Junk Bonds Call for Stock Market Crash ...

Stock-Markets / Financial Crash Aug 18, 2015 - 05:30 PM GMTBy: Clive_Maund

We have looked at plenty enough evidence in recent weeks that a crash is looming for US markets, and now we are going to take a look at another important piece of evidence that we haven't previously considered - the Junk Bond market.

We have looked at plenty enough evidence in recent weeks that a crash is looming for US markets, and now we are going to take a look at another important piece of evidence that we haven't previously considered - the Junk Bond market.

When confidence deteriorates Junk Bonds get sold off. A reason for this is that Junk Bond Holders are low on the list of creditors who can expect to be paid off in the event of corporate default, hence the name. They yield more because they carry more risk, so when risk threatens to rise or rises, savvy holders want out.

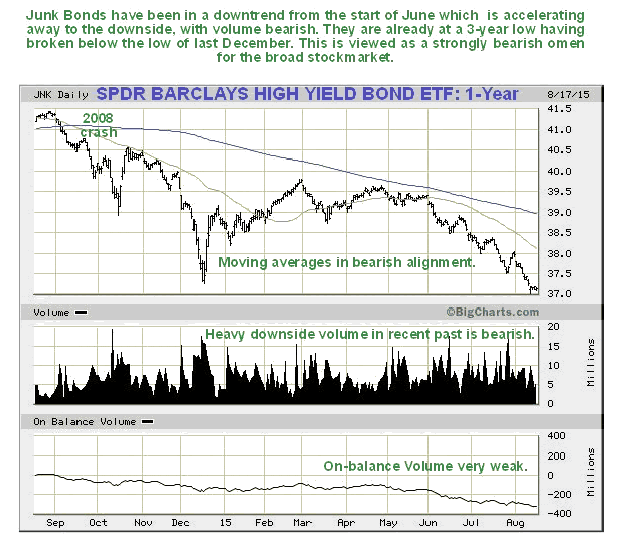

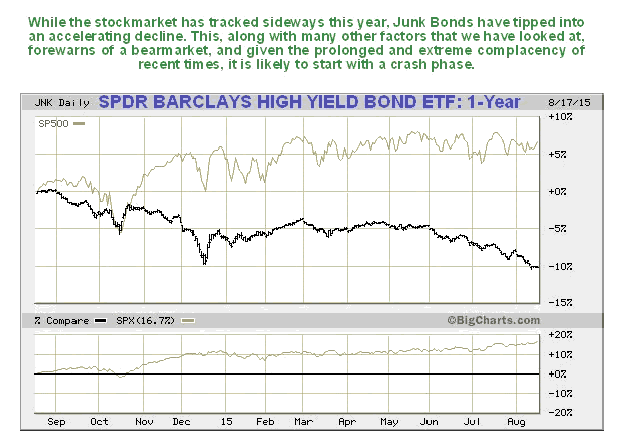

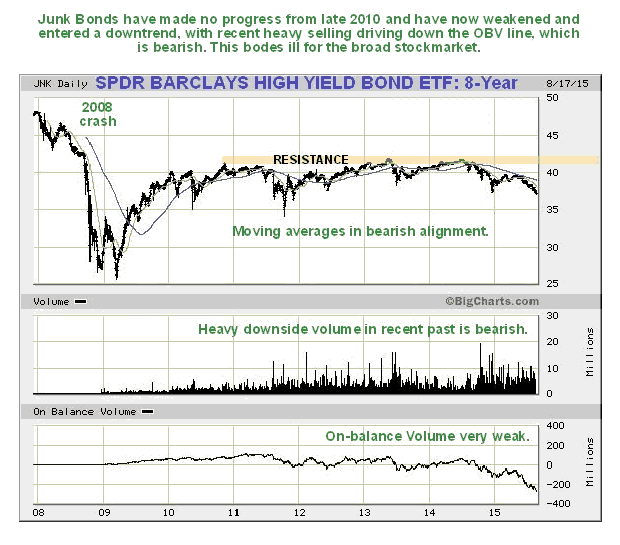

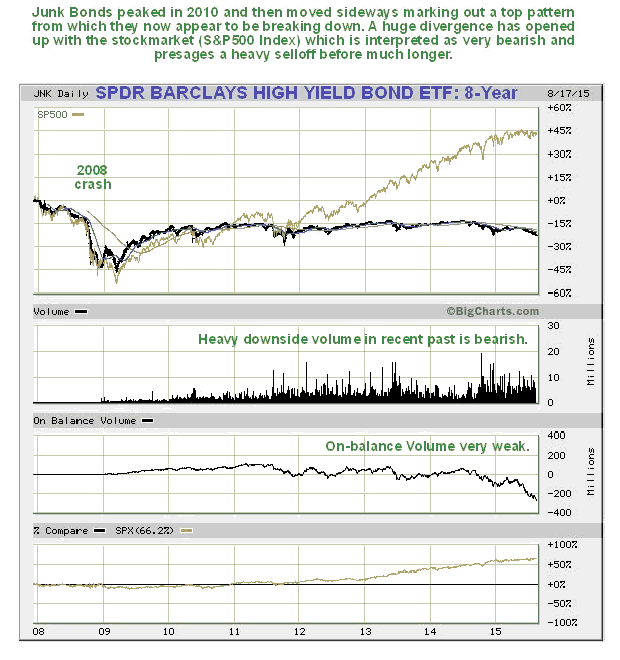

Thus it is interesting to see that Junk Bonds have just fallen to a 3-year low. This is a leading indicator for the market and it means trouble. We can see what has happened on the charts for the SPDR Barclays High Yield Bond ETF, code JNK, shown below. If you can't tell that this is a Junk Bond ETF from the name, you sure can from the code. They have gone into a persistent downtrend from the start of June as we can see on the 1-year chart, which has already taken them to a 3-year low, as can be seen on the 8-year chart. We are using Bigcharts charts here because Stockcharts appear to be carrying inaccurate data, and two 1-year charts are shown, with one showing volume and On-balance Volume, and the other showing a comparison with the S&P500 index, and two 8-year charts.

Another point worth observing on these charts is that prior to Junk Bonds going into decline in recent months, they had leveled off for years, whereas the stockmarket continued higher and higher, resulting in a big divergence that is viewed as ominous. Notice also how Junk Bonds fell in step with the market during the 2008 crash, but now they are falling while the market treads water, which is calling the market down. Note that JNK is pretty heavily oversold sold here and entitled to a minor rally, but that won't change the overall picture.

Many lesser markets around the world are toppling, but somehow the big Western markets of Europe, Japan and the US are staying aloft. If you have ever made a sand castle on the beach and watched what happened when the tide comes in, you will recall that it is the weaker outer ramparts and smaller turrets that collapse first, and the big central towers that hold out the longest. The weaker outer ramparts and smaller turrets are the Emerging Markets which are already crumbling, and it won't be long until the big central towers - the big Western Markets, go the same way - everything is pointing to it.

