These Charts Prove Gold Is Poised for a Rebound

Commodities / Gold and Silver 2015 Aug 05, 2015 - 03:40 PM GMTBy: Investment_U

Sean Brodrick writes: I’m about to show you five commodity charts, four of which should blow your mind.

Sean Brodrick writes: I’m about to show you five commodity charts, four of which should blow your mind.

First of all...

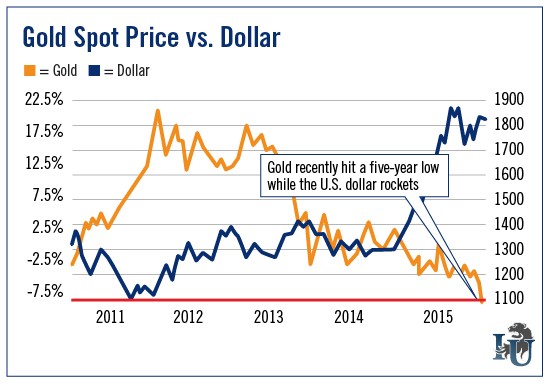

You probably know that gold is cheap. The yellow metal is way, way off the highs it hit in 2011. This is due, at least in part, to the rocketlike rise of the U.S. dollar.

The U.S. dollar is strong against other currencies, too - especially the troubled euro, which is crumbling like stale French bread. And dollar strength equals gold weakness. That’s the bottom line.

But like I said, you probably know all this already. So the chart above isn’t going to blow your mind.

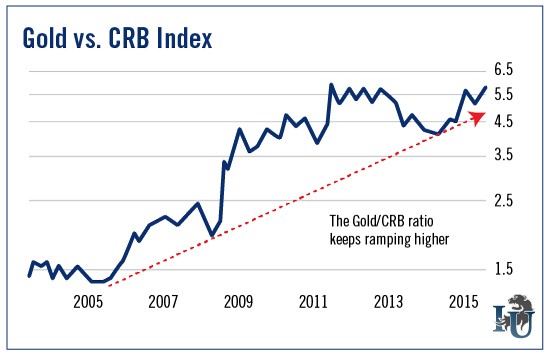

For that, let’s look at a chart of how gold is doing compared to a broad commodity index like the Thomson Reuters/CoreCommodity CRB Index (CRB). This is a diversified basket of 19 commodities.

The fact is, since this ratio bottomed in 2005, gold has gained more than 330% compared to the broad commodity index.

How is this possible? After all, we’ve seen gold smashed for the past five years, right? Well, it’s relative performance. Gold may not be doing well, but it’s doing great compared to most commodities.

Now, this might cause some of gold’s true believers to despair. If this is how the yellow metal performs when it does well against other commodities... how is it going to perform when it does badly?

But let me give you an alternate view: Only despair if you believe this gold-to-commodity ratio is a disconnect from underlying fundamentals. I’ll explain.

Things Aren’t As Bad As They Seem

At the end of the day, fundamentals matter. If you think gold is overvalued compared to other commodities, that last chart isn’t a good one.

On the other hand, if you think gold has fundamental value that shines through - even during a period of disinflation and lackluster commodity performance - then there’s no reason this ratio can’t continue on its present course.

In other words, if and when commodity prices start ramping up again, gold could really take off. And its outperformance relative to other commodities could steepen.

So the next question on your mind might be, when are commodities going to take off again?

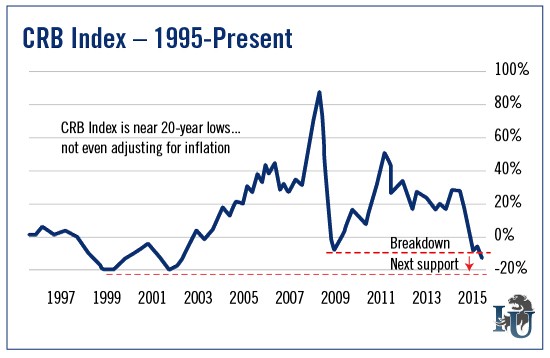

To be sure, the CRB Index is near 20-year lows...

In fact, you can see that the CRB recently broke support and seems to be about to test levels last seen in 1999 and 2001.

