Silver and Warnings From Exponential Markets

Commodities / Gold and Silver 2015 Aug 31, 2015 - 04:48 PM GMTBy: DeviantInvestor

For the past 15 – 40 years, debt and prices in most markets have moved upward, broadly speaking, in exponential trends. See the following log-scale graphs.

For the past 15 – 40 years, debt and prices in most markets have moved upward, broadly speaking, in exponential trends. See the following log-scale graphs.

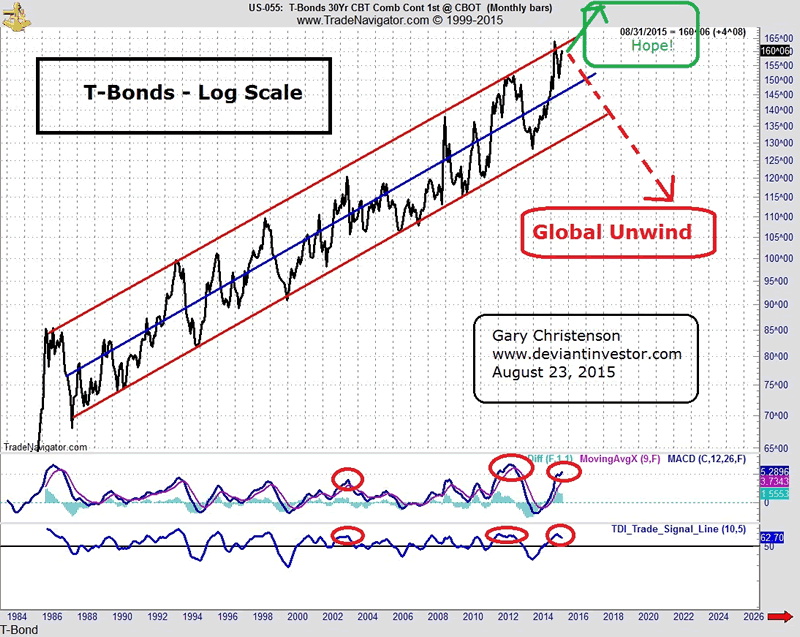

US T-Bonds: T-Bonds have been rallying in their bull market since the early 1980’s. Will they continue, correct, or crash? Doug Noland says it is “The Beginning of the Great Global Unwind.” See chart.

“I really fear for the unwind of the ‘global government finance Bubble’ – the grand finale of a multi-decade period of serial bubbles. It’s history’s first systemic global Bubble, encompassing the world’s Credit systems, securities markets and monetary systems more generally.”

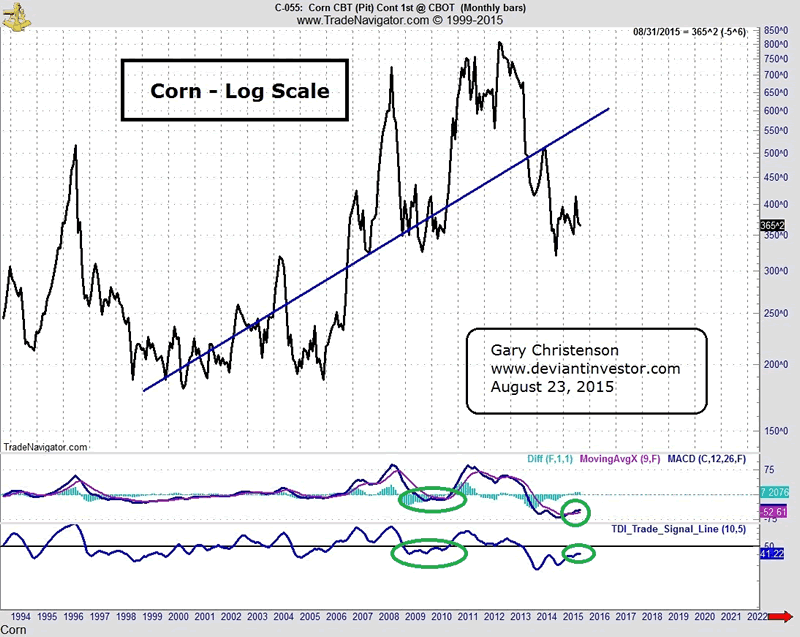

Corn: Since the late 1990s corn prices have increased in an erratic exponential pattern. Corn prices are currently way below trend. Deflationary forces push it downward but devaluation of currencies will push it upward.

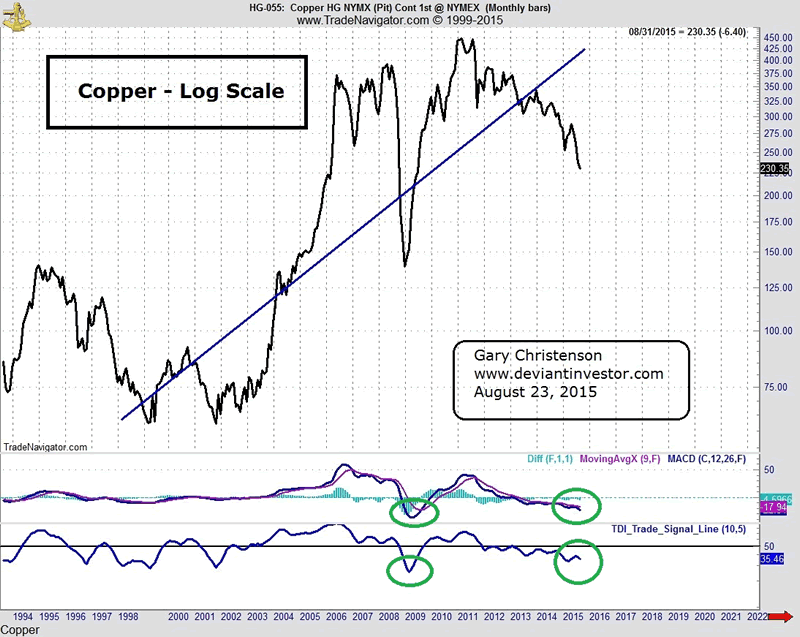

Dr. Copper: It has the same basic pattern as corn and sugar (not shown).

