Gold Shares Lows are Near

Commodities / Gold and Silver Stocks 2015 Aug 29, 2015 - 07:07 AM GMTBy: Aden_Forecast

As most of you know, many mining companies have fallen by over 90%. The HUI Gold Bugs index has fallen 83% since its 2011 peak in the second longest bear market in gold shares on record. It's fallen twice as much as gold's bear market loss of 43%.

As most of you know, many mining companies have fallen by over 90%. The HUI Gold Bugs index has fallen 83% since its 2011 peak in the second longest bear market in gold shares on record. It's fallen twice as much as gold's bear market loss of 43%.

But looking at the next two charts, both are saying the lows may already be in.

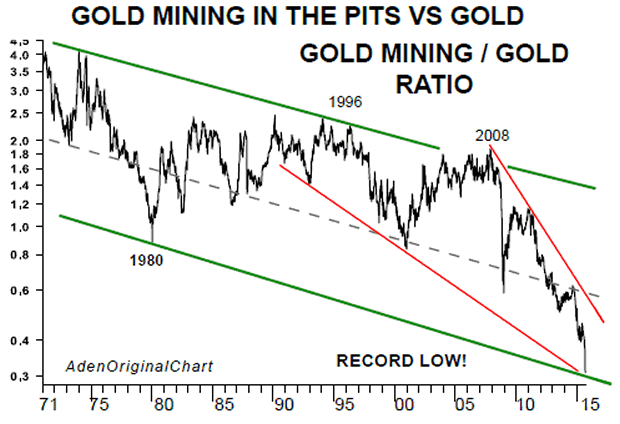

The bear market is not over until it's over, but the gold shares to gold ratio on Chart 1, sure looks like a low is near.

Note the sharp spike down to record lows this month.

Its intensity looks similar to 1980 when it spiked down below the mid-channel line.

Interestingly, at that time gold was much stronger than gold shares during the best part of gold's bull market at the blow off peak.

This time the spike is due to gold shares being extremely weaker than gold. It's now at the bottom side of a 44 year downchannel and it's formed a several decade downside wedge.

This big picture shows that gold shares started to become weaker than gold in 1996.

And it also clearly illustrates how cheap this market is today...

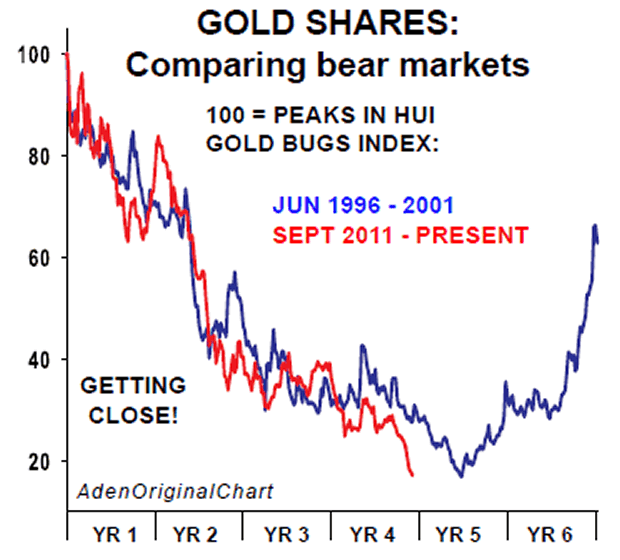

The worst four+ year bear market in gold shares started in 1996 and it ended in 2001. And now, today's bear market is matching this record.

Comparing the two time-periods, you can see the similarities (see Chart 2). That is, today's bear market decline since 2011 looks a lot like the terrible 1996 - 2001 gold share decline.

The craze then was the tech frenzy. Irrational exuberance went out the window and tech stocks soared, leaving gold shares in the dirt.

Most exciting now is to see how close today's lows are to the worst bear market's lows. This is saying we could well be near the lows in gold shares. For now, the HUI index would start to look good by staying above 120.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.