Sentiment Deteriorates Amidst Global Stock Market Crash Warnings

Stock-Markets / Financial Markets Jun 22, 2008 - 07:49 PM GMT Sentiment deteriorated further during the past week as oil prices rebounded, more bad news in the financial sector surfaced, economic woes mounted and inflationary pressures intensified, compounding already-jittery investors' anxiety.

Sentiment deteriorated further during the past week as oil prices rebounded, more bad news in the financial sector surfaced, economic woes mounted and inflationary pressures intensified, compounding already-jittery investors' anxiety.

Status Quo's lyrics “Down down deeper and down” came to mind as global stock markets took a battering. The Dow Jones Industrial Index, for example, plunged by 3.8% over the week to below 12,000 – its lowest level since March. Commensurate with extreme bearishness, short interest on the New York Stock Exchange jumped to an all-time high during the week.

At the centre of investors' angst was the perception that the credit crisis has not yet played itself out. These fears were supported by Goldman Sachs analysts who said last week they did not expect the credit crisis to peak before 2009, and that US banks might need to raise $65 billion of additional capital (on top of $159 billion raised so far) to cope with additional losses from the sub-prime fallout.

At the centre of investors' angst was the perception that the credit crisis has not yet played itself out. These fears were supported by Goldman Sachs analysts who said last week they did not expect the credit crisis to peak before 2009, and that US banks might need to raise $65 billion of additional capital (on top of $159 billion raised so far) to cope with additional losses from the sub-prime fallout.

On a related note, Moody's downgraded the credit ratings of Ambac Financial (ABK) and MBIA (MBI), citing their limited ability to raise new capital and write new business. Banks were also in focus as analysts cut their price targets for, among others, Goldman Sachs (GS), Citigroup (C) and Wachovia (WB).

In one of the most bearish reports for a while, The Royal Bank of Scotland advised clients to brace themselves for a full-fledged crash in global stock and credit markets over the next three months as inflation paralyses the major central banks. “A very nasty period is soon to be upon us – be prepared,” said Bob Janjuah, the bank's credit strategist (who gained credibility after his warnings last year about an impending credit crisis).

Richard Russell, 83-year old author of the Dow Theory Letters , expressed concern about the stock market's negative breadth and said: “I did a double-take when I read Lowry's statistics … Buying Power Index at a multi-year low and Selling Pressure Index at a multi-year high. And the two Indices at about their widest (most bearish) spread in history or since the 1930s. What the devil could this mean? My guess can be summed up in one word – trouble.”

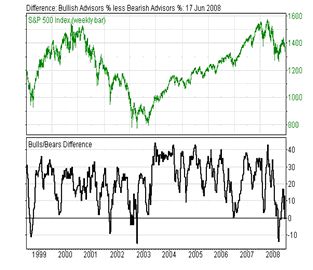

But there is hope still, according to David Fuller ( Fullermoney ) who pointed out that Investors Intelligence 's sentiment index (bottom section of the chart on the left) was extremely bearish. “There has never been a reading at current or lower levels that was not soon followed by a sharp rebound, including during the last bear market. This indicates to me that we are within a week or two of a bear squeeze, providing at least a tradable rally …”

But there is hope still, according to David Fuller ( Fullermoney ) who pointed out that Investors Intelligence 's sentiment index (bottom section of the chart on the left) was extremely bearish. “There has never been a reading at current or lower levels that was not soon followed by a sharp rebound, including during the last bear market. This indicates to me that we are within a week or two of a bear squeeze, providing at least a tradable rally …”

Back to Richard Russell for the last word: “Lousy Fridays are often followed by rotten Mondays.” To which I add: When in doubt (and there is a ton of doubt), better to err on the side of caution than to do something stupid.

I am flying to Slovenia and Switzerland, in my opinion the jewels of “old” and “new” Europe respectively, next weekend for a combination of work and leisure. Blog posts will unfortunately be rather slow during my 10-day absence, and specifically “Words from the Wise” will take a break next Sunday as I will be in midair when the review needs to be compiled.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

“Global business sentiment appears to have turned a corner. It remains weak, but it has moved measurably higher since hitting bottom in late April,” reported the Survey of Business Confidence of the World conducted by Moody's Economy.com . “Confidence remains weakest in the US where it suggests the economy is still contracting, and it is strongest in Asia where it is consistent with an economy growing near its potential.”

