inflation signals as it then painted inflation right out of the picture by selling short-term Treasuries and buying long-term Treasuries. It was genius… and they were 100% honest about it. It was also very wrong, as history will one day conclude.

Why will it prove to have been wrong? Because an economy is like a giant balance sheet. It must always seek equilibrium in its various components or else something, somewhere, sometime is going to bubble up to the surface and not be reconcilable. Will it be an inflationary Godzilla? Will it be a final deflation of all of these human macro parlor tricks? Will it simply be two items that can not coexist, sending dominoes dropping around the globe? I don’t know; I am just the wise guy blogger using another MSM cartoon piece as an excuse to post something.

And oil is just part of the story. If the Fed is looking for a reason to hold off on a September rate increase, it can look no further than commodities markets. The CRB BLS spot raw industrial price index, which includes economy-sensitive materials such as scrap metals (copper, steel and lead), rubber and zinc, has taken a dive to levels last seen in late 2009. The decline in raw materials prices will feed into the prices of finished goods. So the Fed’s confidence in inflation heading higher may be dashed once again.

The inflation, which has been promoted and put forth with great force, has on this cycle gone into the exact assets Bernanke intended (per his 2010 Washington Post op/ed). It was brilliant and he is a genius. That is no comment on how history will one day look back on the operation, but it really was something special.

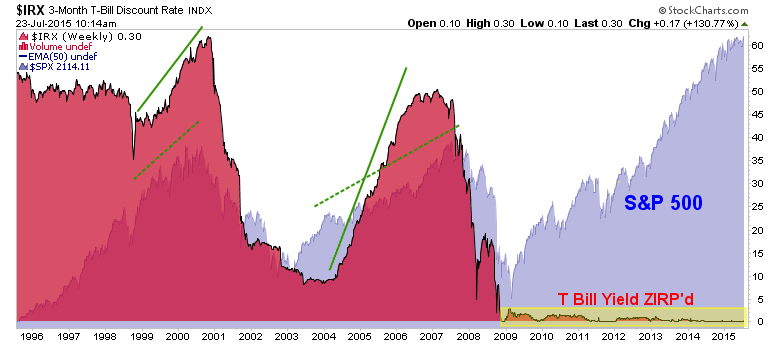

Inflation was begun in earnest (for this cycle) in 2008 and continues by various means well into 2015 and it is stock prices that have benefited. It’s all good. Gold, silver and oil, three stars of the previous inflationary cycle, are going in the wrong direction and irony of ironies, the Fed now frets about whether they are going to be able to get inflation UP to their 2% target. Goldilocks lives in that gap… for now.

This interest rate noise is just another side show, much like Greece. Much like Cyprus. Much like the Fiscal Cliff Kabuki Dance, much like the Flash Crash, much like any one of a hundred other things that have bubbled to the surface during the post-2008 cycle. In relatively normal markets (within the Age of Inflation onDemand ©, mind you), stocks often follow interest rate hikes upward for some time before utterly imploding. So is this a relatively normal market?

[1] Nobody knows for sure what the Fed wants to do or why it wants to do it; and with the opposing Jawbones on auto-yammer seemingly 24/7, 365 we know even less than when there used to be cloak of secrecy surrounding the proceedings.

[2] Of course Grandma could stay within the realm of fixed income and speculate in junk bonds or long-term Treasuries for some return. Grandma is hence forced to take on what she should not have to at this stage of her life, risk (speculative risk in junk and interest rate risk in T bonds).

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.