Game Theory and Retirement Choices

Personal_Finance / Pensions & Retirement Aug 11, 2015 - 09:02 AM GMTBy: Dan_Amerman

Game theory is a hot topic in many fields right now and for good reason - it can uncover better ways of making decisions, that are often otherwise missed. A particularly good example is the uncommon insights that game theory can deliver for us when it comes to making better retirement decisions.

Game theory is a hot topic in many fields right now and for good reason - it can uncover better ways of making decisions, that are often otherwise missed. A particularly good example is the uncommon insights that game theory can deliver for us when it comes to making better retirement decisions.

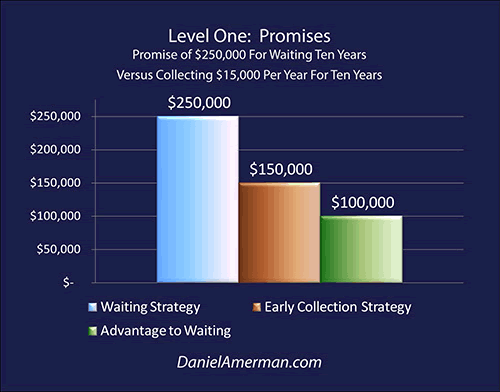

For our decision-making "game", let's say there is a $1 million pool of money to be split between you and nine other people. If you wait until the end of ten years to cash out - you and everyone else are promised that you'll be equally entitled to $250,000 each.

Now, the alternative choice for each person is to start right now and take out $15,000 at the beginning of each year over a ten year period, meaning that over ten years you're allowed to take out $150,000. However, the price of getting your smaller amount of money upfront is that you are not allowed to participate in the big money that is promised on the back end.

So on the surface there appears to be a $100,000 advantage to waiting ten years. Easy decision then, right?

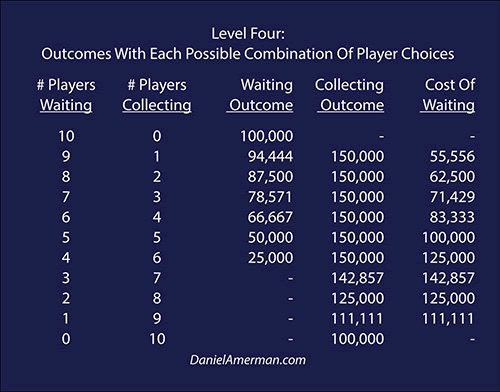

Well, not exactly - as there are some complications to consider. The first problem is that if all ten people choose to wait the ten years to get the most money, then it would take $2.5 million to pay each of them their $250,000 in full. However, there is only $1 million available. Since each person has an equal claim, the ten people would evenly split the $1 million.

Because there is not enough to go around - and this is known in advance - then all that waiting ten years does is mean that the most you can get is $100,000 each. So you would have been $50,000 better off taking smaller payments while there is still the full amount of money available to pay you.

There is another complication as well, and this what happens if some people take the smaller payments early, and other people wait for the promised bigger payment on the back end.

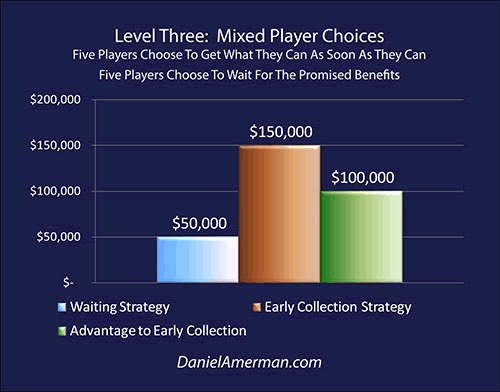

If five people choose to take $15,000 per year, and the other five people wait for the promised $250,000 on the back end, then the first five people take out a total of $75,000 per year, which means $750,000 is removed from the pool over ten years. Only $250,000 remains for the other five to split, which means they receive $50,000 each.

So it isn't just that the money was never there to pay you in full on the back end, but when other people choose to collect smaller payments early, and you don't - then there is less money that is left for you when you eventually do collect.

Indeed, as shown above, for each person who chooses to collect their money early, there is a direct reduction in the money available on the back end for everyone else. And if seven or more people choose early collection, then they entirely deplete the $1 million pool and leave the people on the back end with nothing at all.

So, if that is the game - what is your decision?

Do you take the smaller payments early, or do you wait for the bigger promised payment on the back end?

And if there are only so many dollars to go around, and other people taking early payments comes directly out of what is later available for you - does that have an effect on your choice?