Economic reports in the US were largely overlooked last week as market participants focused on corporate news, although there were several notable releases.

• The NAHB Housing Market Index fell by 1 point to 18, bringing it back to the record low reached in December and before that not seen since 1985.

• After plummeting since the beginning of this year, consumer confidence is showing tentative signs of stabilizing, according to the ABC News/Washington Post Consumer Comfort Index.

• Industrial Production fell by 0.2% in May, following an outsized 0.7% decline in April. Overall, the report is consistent with continued modest declines in manufacturing.

• The Producer Price Index for finished goods rose by a large 1.4% in June as expected, following a 0.2% increase in April. Inflation was once again led by large price increases of food and energy products.

Summarizing the US economic scenario, Paul Kasriel, chief economist of Northern Trust , said: “… despite the Fed's aggressive Federal funds rate reductions, money and credit growth have slowed significantly … to absolutely low rates. The implication of this is that real economic activity is likely to be very sluggish until financial institutions rebuild their capital positions and that the inflationary flames are likely to subside as they are deprived of the ‘oxygen' of credit growth.”

The highlight of next week's economic news will be the FOMC policy announcement on Wednesday. Economists expect the Fed funds rate to remain unchanged at 2.0%, but uncertainty regarding the wording of the policy statement means it has market-moving potential.

“We fully expect that the FOMC will devote a relatively large amount of ‘ink' to the inflationary threats in its no-change policy statement on June 25, but we also expect the FOMC to reiterate that the downside risks to economic growth still dominate its policy decisions in the near term,” said Kasriel.

Elsewhere in the world, escalating inflation concerns are at the top of policymakers' agendas. In addition to rampant inflation in emerging markets, the Eurozone and UK are also shouldering strongly rising prices.

• Consumer price inflation in the Eurozone was up 3.7% in year-ago terms in May. The rate is far above the European Central Bank's 2% inflation target and, given the ECB's more hawkish tone lately, markets are increasingly expecting the bank to tighten.

• Consumer prices shot ahead in May in the UK, rising by 3.3% in year-ago terms. The deteriorating inflation outlook has reduced the likelihood of imminent monetary easing, while a recent statement by Bank of England Governor Mervyn King suggests that rate increases are also unlikely.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Jun 16 | 8:30 AM | NY Empire State Index | Jun | -8.7 | 0.0 | -2.0 | -3.2 |

| Jun 16 | 9:00 AM | Net Foreign Purchases | Apr | $115.1B | NA | $63.2B | $79.6B |

| Jun 17 | 8:30 AM | Building Permits | May | - | 960K | 950K | 978K |

| Jun 17 | 8:30 AM | Core PPI | May | - | 0.2% | 0.2% | 0.4% |

| Jun 17 | 8:30 AM | Housing Starts | May | - | 1000K | 980K | 1032K |

| Jun 17 | 8:30 AM | PPI | May | 1.4% | 1.0% | 1.0% | 0.2% |

| Jun 17 | 8:30 AM | Core PPI | May | 0.2% | 0.2% | 0.2% | 0.4% |

| Jun 17 | 8:30 AM | Housing Starts | May | 975K | 1000K | 980K | 1008K |

| Jun 17 | 8:30 AM | Building Permits | May | 969K | 960K | 960K | 982K |

| Jun 17 | 9:15 AM | Capacity Utilization | May | 79.4% | 79.8% | 79.7% | 79.6% |

| Jun 17 | 9:15 AM | Industrial Production | May | -0.2% | 0.2% | 0.1% | -0.7% |

| Jun 18 | 10:30 AM | Crude Inventories | 06/14 | -1242K | NA | NA | -4560K |

| Jun 19 | 8:30 AM | Initial Claims | 06/14 | 381K | 370K | 375K | 386K |

| Jun 19 | 10:00 AM | Leading Indicators | May | 0.1% | 0.0% | 0.0% | 0.1% |

| Jun 19 | 10:00 AM | Philadelphia Fed | Jun | -17.1 | -10.0 | -10.0 | -15.6 |

Source: Yahoo Finance , June 20, 2008.

