Gold Price Up 3.5% In August, Stocks Fall 6% to 12%

Commodities / Gold and Silver 2015 Sep 01, 2015 - 04:43 PM GMTBy: GoldCore

DAILY PRICES

DAILY PRICES

Today’s Gold Prices: USD 1141.90, EUR 1012.23 and GBP 744.10 per ounce.

Yesterday’s Gold Prices: Bank Holiday in UK

Friday’s Gold Prices: USD 1,125.50, EUR 998.23 and GBP 730.99 per ounce.

(LBMA AM)

Gold was marginally higher yesterday and closed at $1135.50 per ounce, up $1.10. Silver was 0.3% higher and closed at $14.64 per ounce.

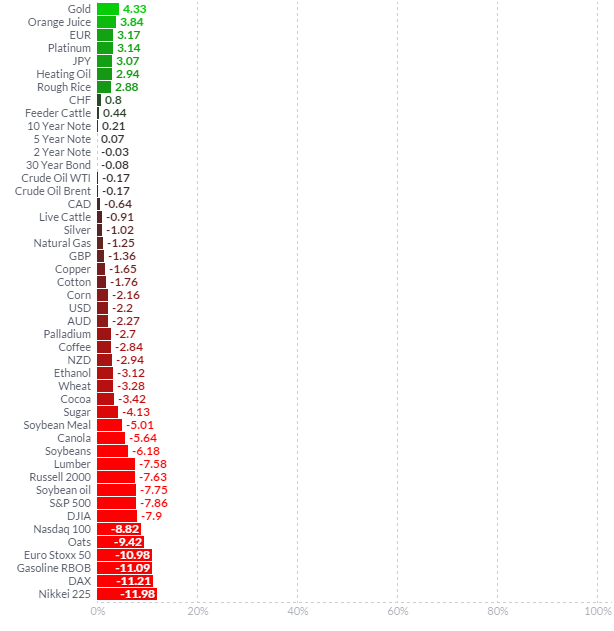

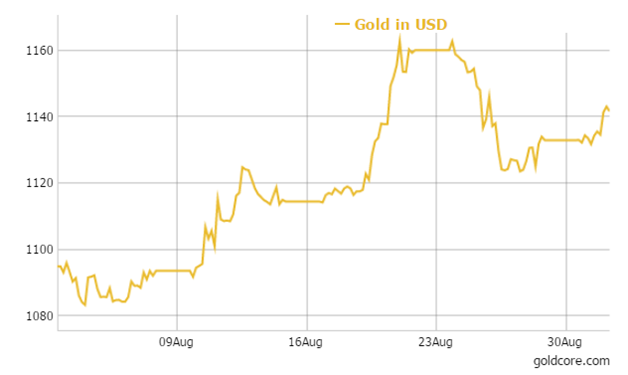

Gold rose 3.5% in August as stocks globally saw sharp falls on growing concerns about the Chinese and the global economy. Silver was 1% lower for the month of August and also acted as a hedge from falling stock markets globally.

Asset Performance in August – Finviz.com

Internationally, stocks had their worst month in the last three years. In one of the most volatile trading periods since the financial crisis, August saw $5.7 trillion erased from the value of stocks worldwide and no major stock market was left unscathed.

The S&P 500 was down a significant 6.3% and the Dow Jones Industrial Average ended the month 6.6% lower, while the Nasdaq was down 6.9%. At one stage losses were much higher but a sharp bounce toward the end of the month meant the declines were that as bad as they looked like they would be.

The weak performance of equity markets in August was mirrored across the world’s major financial centres, with the FTSE down 6.7%. The pan-European FTSEurofirst 300 index recorded a monthly loss of 9% – its worst monthly performance since August 2011.

Gold in USD – 30 days

Germany’s DAX was down 9% and posted its worst monthly performance since August 2011. The DAX is currently some 17% below a record high reached in April.

Asian stock markets closed their worst monthly performance in more than three years in August, as shares struggled to recover from a global selloff sparked by worries about China, the Fed and the global economy.

A slowdown in China’s economy, magnified by a surprise devaluation of the Chinese yuan earlier this month, accelerated a rout in Shanghai that spread across the globe, pushing down everything from stocks in the U.S. and Europe, to commodities and emerging market-currencies.

The Nikkei 225 down 8.2% – its biggest monthly decline since January 2014.

The Shanghai Composite Index ended down 12.5% , its third straight month of declines, and a close runner-up to July’s 14% loss, which was the index’s biggest monthly drop since August 2009.

India’s Sensex was down 6.5% in August.

The losses were broad-based as nine out of the 10 S&P sectors in the U.S. fell. Energy stocks were the sole gainers and interestingly oil prices have surged for a third straight day after the OPEC indicated they are prepared to discuss production levels. U.S. benchmark crude surged 8.8% to $49.20 a barrel on the New York Mercantile Exchange. Oil has surged 27% in just three days.

Today came further evidence of a global slowdown when factory gauges from France, Norway and Russia signaled contractions before data from the U.S. that economists predict will show slower growth

Gold served its function as a safe haven in August, rising strongly in the major currencies. Importantly, from a technical perspective gold recorded a monthly higher close which should see ‘trend following’ momentum traders and speculators begin to add to long positions and “to make the trend their friend”.

The ‘Fall’ and September and October can be the ‘cruelest’ months for stocks. Conversely, more years than not, precious metals prices perform well in September and the autumn period. Safe haven demand for bullion internationally remains robust and Indian festival seasonal demand looks set to be healthy as does Chinese New Year demand later in the autumn.

Given the very uncertain financial and economic outlook, it is important that investors remain diversified with healthy allocations to gold.

Download Essential Guide To Storing Gold Offshore

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.