Will China Yuan Currency Devaluation Cause a Stock Market Crash?

Stock-Markets / Financial Crash Aug 14, 2015 - 06:06 PM GMTBy: ...

MoneyMorning.com  David Zeiler writes: Stocks tumbled again early today (Wednesday) after a second round of yuan currency devaluation by the Chinese central bank.

David Zeiler writes: Stocks tumbled again early today (Wednesday) after a second round of yuan currency devaluation by the Chinese central bank.

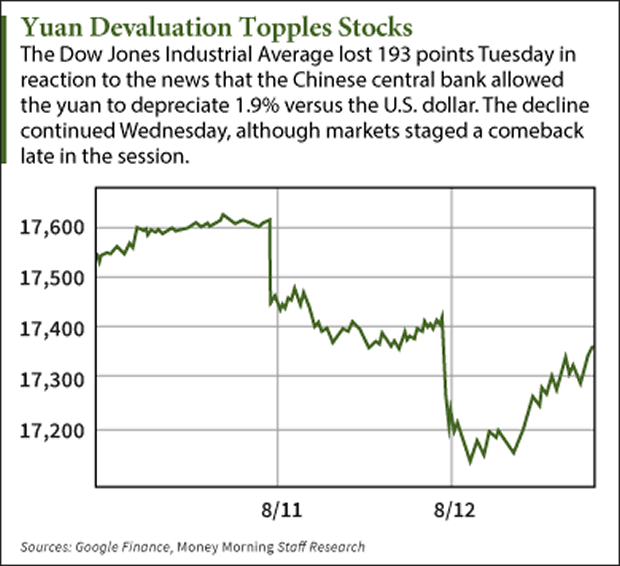

The Dow Jones Industrial Average fell as much as 250 points, or 1.5%, in Wednesday morning trading. That decline followed a 212-point loss (1.2%) Tuesday.

Stock markets around the world have been reeling since the surprise move by the People's Bank of China (PBOC) to let the markets play a greater role in determining the value of the yuan currency.

Tuesday's drop of 1.9% against the U.S. dollar was the biggest since 1994. Today, the PBOC allowed the yuan to fall 1.8%, approaching four-year lows.

Investors are worried that the sudden willingness of the PBOC to devalue the yuan currency is a sign the Chinese economy is much weaker than suspected.

"We spend a lot of time obsessing over Greece or Puerto Rico, but China is a much bigger economy and a much bigger problem to the global economy, and devaluing the currency is shaking people up," Tom Wright, the New York-based director of equities at JMP Securities, told Bloomberg.

Because the move came as such a surprise, the markets didn't have time to sort out the full impact of a devalued yuan currency, adding fear to an already unsettled mood.

"You have reactive behavior and investors scrambling trying to reorient their portfolios and play the guessing game of what the ramifications are here," Gene Peroni, a fund manager at Advisors Asset Management Inc., told Bloomberg.

But two days in, dire implications have become clear: A 10% stock market correction is a strong possibility, and it could easily lead to a full-blown stock market crash.

In fact, at least one market observer believes the devaluation of the yuan will lead to a stock market crash on the scale of what we saw during the 2007-2008 financial crisis…

How the Yuan Currency Devaluation Could Trigger a Stock Market Crash

In a note to clients today, Societe Generale strategist Albert Edwards warned that China's move to devalue the yuan will set forces in motion that ultimately will lead to a major stock market crash.

"We expect the acceleration of [emerging market] devaluations to send waves of deflation to the West to overwhelm already struggling corporate profitability and take us back into outright recession," Edwards said. "As investors realize yet another recession beckons, without any normalization of either interest rates or fiscal imbalances in this cycle, expect a financial market rout every bit as large as 2008."

Even if you disagree with Edwards' argument for a major stock market crash, the yuan currency devaluation clearly has investors worried. And after a six-year bull market, almost any negative catalyst could cause a big sell-off.

The PBOC move can hurt the markets in several ways:

Yuan Currency Devaluation Concern No. 1: Impact on U.S. Multinationals

Earnings of U.S. multinationals that do business in China were already under pressure from the slowing Chinese economy and the strong U.S. dollar. The devaluation of the yuan will make U.S. products and services more expensive in China, reducing sales and eating further into profits. Many of these stocks have suffered larger losses than the broader market over the past two days: Apple Inc. (Nasdaq: AAPL) lost 5.2% Tuesday. General Motors Co. (NYSE: GM) lost 3.75%. Micron Technology Inc. (Nasdaq: MU) also lost about 3.75%. And Yum Brands Inc. (NYSE: YUM) is down a painful 8.5% over both days. As the weaker yuan hurts big companies like these, they will drag down the markets.

Yuan Currency Devaluation Concern No. 2: Falling Commodities

One of the indirect impacts of yuan devaluation is the suggestion of a weaker Chinese economy, which brings lower commodity prices, particularly for energy and industrial metals. It's especially acute because most commodities are priced in U.S. dollars. That's why oil prices fell 4% Tuesday and copper prices plunged 8%. Falling commodity prices are bad for those who pull them from the earth, such as oil drillers and mining companies. And there's a double whammy here. The yuan currency devaluation increases commodity prices in China, encouraging mining while discouraging consumption. Both will serve to depress commodity prices further.

Yuan Currency Devaluation Concern No. 3: This Is Just the Beginning

The hope that the PBOC was doing a "one-off" on Tuesday evaporated quickly on Wednesday as the yuan currency slid further. And that raised the specter of a long slide for the Chinese currency, creating uncertainty about how low it might fall. Several analysts, including Deutsche Bank (NYSE: DB), predicted the yuan will slide as much as 10% to 15% further in the weeks ahead before it stabilizes. The longer this process takes (and the lower the yuan goes), the heavier the toll on stocks.

Investors trying to cope with the prospect of a stock market crash should consider putting some money into assets that stand to benefit from the yuan devaluation.

Options include safe-haven investments like gold, the U.S. dollar, longer-term U.S. Treasuries, and defensive investments like utilities and telecoms as well as REITs (real estate investment trusts) and MLPs (master limited partnerships).

Finally, investors might want to look at ETFs that invest in Chinese stocks, such as the iShares MSCI China Index Fund (NYSE Arca: MCHI). Not only are these shares depressed after the 30% drop in the Chinese stock market, but a policy of monetary devaluation will eventually start driving prices higher.

Follow me on Twitter ;@DavidGZeiler.

Why China Devalued the Yuan Now: The PBOC action took many by surprise, but when you look at what's happening in China right now, it makes sense that the Chinese government would move to devalue the yuan currency. It has its roots in China's June stock market crash. But something happened over the weekend to force the PBOC's hand…

Source :http://moneymorning.com/2015/08/12/will-the-yuan-currency-devaluation-cause-a-stock-market-crash/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.