In addition to the FOMC's interest rate decision on Wednesday, June 25, next week's economic highlights, courtesy of Northern Trust, include the following:

1. Conference Board's June Index of Consumer Confidence (June 24) – Consensus: 56.5, Previous: 57.2.

2. May Durable Goods Orders (June 25) – Consensus: 0.0%, Previous: -0.5%.

3. May New Home Sales (June 25) – Consensus: 515K, Previous: 526K.

4. FOMC decision (June 25) – Consensus: no change in Fed funds target.

5. Q1 Final GDP (June 26) – Consensus: 1.0%, Previous: 0.9%.

6. May Existing Home Sales (June 26) – Consensus: 5,000K, Previous: 4,890K.

7. May Personal Income (June 27) – Consensus: 0.4%, Previous: 0.2%.

8. May Personal Consumption Expenditures ( PCE ) (June 27) – Consensus: 0.7%, Previous: 0.2%.

9. May Core PCE Price Index (June 27) – Consensus: 0.2%, Previous: 0.1%.

10. June Final University of Michigan Consumer Attitudes Index (June 27) – Consensus: 56.9, Previous: 56.7.

Markets

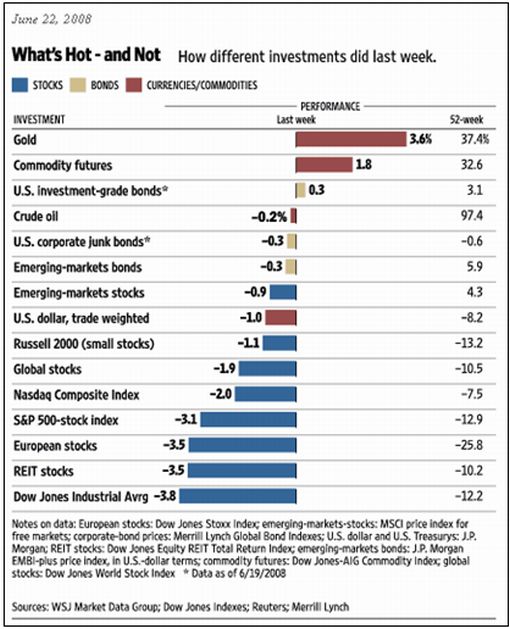

The performance chart obtained from the Wall Street Journal Online shows how different global markets performed during the past week.

Source: Wall Street Journal Online , June 22, 2008.

Equities

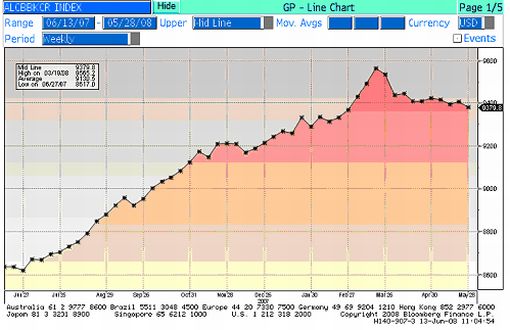

The MSCI World Index dropped by 1.9% during the past week as concerns about surging inflation, further credit-related trouble and deteriorating corporate earnings spooked investors.

The Nikkei 225 Average (-0.2%) was the only developed market to survive the sell-off relatively unscathed. David Fuller ( Fullermoney ) regards Japan as “the best industrialized stock market for today's economic climate”.

The performance of emerging markets (-0.9%) – the big casualties of the previous week with a steep decline of 5.3% – varied from the Hong Kong Hang Seng Index (+0.7%) and the Russian Trading System Index (+0.8%) that ended the week in the black, to the less fortunate markets such as the Brazilian Bovespa Index (-3.9%) and the Indian BSE 30 Sensex Index ( 4.1%). Year-to-date returns show the performance of emerging markets (+12.0%) still handsomely ahead of mature markets (-9.7%).

The performance of emerging markets (-0.9%) – the big casualties of the previous week with a steep decline of 5.3% – varied from the Hong Kong Hang Seng Index (+0.7%) and the Russian Trading System Index (+0.8%) that ended the week in the black, to the less fortunate markets such as the Brazilian Bovespa Index (-3.9%) and the Indian BSE 30 Sensex Index ( 4.1%). Year-to-date returns show the performance of emerging markets (+12.0%) still handsomely ahead of mature markets (-9.7%).

The US stock markets faced the brunt of heavy selling pressure and closed on a very weak note on Friday – option and futures expiration day. The index movements tell the story: Dow Jones Industrial Index -3.8% (YTD -10.7%), S&P 500 Index -3.1% (YTD -10.2%), Nasdaq Composite Index -2.0% (YTD 9.3%) and Russell 2000 Index -1.1% (YTD -5.3%).

