Gold and Silver Offer The Most Profitable Secular Opportunity Today

Commodities / Gold and Silver 2015 Aug 14, 2015 - 01:50 PM GMTBy: GoldSilverWorlds

July was a horrible month for precious metals prices. Sentiment reached levels never seen before. As metals and the miners broke through a long term support line, so did pessimism.

July was a horrible month for precious metals prices. Sentiment reached levels never seen before. As metals and the miners broke through a long term support line, so did pessimism.

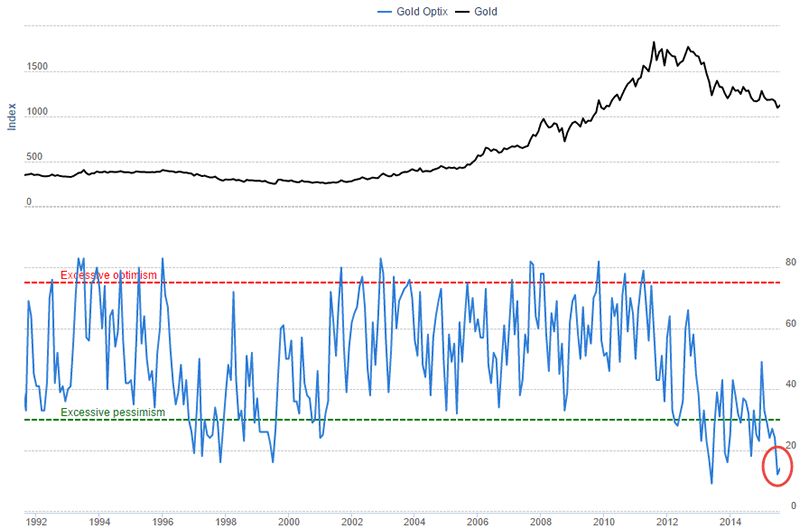

To get an idea of the level of pessimism, we are including a very long term chart going back to 1992 (courtesy of Sentimentrader). As readers can see, market sentiment in the last 2 years is worse than the bear market lows of 1998 – 2000.

When everyone panicked in July, we urged investors to stay calm, and look at the gold market space being an opportunity. A contrarian call which characterizes our vision. For instance, our column of July 19th contained the following quote:

“Can precious metals go lower from here? Yes, no doubt. But, if we get a breakdown, then a sharp V-shaped recovery should take place very quickly. In that sense, timing the bottom is a fool’s game. Investors will be chasing the gold price, with little success whatsoever.”

Two weeks later, on August 2nd, when literally everyone was throwing in the towel, convinced that gold would collapse to $800 an ounce, we wrote the following:

“Although we do not believe that markets trend higher or lower based on ‘reasons’, we still think there are two signals that indicate there is not much downside left for gold.

So rather than panicking, we look at the level of hate surrounding the gold market, and we become more bullish by the day. We believe that smart investors should be preparing their shopping list right now, instead of reading mainstream media headlines about gold.”

Indeed, it is our job to guide investors through rough waters in the markets. When we become contrarian, there is a good reason for that. Gold, silver, and miners are undervalued. The correction has been too long, too sharp. Over time, a mean reversal will take place. Gradually increasing positions in undervalued assets is what secular investors should do in order to tap into the potential of the market.

Investors are faced with a serious challenge: how exactly to play the beaten down precious metals sector? If anything, investors must avoid too much risk when putting capital at work.

There are four rules that investors should take into account which, especially in these hard times, are important to respect in a disciplined way. Admittedly, it is a contrarian approach, and it is probably not what most investors would do.

First rule: always stay diversified when it comes to your investments. It is imperative that the holdings in your portfolio are sufficiently spread across assets and segments (stocks, commodities, precious metals, countries, etc). This has become such a ‘cliché’ that most investors are simply neglect it. But a well diversified portfolio allows to grab the opportunity of collapsing precious metals, which, at some point in the future, will reverse their downtrend. Because of the technical damage, repair time itwill take quite a while. Meantime, secular investors should be using their time to analyze which companies are able to survive this storm, in order to make up their shortlist of future ten baggers.

Second rule: only add gradually to your positions. That assumes that your additional positions remain relatively small. It also assumes that you have, at all times, liquidity available. Picking a bottom or a top is a fool’s game, so your positions need to be managed, literally, over time, based on the evolution of the market.

Third rule: value will never disappear, and it will be rewarded at some point in the future. Companies that ‘possess’ true value are heavily sold right now, just like almost every company in the commodity and precious metals space, but to a less extent than their peers. Secular investors are focused on true value. Let’s face it, a miner that is producing gold at below average production cost, has a pipeline with exploration projects with high-grade metal, and has its finances under control, has value that will not magically ‘disappear.’

Fourth rule: your portfolio must be future proof. In today’s world, that means that you should anticipate rising interest rates. One of the key themes at Secular Investor is that the top of the bond market is in, so investors should prepare for a world of rising interest rates (hence, lower bond prices). That means that your selection of assets and stocks should not contain companies that are heavily indebted. It definitely adds to the complexity, but we believe it will largely pay off in the future.

Stay calm, focus on the big picture, manage your investments … and above all, manage your emotions. Secular investing pays off over the long term.

RECEIVE OUR FREE GOLD INVESTING GUIDE >>

Secular Investor offers a fresh look at investing. We analyze long lasting cycles, coupled with a collection of strategic investments and concrete tips for different types of assets. The methods and strategies are transformed into the Gold & Silver Report and the Commodity Report.Follow us on Facebook ;@SecularInvestor [NEW] and Twitter ;@SecularInvest

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.