Finally there is the somewhat amusing notion going around in some quarters that all the money panicking out of various markets, or soon to panic out of various markets around the world, is going to be funneled into US markets, because its markets are big and deep and because the US is far away from the Islamic State and the refugees' little rubber boats are unlikely to try crossing the Atlantic, and because the US has a huge overpowering military and is capable of defending the country from anyone and anything. It's a quaint theory, that the US markets will rise while everywhere else they are falling, but if you have ever leaned on farm gate and watched a sheepdog herding sheep around a field, you will know that they move together - one doesn't just break off and go his own way - it has to be forcibly separated. So the idea that the US markets will rise while markets elsewhere are dropping doesn't make any sense. It doesn't make any sense economically either, because the US cannot prosper in isolation while the rest of the world is in depression. However, there is likely to be a frenzied "dash for cash" into the US dollar, driving it even higher, and for this reason short-term Treasuries may benefit for a while, so in this sense the US will likely benefit temporarily from the mayhem.

As you know, we are cautiously optimistic about the Precious Metals sector. We know it is absurdly oversold and undervalued, but that doesn't mean that it won't get taken down even more for a while when the deflationary downwave turns its attention to the big Western markets. This is the reason that we are reticent to go in "guns blazing" buying everything in sight, although it does look like there is room for a tradable rally here before the downwave hits. As an example, say we have a PM stock with good assets that has fallen from $20 to about $2 since 2011, which is not that unusual. It might rally now to say $2.70 over the short to medium-term, which would be a good percentage gain, but then roll over and get smashed down to just $1.00 when the downwave hits and markets crash. That is what we are anxious to avoid. Our strategy therefore is to play this rally and either get out at the intermediate top, if we can spot it, or on the failure of recent lows, and then lie in wait for the crash bottom, which is where the PM sector should take off higher, very possibly on the announcement of another QE program by a panicked and rattled Fed and government.

Because we are much more sure that the stockmarket will crash soon than that the PM sector won't drop further, bear ETFs and Puts in the broad market are regarded as a considerably safer bet at this juncture than going long PM stocks here. PM stocks certainly are horribly undervalued now, but they may be even greater bargains once the stockmarket crashes. Please refer to the article PREPARING FOR THE CRASH - BEAR (INVERSE) ETFs SHORTLIST, INCLUDING LEVERAGED for details of suitable broad market bear plays.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.