At the centre of the sub-prime fallout, the Philadelphia Bank Index dropped to its lowest level in five years, closing down 5.9% on the back of further credit-related concerns and analysts downgrading their price targets for a number of companies.

At the centre of the sub-prime fallout, the Philadelphia Bank Index dropped to its lowest level in five years, closing down 5.9% on the back of further credit-related concerns and analysts downgrading their price targets for a number of companies.

Fedex (FDX), viewed as a bellwether for the broader economy, reported earnings that missed the consensus estimate and issued 2009 earnings guidance well below expectations, citing a weak US economy and record fuel prices.

Ford (F) and General Motors (GM) retreated by 8% and 16% respectively for the week after Ford said it would be difficult to “break even” in 2009, and Standard & Poor's put a negative credit rating watch on both companies. It makes one wonder about the old adage stating that “As GM goes, so goes the nation” …

Gold stocks (+4.8%) and platinum stocks (+4.6%) were among the few to keep head above water during the sell-off.

The Dow Jones Industrial Index and the S&P 500 Index are solidly below both their 50- and 200-day moving averages, and are now challenging their March lows of 11,740 and 1,273 respectively. The Nasdaq Composite Index has also now succumbed to both moving averages, whereas the Russell 2000 Index is right at its 50-day moving average (and already below the key 200-day line).

I penned some (rather sobering) thoughts on the fundamental outlook for the US stock in a post a few days ago. Here is the link: US Stock Market: Muddling Through the Fundamentals .

Fixed-interest instrument

Federal Reserve and European Central Bank officials last week moderated market participants' expectations of interest rate increases, resulting in rates coming off the boil as seen in the US three-month Treasury Bill rate dropping by 16 basis points to 1.80%. Fed funds futures moved to price in only a 10% chance that the Fed will raise rates by 25 basis points at Wednesday's FOMC meeting, compared with 22% a week ago.

Federal Reserve and European Central Bank officials last week moderated market participants' expectations of interest rate increases, resulting in rates coming off the boil as seen in the US three-month Treasury Bill rate dropping by 16 basis points to 1.80%. Fed funds futures moved to price in only a 10% chance that the Fed will raise rates by 25 basis points at Wednesday's FOMC meeting, compared with 22% a week ago.

The front end of the Treasury yield curve, being most sensitive to Fed policy moves, gained, with the yield on the two-year Note dropping by 19 basis points during the week to close at 2.85%. The yield on the 10-year Note, which is more sensitive to inflation pressures, declined by 12 basis points to 4.14%.

As far as the rest of the world is concerned, short-dated bond yields were mostly lower. For example, the yield on the UK two-year Gilt declined by 16 basis points to 5.29%, whereas the German two-year Schatz yield dropped by 9 basis points to 4.60%.

Safe-haven considerations played a role pushing up bond prices, but BCA Research warned that “… government bond markets will remain at risk until oil prices correct decisively or there is evidence that the disinflationary impact of the ongoing slowdown in the G7 economy is starting to unfold”.

US mortgage rates were virtually unchanged, with the 15-year fixed rate declining by 1 basis point to 5.99% and the 5-year ARM 1 basis point higher at 5.88%.

Credit market stress increased as shown by the widening spreads in both the US and Europe. The CDX (North American, investment grade) Index rose by 11 basis points to 126, and the Markit iTraxx Europe Crossover Index by 14 basis points to 500.

Currencies

A realization that the Fed might not hike interest rate as quickly as expected caused the US dollar to trade lower. The euro rose by 1.4% against the dollar in anticipation of the ECB carrying out its threat of increasing interest rates a notch next month. Other major currencies – the British pound (+1.4%) Swiss Franc (+1.0%) and Japanese yen (+0.9%) – also made headway against the greenback.

A realization that the Fed might not hike interest rate as quickly as expected caused the US dollar to trade lower. The euro rose by 1.4% against the dollar in anticipation of the ECB carrying out its threat of increasing interest rates a notch next month. Other major currencies – the British pound (+1.4%) Swiss Franc (+1.0%) and Japanese yen (+0.9%) – also made headway against the greenback.

