Gold Miners Are Saying It's Time

Commodities / Gold and Silver Stocks 2015 Aug 13, 2015 - 01:00 PM GMTBy: Bob_Loukas

Back in early July I published the view that we needed “Just a Little Bit More“ downside to complete the gold Investor Cycle. All of the indicators and tools we used to spot these turns were firmly in place and it had become a matter of cleaning out the remaining bulls before turning. At the time of publishing, gold stood at $1,130, and my expectation was for one more decline, below $1,110, in order to complete the Cycle and form a major Investor Cycle Low.

Back in early July I published the view that we needed “Just a Little Bit More“ downside to complete the gold Investor Cycle. All of the indicators and tools we used to spot these turns were firmly in place and it had become a matter of cleaning out the remaining bulls before turning. At the time of publishing, gold stood at $1,130, and my expectation was for one more decline, below $1,110, in order to complete the Cycle and form a major Investor Cycle Low.

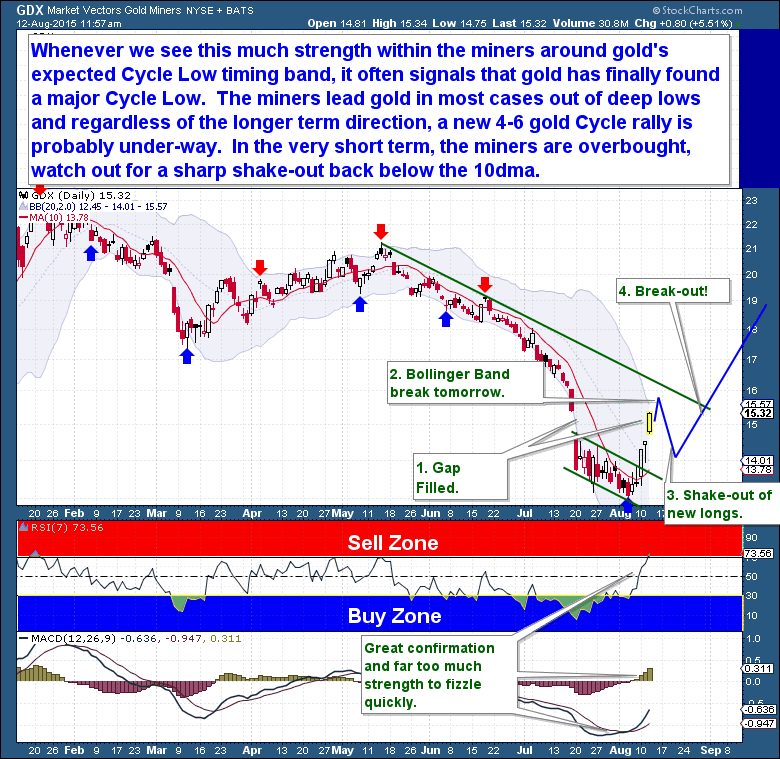

Well, that expectation has been fulfilled, and with the strength seen in the miners these past few days, we can say with a very high degree of confidence that the Gold Weekly (Investor) Cycle has turned. Judging by the gold chart alone, that call might seem a touch premature. But it’s the gold miners that almost always lead the gold Cycle out of significant troughs. And whenever we see this much front-running strength within the miners, around these expected Gold Cycle Low timing bands, then it pays to be a little aggressive and expect that gold will quickly follow suit.

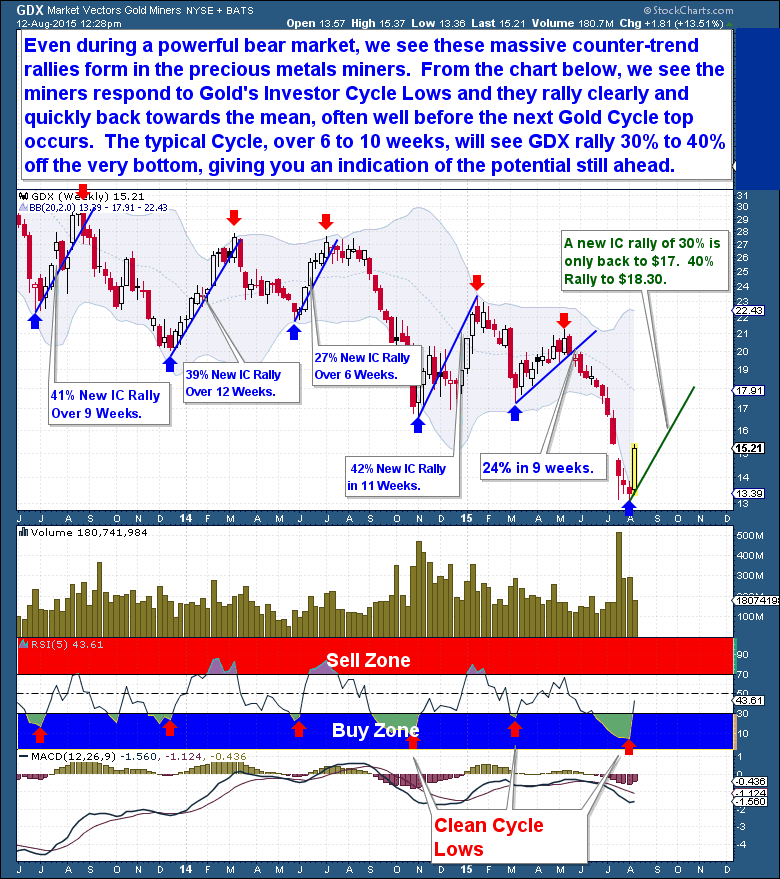

A word of caution though, the miners are short-term overbought. Anyone buying in here should be aware that a fast 1 to 2 day drop, back below the 10dma, is actually quite possible and within character. Looking longer term, throughout this powerful bear market, we see these massive counter-trend rallies form in the precious metals miners. From the chart below, we see the miners respond to Gold’s Investor Cycle Lows and they rally clearly and quickly back towards the mean, often well before the next Gold Cycle top occurs. The typical Cycle, over 4 to 8 weeks, will see GDX rally 30% to 40% off the very bottom, giving you an indication of the potential still ahead.

To be clear however, this is not a call on the great gold Bear Market, it’s grip on this asset remains firm…for now. What we can expect however is for gold to rally for 4 to 6 weeks and to the point where most bear market counter-trend rallies have stalled. It’s at that point where we will see gold’s true, longer term intentions.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try#

By Bob Loukas

© 2015 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.