Retirement Game Theory #1: Bigger Payments When We Wait

Once we change a few labels and the numbers of people and dollars involved, our round number "game" does have quite a bit of applicability to the issues many people face when it comes to making retirement decisions.

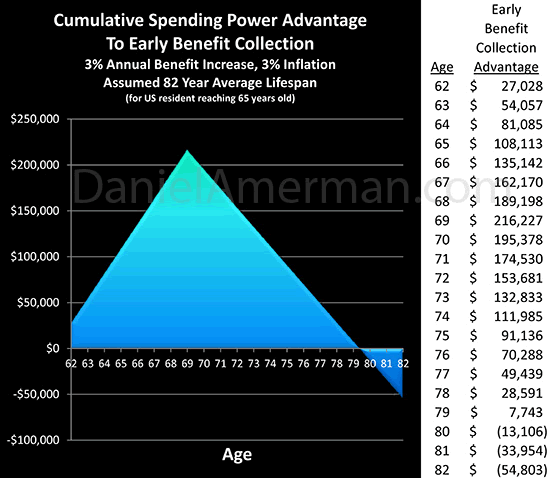

As a starting point - the most widely disseminated advice is currently to wait to collect retirement benefits. Indeed, there is supposed to be a six figure advantage for many people to defer collecting Social Security benefits until age 70, over starting at first eligibility at age 62.

There are some problems with that approach, however, as analyzed here, one of the really big ones is that the supposed advantage is based on benefit payments increasing with inflation, but at the same time the value of those future payments is not discounted for inflation. This creates a gross distortion in results, where the farther out in time we go, the more valuable a payment is shown as being.

Once we correct this fundamental error by taking the simple step of adjusting for inflation, then as shown above, most of the supposed advantage to waiting evaporates. However, most people who aren't financial professionals don't think in those terms, they think of a dollar being a dollar, so the widely disseminated numbers look authoritative and convincing - and therefore millions of people genuinely believe that they will be $100,000+ better off if they wait. So in the real-life game of retirement choices, many opt to wait for the much bigger payoff - and they are highly encouraged to do so.

Retirement Game Theory #2: Impossible Promises

Now one element of our game example that may have seemed a bit on the unbelievable side, is the idea that ten people would wait for $250,000 each from a pool of money that is only $1 million. If it is known in advance that the money isn't there to pay everyone - then who in the real world would actually make a decision to wait to get their money?

For an answer - just look around.

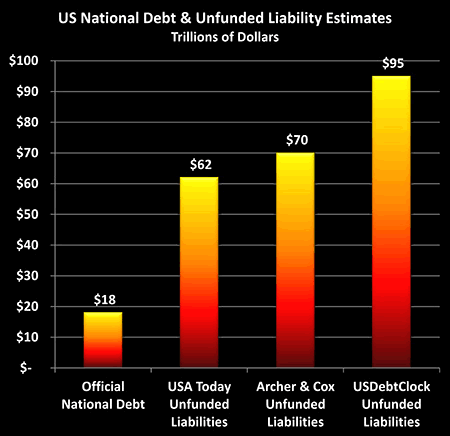

There have been numerous studies showing that if we take a normal rate of economic growth and project it into the future, look at current tax rates, and compare these future expected tax revenues to government retirement promises - then we have a gross shortfall. Indeed, as reviewed here, these unfunded retirement liabilities are likely to be at least four to five times greater than the current official national debt.

So the money isn't there. And studies showing that the money isn't there have received enough attention that most people are at least somewhat aware of the issue. Which is why so many people in their 50s or younger are skeptical about the amount of Social Security they will actually receive.

But how is this overriding problem taken into account with most retirement decision aids? It is generally completely ignored.

Instead, if the government schedules show that payments will be made, then for decision-making purposes those are treated as being certainties, regardless of the date promised - or of the expected financial ability of the government to pay at that time.

Retirement Game Theory #3: Getting Less Because Others Took The Available Money First

This much we know - there is a limited amount in the Social Security Trust Funds. And once that is gone, there is very good chance that the rules will change. The rules may change a little, or they may change a lot - but there is quite a good chance that Social Security benefits will be reduced at that time.

Part II

Part II of this article explores 1) the two ways in which early claimants can use up all of the Trust Funds, possibly leaving their peers of the same age with zero; 2) the three differing levels of information available, and how the informed are able to profit from the two types of uninformed decision makers; and 3) the four takeaway points for decision making.

Daniel R. Amerman, CFAWebsite: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2015 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.