Commodities

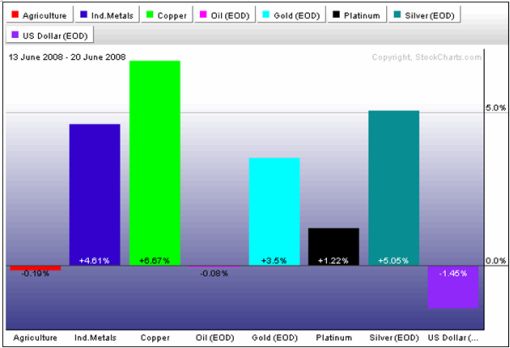

Commodity markets as a whole rose by 1.8% as a softer US dollar encouraged buying of precious and industrial metals.

However, movements in the crude oil price remained the focal point. West Texas Intermediate closed a volatile week nearly unchanged at $134.62 per barrel after trading as high as $139.89 (a new record) and as low as $131.19. Trading triggers included the US government's oil inventories report that showed a mixed picture of demand, an announcement that China was increasing its gasoline and diesel prices, and news that Israel performed a military exercise to simulate the bombing of nuclear facilities in Iran.

The chart below shows the past week's performance of various commodities.

Now for a few news items and some words and charts from the investment wise that will hopefully assist in navigating the stormy waters of financial markets. And remember, the emphasis at this point should be on the return of capital rather than the return on capital.

Hat tip: Phil's Stock World , June 17, 2008.

Giles Keating (Credit Suisse): World economy moves toward long-term balance

“Rising oil and food prices and inflation are making headlines worldwide. Giles Keating, head of the Credit Suisse Global Economics and Strategy Group, explains the economic impact of these issues.”

Source: Credit Suisse , June 16, 2008.

Bloomberg: G8 says economy faces “headwinds”, oil prices a threat

“Finance ministers from the Group of Eight nations said spiraling food and fuel prices are their chief concern in a statement following their meeting in Osaka, Japan, on June 14. Inflation is accelerating after the price of oil reached an unprecedented $139.12 a barrel last week and food costs from rice to soybeans set records this year. Central banks are already shifting towards tighter monetary policy even as expansion fades.”

Source: Mike Fern, Bloomberg , June 16, 2008.

Bloomberg: Henry Paulson – “strong” dollar is in US's interest

“US Treasury Secretary Henry Paulson spoke at a news conference in Osaka, Japan, on June 14 following the meeting of finance ministers from the Group of Eight nations about the outlook for the US economy, dollar, the importance of supporting clean-energy projects, and the rise in oil prices.”

Source: Bloomberg , June 14, 2008.

Ambrose Evans-Pritchard (Telegraph): RBS issues global stock and credit crash alert

“The Royal Bank of Scotland has advised clients to brace for a full-fledged crash in global stock and credit markets over the next three months as inflation paralyses the major central banks.

“‘A very nasty period is soon to be upon us – be prepared,' said Bob Janjuah, the bank's credit strategist.

“A report by the bank's research team warns that the S&P 500 Index of Wall Street equities is likely to fall by more than 300 points to around 1050 by September as ‘all the chickens come home to roost' from the excesses of the global boom, with contagion spreading across Europe and emerging markets.

“Such a slide on world bourses would amount to one of the worst bear markets over the last century.

“RBS said the iTraxx index of high-grade corporate bonds could soar to 130/150 while the ‘Crossover' index of lower grade corporate bonds could reach 650/700 in a renewed bout of panic on the debt markets.

“‘I do not think I can be much blunter. If you have to be in credit, focus on quality, short durations, non-cyclical defensive names. Cash is the key safe haven. This is about not losing your money, and not losing your job,' said Mr Janjuah, who became a City star after his grim warnings last year about the credit crisis proved all too accurate.

“RBS expects Wall Street to rally a little further into early July before short-lived momentum from America's fiscal boost begins to fizzle out, and the delayed effects of the oil spike inflict their damage.”

Source: Ambrose Evans-Pritchard, Telegraph , June 19, 2008.

Telegraph: Morgan Stanley warns of “catastrophic event” as ECB fights Federal Reserve

“The clash between the European Central Bank and the US Federal Reserve over monetary strategy is causing serious strains in the global financial system and could lead to a replay of Europe's exchange rate crisis in the 1990s, a team of bankers has warned.

“‘We see striking similarities between the transatlantic tensions that built up in the early 1990s and those that are accumulating again today. The outcome of the 1992 deadlock was a major currency crisis and a recession in Europe,' said a report by Morgan Stanley's European experts.