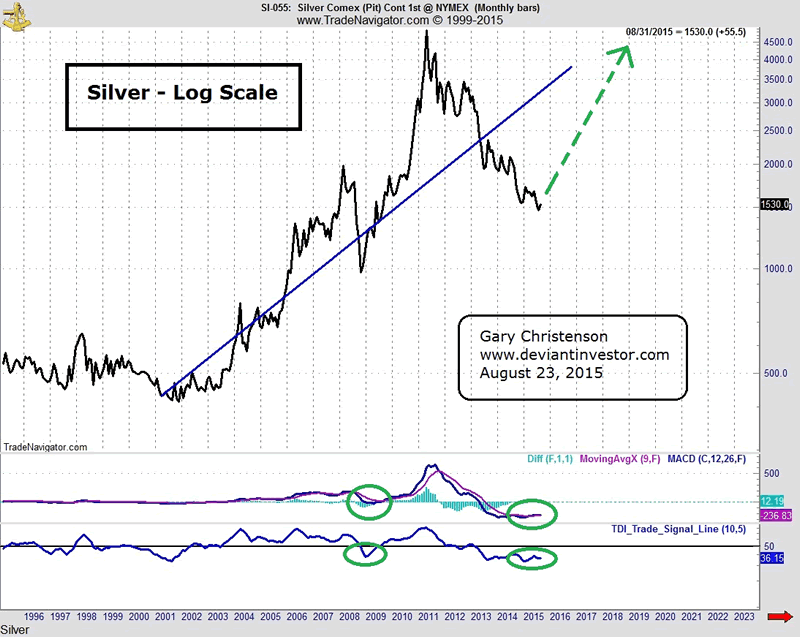

Silver: Silver prices increased exponentially since 2001, peaked in April 2011 at more than double the exponential trend price (as drawn), and crashed to about half the exponential trend price.

The Message from the Markets:

Paper markets such as T-Bonds and the S&P 500 have been levitated by central bank “money printing,” government support, and the inevitable devaluation of fiat currencies built into the structure of the financial system. Paper markets move higher – exponentially – as currencies devalue and reset or crash to lower levels, and then repeat.

“Buy for the long term” works if you buy the lows and lighten up at the highs. Few people succeed. NOW is NOT the time to buy most stocks, while NOW is the time to buy silver and gold. However, few people will transfer their digital currencies into physical metal, and most will regret not doing so.

Commodity markets increase in price due to the same devaluation of currencies that propels paper markets higher. They also fall when global economies weaken, or when countries manipulate commodity prices lower (e.g. crude oil) to damage the economies of enemies. These tactics have been used for decades – and will continue to be used by global governments.

But people and economies need commodities such as silver, copper, crude oil, and sugar. Devaluations, manipulations, supply, demand, taxes, HFTers, and government legislation can push prices far higher and lower for years. Perhaps some commodity prices will stay low for a while longer, but remember:

- Central banks heavily influence the supply of money and will inflate their currencies. The exponential increases in prices will continue unless we devolve into a deflationary depression that overwhelms the considerable efforts of central banks to inflate.

- Central banks fear deflationary forces and will inflate and devalue their currencies to avoid deflation.

- Politicians will spend and borrow, and create exponentially increasing debt which increases the money supply and devalues their currencies.

- Silver and gold act like commodities but also as monetary metals. When economies, stock markets, and bond markets become unstable due to excess leverage and overly optimistic valuations (like now), when people, hedge funds, and institutions become fearful, they want real assets, like gold and silver, not debt based paper that can devalue rapidly. A trickle of demand for silver and gold can quickly become a flood based on fear and worry.

GENERAL CONCLUSIONS:

Economic policies that devalue currencies and create inflation … will create inflation. Yes, it is stupid but central banks and governments everywhere use the same flawed thinking. How are those policies working for people in Venezuela, Argentina, and Ukraine today? Is it conceptually different in Greece, Russia, the UK, Japan, or the US?

Silver prices are currently low compared to global debt, CEO bonuses, government spending, official US national debt, the S&P 500 Index, silver prices in 2011, money in circulation, gold prices, military spending, pension underfunding, and the prices of college tuition and health care. Silver prices will increase substantially in the next five years.

If a government subsidizes butter, it will get more butter. The US government, and many others, currently subsidize social welfare spending, food stamps (SNAP), poverty, disability income, corporate welfare, military adventures, dependence upon government, media propaganda, financial corruption, medical expenses, Medicare, congressional corruption, and so much more. Expect more of the same. The consequences of most of the above will directly or indirectly increase silver prices over the next five years.

Thought Experiment: Place a few assets in a virtual time capsule that you will open in the year 2020. Do you want gold coins, silver bars, paper dollar bills, a stock index ETF certificate, a junk bond issued by an insolvent “fracking” company, Apple stock certificates, Venezuela Bolivars, Russian Rubles, junk silver coins, or Hillary 2016 campaign buttons? In 2020 we will recognize that the value of silver coins, silver bars, and gold coins has increased substantially compared to the other options.

Invest and purchase financial insurance, such as silver and gold, accordingly.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.