SPX Stock Index Breaking Down

Stock-Markets / Stock Markets 2015 Aug 20, 2015 - 03:30 PM GMT SPX broke below its prior low at 2052.09. There may not be much of a bounce this time since this appears to be a third wave scenario.

SPX broke below its prior low at 2052.09. There may not be much of a bounce this time since this appears to be a third wave scenario.

ZeroHedge comments, “Small Caps hitting 6 month lows, S&P swinging red year-to-date, and Dow near 7-month lows... but remember China doesn't matter and Fed is priced in...”

Further commentary. “50-day “droughts” before and after a 52-week high in the Dow Jones Industrial Average have marked several major tops.

It has now been 64 days since the last 52-week high in the Dow Jones Industrial Average (DJIA) on May 19. While that may seem like an eternity in the context of the past 2.5 years, it’s not at all unusual in the grand scheme of things. However, what did have us thinking “hmmm” is the fact that there was also an extended period of time – 53 days to be exact – prior to the DJIA’s high on May 18 when the index was unable to score a new high. As it turns out, such droughts prior to andsubsequent to a DJIA 52-week high have been unusual. And, as it turns out, such occurrences have often come at inauspicious times in the market cycle.”

VIX now has a double breakout to another new high. It is possible that it may pause at the 2-hour Cycle Top, but only for a pause that refreshes. This is very bullish for the VIX and its ETFs.

The Hi-Lo rose briefly this morning, but only to decline back to its lows. This shows that there were buyers at the open, but they were overcome by sellers.

The reason for the prior bounces is that selling into the lows was light and tapered off, giving the HFT algos a chance to reverse the flow on very light volume. Once volume increases on the declines, the algos may either withdraw or join the selling. This scenario potentially show volume increasing on a down day.

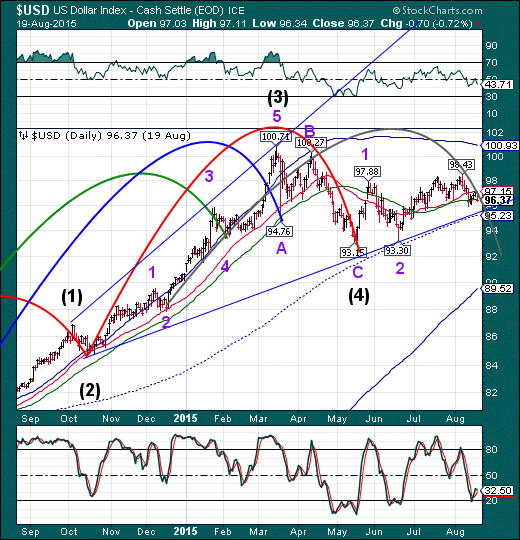

The USD declined to 95.86 this morning. While still above mid-Cycle support, the current Master Cycle has another 10 calendar days to complete its low. That may invalidate its Broadening Wedge or confirm it, depending whether USD crosses the trendline and how far it may fall.

To make matters even more interesting, BKX, which is my proxy for liquidity, forcefully broke the lower trendline of its Broadening Wedge. BKX is on a different Cycle pattern from stocks and bonds.

The Cycles Model calls for a Master Cycle low on either September 30 or October 1, 2015.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.