“Just as then, Washington has slashed rates to bail out the banks and prevent an economic hard-landing, while Frankfurt has stuck to its hawkish line – ignoring angry protests from politicians and squeals of pain from Europe's export industry.

“Indeed, the ECB has let the de facto interest rate – Euribor – rise by over 100 basis points since the credit crisis began.

“Just as then, the dollar has plummeted far enough to cause worldwide alarm. It is potentially worse for Europe this time because the yen and yuan have also fallen to near record lows. So has sterling.

“Morgan Stanley doubts that Europe's monetary union will break up under pressure, but it warns that corked pressures will have to find release one way or another.

“This will most likely occur through property slumps and banking purges in the vulnerable countries of the Club Med region and the euro-satellite states of Eastern Europe.”

Source: Ambrose Evans-Pritchard, Telegraph , June 17, 2008.

David Fuller (Fullermoney): Inflation threat more serious than banking crisis

“… obfuscation of financial data is creating many conflicting signals for investors. Also, the inflation problem is certainly a concern, although not a surprise to Fullermoney subscribers since the seeds for it, in terms of inflationary monetary policy, had been sown since 1997, as often mentioned.

“I agree that there are many economic difficulties which are not supportive of stock markets. I regard today's inflationary problems, which are global, as more serious than the banking crisis which is mainly confined to the west. There is a risk that central banks, having fanned the flames of inflation with excessive monetary growth relative to GDP, will now overreact in their efforts to douse this fire.

“I have often mentioned that most of the inflation was coming from resources prices and government services in many countries, not least the UK. Unfortunately but inevitably, soaring prices for food and energy are highly emotive. I maintain that the prices consumers pay for these staples will stay high, more often than not, despite sharp fluctuations in underlying commodity prices.

“However, given the annualised data, if commodity prices levelled out for a year, their contribution to inflation data would be zero. Thereafter if jawboning and the economic slowdown mostly contain wages, central banks will declare at least a partial victory against inflation, albeit at the less publicised price of a lower standard of living for many people. The claim of lower inflation would probably not hold up under close scrutiny but at least central banks would be able to switch their emphasis to stimulating economic growth for a while.”

Source: David Fuller, Fullermoney , June 18, 2008.

CNBC: Goldman's Jan Hatzius on Fed rates, inflation and jawboning

Source: CNBC , June 16, 2008.

Bill King (The King Report): The recession in GDP is here

“Merrill's David Rosenberg: The recession in GDP is here – but it's in the monthly data, not the quarterly data. The MacroEconomic Advisers monthly database shows that real GDP dipped at a 0.5% annual rate in April and has contracted now in two of the past three months.

“Note that since January, the month we had been saying for some time that represented the peak of the business cycle, real GDP has declined at a 2.2% annual rate. So, do not be fooled by that 0.9% first quarter GDP print – it is masking erosion in activity beneath the veneer of quarterly averages.”

Source: Bill King, The King Report , June 19, 2008.

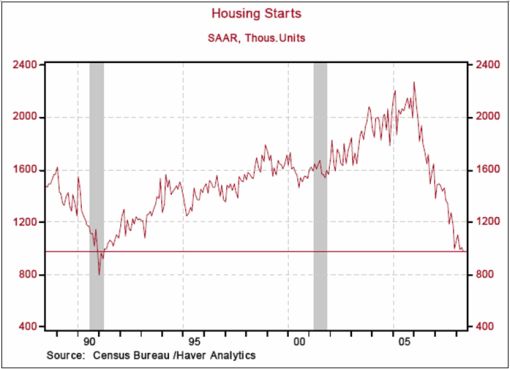

Paul Kasriel (Northern Trust): Housing starts plumb new cyclical low

“After unexpectedly increasing in April, housing starts got back to the script, falling 3.2% in May to an annualized rate of 975 thousand units – a cycle low and the lowest annualized rate since March 1991. Housing starts have fallen 57% from their January 2006 peak.”

Source : Paul Kasriel, Northern Trust – Week in Review , June 16 – 20, 2008.