Here’s an interesting factoid: On an inflation-adjusted basis, commodities are at their lowest level since 1956.

To put it another way... adjusted for inflation, 100% of the time from 1956 until today, commodities have been higher.

That doesn’t mean they can’t get cheaper. In fact, I expect commodity prices to get cheaper in the short run. But commodities are lower in inflation-adjusted terms than they have been in 60 years - and lower in non-adjusted terms than they have been in nearly 15 years.

The current downward trend won’t last much longer.

Investor Sentiment Is “Stupidly Bearish”

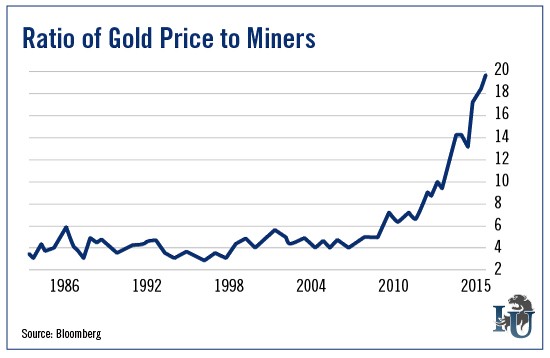

Let’s go back to gold and a potential “disconnect.” I’m talking about gold miners.

It turns out gold miner stocks are at their cheapest value relative to gold in at least 30 years.

Sure, you could say this is at least partly due to bad decisions by the gold miners. And then there’s the fact that a falling gold price has squashed miner profit margins to razor-thin or even nonexistent levels.

But sentiment counts for a lot in this market. And right now, investor sentiment on gold miners is superbearish. You might even say “stupidly bearish.”

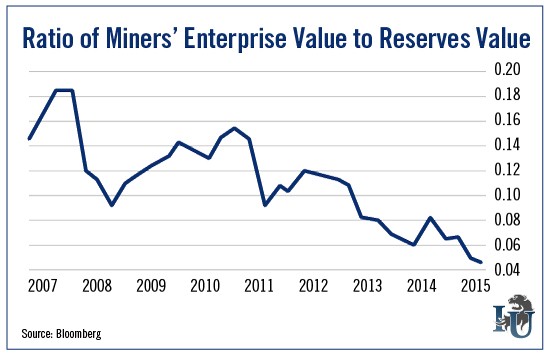

The way I see it, sentiment has disconnected from the fundamentals. And we’re talking about important fundamentals like gold reserves.

Gold miners are now valued at an eight-year low relative to their assets.

So, to sum up: Gold miners have plenty of reserves. The valuation of gold miners compared to those reserves is at least an eight-year low. And the ratio of gold miners to the metal itself is down to a 30-year low.

That sounds like a disconnect from fundamentals to me.

Meanwhile, gold continues to outperform most other commodities - and certainly the broad basket of commodities that is measured by the CRB Index. This isn’t so much fundamental as it is showing what investors consider a true store of value. And the 60-year march lower in commodities - in inflation-adjusted terms - can’t continue forever.

The Premier Long-Term Hedge

At some point, things will turn.

When will that happen? As John Maynard Keynes famously said, “the market can remain irrational longer than you can remain solvent.”

I hope it doesn’t take THAT long. But I do think that now, right now, is a great time to make shopping lists of gold miners to buy when the bottom comes. Because those will probably be the best bargains in decades.

And as for gold itself, the yellow metal remains the premier long-term hedge against bad government policy, both monetary and fiscal. The U.S. dollar may be marching higher, but some might consider it a “Wile E. Coyote” march - on nothing more than thin air.

The dollar is doing so well because other currencies are doing poorly. When that ends - and cycles always end - the day of reckoning may come as less of a gentle tap on the shoulder... and more of a Mike Tyson-force punch. Then gold will prove its worth as a shield against bad government decisions you have no control over.

All the best,

Sean

Editorial Note: When commodities rebound, as Sean is predicting, fortunes will be made. There’s no question. But the spoils will go only to those who spotted the right opportunities... at the right times. To give yourself a leg up, consider enrolling in Sean’s eight-part resource investing course. You can get all the details here in the Investment U Bookstore.

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.