The Gold Investment Demand Juggernaut

Commodities / Gold and Silver 2015 Aug 03, 2015 - 05:37 PM GMT Whenever the mainstream media decides to undertake one of its periodic attacks on gold and gold ownership, it almost always begins by laying out gold's long history as a proven inflation hedge. It then proceeds to explain that inflation is not a problem at the present, and, as a result, no one with any common sense would bother to own it. This argument is a set-up – a pretext meant to confuse investor thinking and redirect interest away from the one investment vehicle likely to do them some good in these uncertain times.

Whenever the mainstream media decides to undertake one of its periodic attacks on gold and gold ownership, it almost always begins by laying out gold's long history as a proven inflation hedge. It then proceeds to explain that inflation is not a problem at the present, and, as a result, no one with any common sense would bother to own it. This argument is a set-up – a pretext meant to confuse investor thinking and redirect interest away from the one investment vehicle likely to do them some good in these uncertain times.

In mid-2007, the year the financial crisis began, gold was trading at $650 per ounce. As financial markets courted collapse in the following two years, gold rose steadily. By the time, the global economy came up for air in late 2010, gold was trading at $1400 per ounce and well on its way to an interim top of $1900 in September, 2011.

The one glaring truth is that gold's rise in value occurred during a distinctly disinflationary period, when not even the whiff of inflation was present. Investors purchased gold not as a defense against inflation, but as a defense against systemic risks – including a general bank collapse and financial panic. Gold, as a result, had proven itself to be more than simply an inflation hedge – but a hedge against disinflation as well. By extension, since the dangers and effects of deflation are similar to those of disinflation only more exaggerated, gold elevated its reputation as a deflation hedge as well. That piece of history, though irrefutable, is conveniently ignored in these orchestrated press attacks on gold and gold ownership.

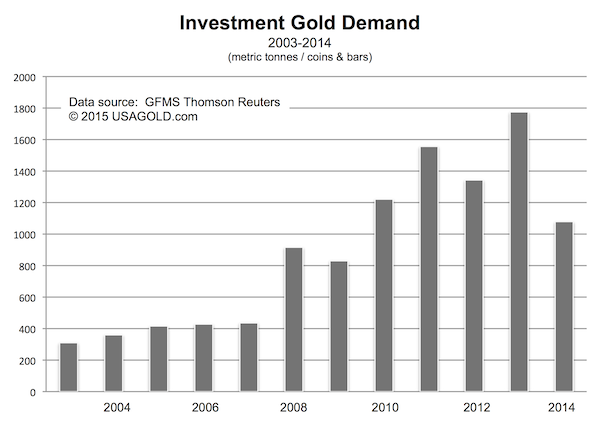

The chart above illustrates the rapid increase in demand following the 2007-2008 financial crisis. Note that there are two distinct divisions to the chart – one before launch of the crisis and the other after. Before the crisis, gold investment volume was running at 300-400 tonnes per year. Gold investment demand doubled from that base in 2008 and 2009 to 800 tonnes. It tripled in 2010 to 1200 tonnes, nearly quadrupled in 20ll to just under 1600 tonnes, and reached nearly 1800 tonnes in 2013 (six years after the start of the crisis and with inflation nowhere in sight). In 2014, a year of sideways price action, gold investment demand still remained over 1000 tonnes demonstrating that the crisis psychology driving gold demand had not abated, but simply went to low boil. Average investment demand for the seven period was nearly 1250 tonnes per year, or 44% of the average annual mine production – a hefty component in the supply and demand tables.

One of the principal features of the chart is the consistency of the demand in periods of both rising and falling prices. That consistency comes as a deliberate response to the economic times in which we live. It used to be that gold demand would moderate during price declines. Now gold investors view those declines as buying opportunities indicating a fuller understanding of gold's role as a safe haven, portfolio hedge and alternative savings vehicle. Another factor driving this chart is the sheer number of new participants in the gold market globally – a group whose thinking is identical to the one that preceded it. Investment gold demand, in conclusion, has become a juggernaut, and one likely to remain in place as long as widespread financial system risks remain a part of the investment equation.

Mining costs pose existential threat to world's gold mines

Moving over to the supply side of the fundamentals' table, Gold Survey 2015, GFMS Thomson reports that the all-in cost of gold mine production, a figure that encompasses the total operating overhead, comes in at $1208 per ounce industry-wide. When impairments (write-downs in the value of mining company assets) are taken into consideration, the all-in cost of production jumps to $1314 per ounce. In other words, at current prices the gold mining industry is operating deeply in the red. If market prices do not improve, and soon, the threat of reduced production and possibly even closures looms on the horizon. Though few have taken note, GFMS sums up the situation by saying, "[I]n terms of both volumes and profitability, the mining industry remains in a precarious position." GFMS reports 64% of the world's gold mines had all-in costs less than $1266 per ounce in 2014, the average price for the year. One wonders what percentage of mines are underwater at the current $1100 per ounce price, or worse the level of damage that would be done if Goldman Sach's recent forecast of $950 per ounce actually came to fruition. Dim prospects for the mines translate to brighter expectations for long-term holders of physical gold coins and bullion investors who could become the primary beneficiaries of a mining industry existential crisis.