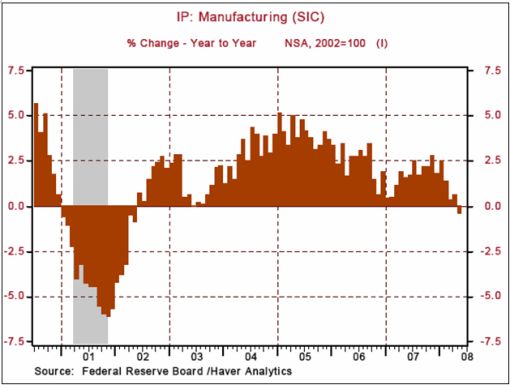

Paul Kasriel (Northern Trust): Manufacturing output remains in the pits

“The Federal Reserve reported that total industrial production slumped another 0.2% in May after plunging 0.7% in April. On a year-over-year basis, the manufacturing index was down 0.4% in May, its first year-over-year decline since June 2003. We do not expect that manufacturing output will contract as much in this recession as it did in the 2001 recession because of support from exports.”

Source : Paul Kasriel, Northern Trust – Week in Review , June 16 – 20, 2008.

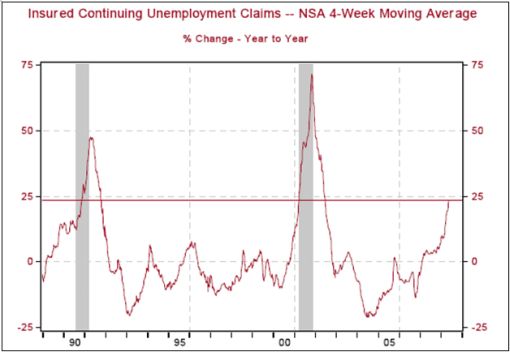

Paul Kasriel (Northern Trust): Continuing unemployment claims continue to suggest recession

“Seasonally adjusting weekly economic data is an ambitious undertaking. With regard to the weekly unemployment claims data, I prefer to look at the behavior of the four-week moving average of the unadjusted data, taking the year-over-year percent change. In the four weeks ended June 6, the average of continuing unemployment claims is up a cycle-high 23.6% from a year ago. This percentage increase is a little low compared to the early months of the 2001 recession but a little higher than it was in the early months of the 1990-91 recession. Rest easy, continuing claims are going significantly higher before this recession is over.”

Source: Paul Kasriel, Northern Trust – Daily Global Commentary , June 19, 2008.

Ed McKelvey (Goldman Sachs): Fed tightening would be inappropriate

“An interest rate rise by the Federal Reserve would be both inappropriate and unlikely any time soon, believes Ed McKelvey, senior economist at Goldman Sachs.

“He notes that interest rate futures are implying that at least one 25 basis point rise is virtually certain by the time of the Federal Open Market Committee's monetary policy meeting on September 16, with considerable probability of more increases to come.

“‘We cannot rule out a rate hike given the warnings issued by Fed chairman [Ben] Bernanke and vice-chairman [Donald] Kohn about long-term inflation expectations,' Mr McKelvey says.

“‘With retail sales also firming up, we can imagine a scenario in which Fed officials feel compelled to make good on these words.'

“However, Mr McKelvey lists three main reasons why a tightening would be inappropriate at this stage.

“First, the economy is fundamentally weak, with tax rebates driving the surge in retail sales. Second, financial markets remain fragile; and third, worries about inflation are overdone.

“‘As these points become apparent, we think Fed officials will see things our way,' Mr McKelvey says.

“‘We continue to believe that most FOMC members want to see three things before tightening – labour market improvement, some clear signs of stability in the housing market, and much more progress towards normalcy in the financial markets.'”

Source: Ed McKelvey, Goldman Sachs (via Financial Times ), June 16, 2008.

Bill King (The King Report): Bank credit continues to contract

“… bank credit continues to contract as banks dump assets and procure capital in order to de-lever. Ergo many companies must scramble for credit. And so far, the Fed is pumping furiously to keep the system from contracting sharply or worse.”

US Commercial Bank Credit (seasonally adjusted)

Source: Bill King, The King Report , June 16, 2008.

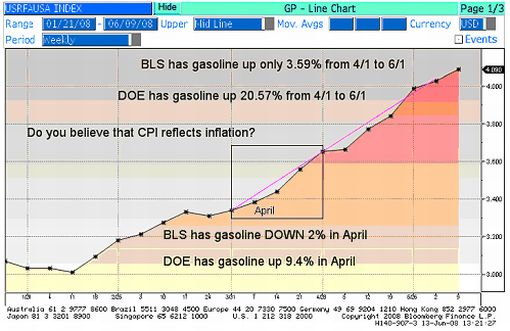

Bill King (The King Report): Be careful about “bogus CPI”

“The deeply flawed and increasingly recognized as bogus CPI is up 4.2% y/y. Ergo real interest rates are sharply negative. This fosters inflation … Seasonal adjusting for the spring has greatly understated energy inflation, which the BLS has noted will change with June CPI. We'll see.

