Stock Market Margin Debt - Don't Let This Nonsense Number Fool You

Stock-Markets / Stock Markets 2015 Aug 05, 2015 - 03:31 PM GMTBy: DailyWealth

Dr. David Eifrig writes: Some people just want to see the worst in a stock market...

Dr. David Eifrig writes: Some people just want to see the worst in a stock market...

They like to take every fact or statistic they can find and twist it into an omen of doom.

We don't work that way. In my Retirement Trader newsletter, we look at the facts, talk about them, and draw simple conclusions about what's possible.

As longtime subscribers know, we've been bullish on America, the U.S. economy, and the market for five years running. And we've largely been right. We've talked about a slow grind higher and higher.

The current nail biting over "margin debt" is just the latest example of what I'm talking about...

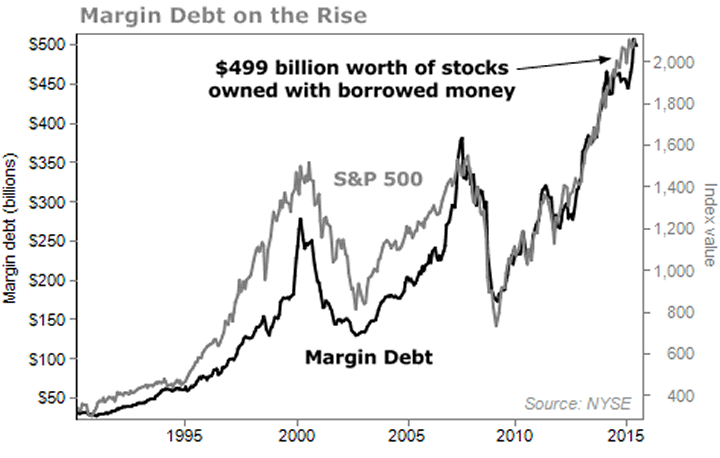

Buying "on margin" means to buy with money borrowed from your broker. The following chart shows that the amount of money that stock investors have borrowed has recently climbed to almost $500 billion.

To a bear, that looks like the market is getting "frothy"... when people get so excited about stocks that they start borrowing more and more money to buy them. Pretty soon, that frothiness causes a crash.

And in the chart, you can see that margin debt and stock prices fell together during the bear markets of 2000 and 2007-2008.

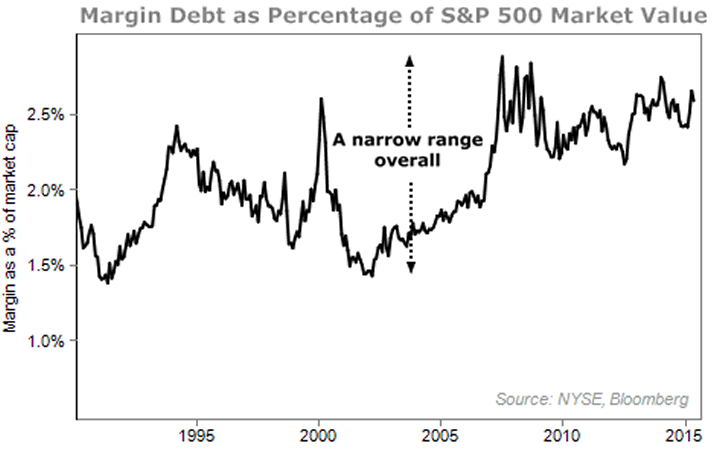

Guess what? Margin debt is a nonsense number. And that chart contains all the information you need to realize it.

It's not investor euphoria or excessive risk-taking that's driving margin borrowing up... It's just the market.

After all, if investors borrow a consistent amount of their holdings to boost their returns, then that amount will rise as the value of their holdings rise.

And margin debt as a percentage of total market cap has remained consistent, floating around the 2% level.

It is a touch on the high side compared with the bearish bottom of 2002... but there have been no sharp moves or spikes to suggest a bubble in the making.

Make no mistake about it, debt does cause volatility. But the level of debt here just isn't that high or troublesome.

We remain confident in the markets as a whole. And we're still bullish on the stock market and content with the economy.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.