* * * I would like to thank GFMS Thomson Reuters for its kind permission to use their statistics in this issue of our newsletter.

Confused about gold and the DJIA? Don't be.

Thoughtful question from would-be gold owner/my answer

Michael,

I have been reviewing your web site and am impressed.

I currently have about $750,000 in cash, money market funds, equities and bonds. I am 74 and my wife is 72. We are both retired.The only fixed income we receive is $21,000 per year from social security, and $7,000 per year in bookkeeping fees earned by my wife. Our living expenses are about $75,000 per year leaving us a shortfall of about $36,000 per year. Our total net worth is about $2,200,000 (home is $1,500,000 of that).

When I read your article Choosing a Gold Firm about 3 weeks ago, I felt motivated to jump in to the gold market. However, it seems that the value of an ounce of gold has dropped to about $1,100. What confuses me is the fact that the DJIA, is right now less than it was at the first of the year. Based on what I thought I knew, I expected to see gold soaring, but the reverse is the case.

What should I do? Is gold at a bottom? Should I get in now, or wait?

BN

Charleston, SC

______________________

Hello, BN.

Gold rarely goes by a predetermined schedule. Some would say it is rather obstinate. It goes where it wants to go in its own time and there are all sorts of forces at play with respect to its pricing – a situation of which I am sure you are fully aware. I have never believed that people should own gold because they think it is going to soar in price in the short term. Gold is first and foremost portfolio insurance and a longer-term alternative savings plan where asset preservation is a key objective. Secondarily, it is an investment for capital gain. As a result, if one goes into gold ownership with the attitude that it is simply a workable alternative to stocks or bonds, then short term price fluctuations should not serve as discouragement to either current or would be owners.

None of the conditions that caused gold to rise from the $300 level to the $1800 level pre- and post-crisis have changed, and ultimately they could reassert themselves down the road perhaps in ways most of the analysts never dreamed. The reasons for owning gold are as strong today as they've ever been and perhaps even stronger given the socialized, artificial values at work in other markets.

It is unfortunate that you have come to this place in your life (at 74) only to find that your savings will not do for you what you had hoped and I empathize with that. Investors are forced into speculation in stocks, real estate and other ventures when they should be living off a fair annual return on their bank savings. I don't think those circumstances are likely to change any time soon. If I were to guess at this juncture, I would say that even if we do get increases in interest rates, they will be small and nearly inconsequential and you will be in no better position than you are now.

From my perspective, gold is among the most undervalued of the major portfolio assets at this juncture. I am not the only one who believes that. Recently Interest Rate Observer's James Grant announced "Mr. [Gold] Market is having a sale." Similarly, Tocqueville's John Hathaway commented that "Evidence suggests the bull market in gold is far from finished." (More on that "Evidence" in an upcoming News & Views. Sign-up here to receive your complimentary issue by e-mail when released.) Contrary to characterizations in the mainstream financial media, global physical demand is soaring in the wake of the recent artificial price drop and very strong among our firm's clientele. Web site visits to USAGOLD have increased markedly and inquiries are at a level not seen for years.

In short, a large segment of the public believes gold is a buy at these prices. Much of this is due to a major change in financial market psychology that has evolved over the past several years. Now there is a very large group of people out there who believe in gold, and not just in the United States. That belief cannot be suppressed no matter how hard the mainstream press tries. An equally large contingent understands that markets supported artificially are ultimately doomed to failure and potential collapse once the props come down.

In the end, you will need to make a decision on three matters:

1. "Do I believe that the current economic situation warrants hedging?"

2. "Do I believe that gold is the hedge that will get the job done for me?"

3. "Do I own enough gold with respect to my total portfolio to make a difference?"

If the answers in respective order are yes – yes – no, then you should add more gold to your portfolio and it should be in the proper form – gold coins held in your possession.

My continuing golden wishes to you and family,

By Michael J. Kosares

Michael J. Kosares , founder and president

USAGOLD - Centennial Precious Metals, Denver

Michael J. Kosares is the founder of USAGOLD and the author of "The ABCs of Gold Investing - How To Protect and Build Your Wealth With Gold." He has over forty years experience in the physical gold business. He is also the editor of Review & Outlook, the firm's newsletter which is offered free of charge and specializes in issues and opinion of importance to owners of gold coins and bullion. If you would like to register for an e-mail alert when the next issue is published, please visit this link.

Disclaimer: Opinions expressed in commentary e do not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell any precious metals product, nor should they be viewed in any way as investment advice or advice to buy, sell or hold. Centennial Precious Metals, Inc. recommends the purchase of physical precious metals for asset preservation purposes, not speculation. Utilization of these opinions for speculative purposes is neither suggested nor advised. Commentary is strictly for educational purposes, and as such USAGOLD - Centennial Precious Metals does not warrant or guarantee the accuracy, timeliness or completeness of the information found here.

Michael J. Kosares Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.