“For May, the BLS has energy prices up 4.4% after showing no change in April and gasoline +5.7% m/m, with April -2.0%! In June, the BLS should rectify the under-reporting of energy inflation. Gasoline futures are up 33% since March. If the BLS actual allows the full fury of energy inflation from the spring to appear in June, the CPI will be horrendous unless the BLS finds other prices to seasonally adjust lower.”

US Department of Energy (DOE) Retail Automotive Gasoline Total All Grades Average Price

Source: Bill King, The King Report , June 16, 2008.

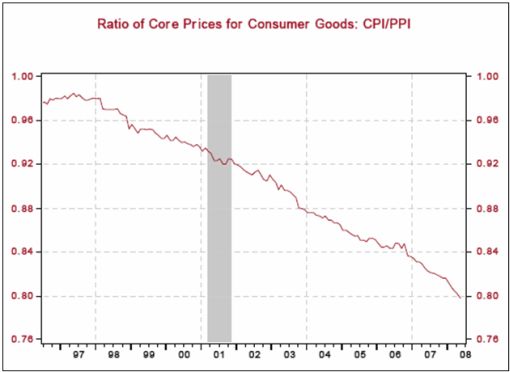

Paul Kasriel (Northern Trust): PPI data point to profit margin squeeze

“The PPI for finished goods of all kinds was up 1.4% in May. Comparing the PPI for finished consumer goods with the CPI for consumer goods suggests that businesses are having a tough time passing-through to the consumer the higher prices they are paying for goods. … that since the late 1990s, the ratio of the CPI for core goods has been falling relative to the PPI for consumer core goods. All of this suggests that profit margins are being squeezed. Narrower profits margins in conjunction with slower growth in physical volumes are a bad combination for business profit growth.

“Right now the Fed's bet and ours is that an environment in which aggregate economic demand is weak will be conducive to bringing down the overall inflation rate later this year after a month or two more of higher energy prices. Part of our bet on weak aggregate demand has to do with the ongoing credit crunch. Without rapidly growing credit, inflation has a difficult time sustaining itself. Bank credit and money supply growth have shown a sharp deceleration in recent weeks, which, if continued, will tend to damp aggregate demand and inflation going forward.”

Source : Paul Kasriel, Northern Trust – Week in Review , June 16 – 20, 2008.

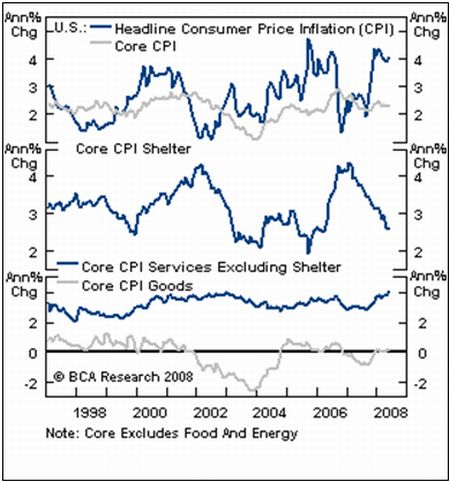

BCA Research: US inflation angst remains high, but core CPI should move lower

“US core consumer price inflation should continue to drift lower, dragged down by a weak domestic economy and the relentless slide in house prices.

“The Fed has sounded more hawkish of late, worried that longer-term inflation expectations will soon follow the rise in shorter-term expectations. The multi-year boom in pipeline price pressures and ever-sinking dollar have sparked heightened inflation fears, even in the face of a domestic recession and housing deflation. Importantly, pipeline pressures still hit a brick-wall when they reach retail outlets, and there is no likelihood of any leakage into wages given the uptrend in the unemployment rate.

“Bottom line: Core CPI should move lower over the balance of the year, but inflation angst may not ease until oil prices decisively correct.”

Source: BCA Research , June 16, 2008.

Click here to go back to Part 2

Did you enjoy this posting? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.