China Stock Market Shanghai Composite Index Update...

Stock-Markets / Chinese Stock Market Aug 26, 2015 - 05:32 PM GMTBy: Clive_Maund

The Chinese market is of interest to us not because we necessarily want to trade it, but because of its effect on other world markets. Its heavy drop on Monday morning contributed to the rout on Wall St later in the day. The Chinese economy is a massive Ponzi scheme that is threatening to implode, with grave implications for the world economy.

The Chinese market is of interest to us not because we necessarily want to trade it, but because of its effect on other world markets. Its heavy drop on Monday morning contributed to the rout on Wall St later in the day. The Chinese economy is a massive Ponzi scheme that is threatening to implode, with grave implications for the world economy.

A common misconception about China is that the market can't drop too much because the Chinese government and Treasury has a huge budget surplus which it can use to wade in and prop up the market, either directly or indirectly. Veteran top bubble expert Doug Noland, of the Credit Bubble Bulletin, succinctly illuminates the stark reality of the situation as follows -

"According to SNL Financial, Chinese banks now hold four of the top five spots on the list of the world's largest banks. Pulling data from year-end 2014 balance sheets, the big four Chinese banks - Industrial & Commercial Bank of China, China Construction Bank, Agricultural Bank of China and Bank of China - ended 2014 with assets of 87.59 TN yuan, or $13.7 TN. China's big four saw combined Total Assets expand 64% in four years, with Loans up 80%. Estimates place total China banking system assets at $172 TN yuan to end 2014, or about $27 TN at today's exchange rate. Since the end of 2008, banking assets have swelled 175%. Estimates show "shadow banking" assets having ballooned to the neighborhood of $5.0 TN. A bursting Chinese Super Bubble is a systemic issue - for the global economy, for global markets and for global finance. Rather quickly, China's $3.7 TN international reserve position doesn't seem as all-powerful." This makes it clear that, despite its apparently huge reserves, China's economy is a lot more vulnerable than many think.

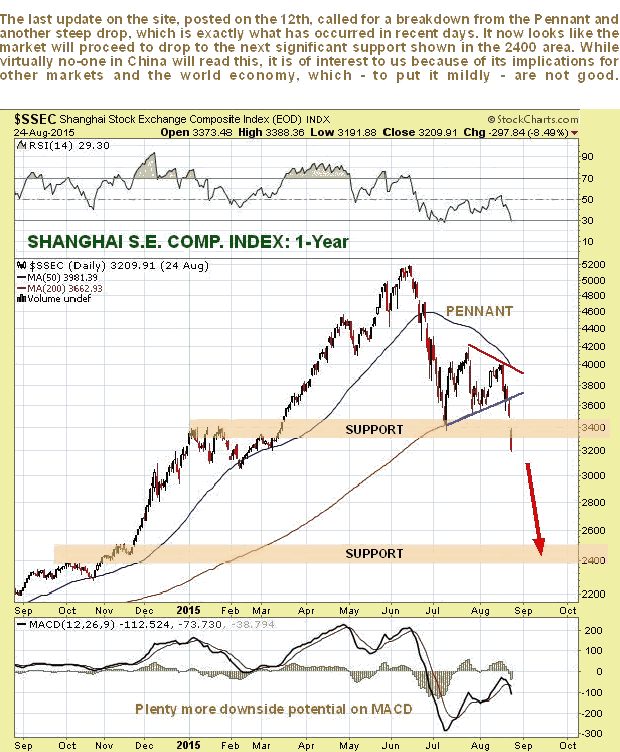

The last update on China was posted on the site on the 12th, when the Shanghai Composite index had rallied up to the top boundary of the bear Pennant that we had correctly identified. That update called for the market to break down from this Pennant and below its rising 200-day moving average and proceed to drop hard. That is what has since happened as we know, and the purpose of this update is to delineate a probable downside target for the market for this downleg.

On the latest 1-year chart for the Shanghai Composite index, we can see that it has broken down from the Pennant and dropped steeply, crashing through the support level shown. While there is a lesser support level in the 3050 area, it is now expected to continue to drop fairly steeply, over the next several months and possibly within weeks, to the next important support level at and above about 2400.

Anyone looking for fundamental justification for further losses might want to reflect on the fact that the average PE ratio for the Chinese stockmarket is a lofty 61 - those long the market had therefore better hope it doesn't decide to overshoot to the downside.

The Chinese market actually performs very well technically, which is probably due to the naivety of most participants in this market, and that includes the government. This is partly why we were able to call the June - July crash before it happened, admittedly a little ahead of the final high, the bounce to the 4000 area from mega-oversold in July, and then the breakdown from the Pennant leading to the latest sharp drop.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2015 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.