Stock Market Third Wave - Elliott Waves Point to Market Probabilities

Stock-Markets / Stock Markets 2015 Sep 04, 2015 - 05:49 PM GMTBy: EWI

The "personality" of a third wave shows itself in recent market action

The "personality" of a third wave shows itself in recent market action

A classic issue of The Elliott Wave Theorist published this exchange:

Q. Do you believe that the Wave Principle provides for an objective form of analysis? ... There are market watchers who say that applying wave theory is very subjective.

Prechter: I always ask, "compared to what?" There is no group more subjective than conventional analysts who look at the same "fundamental" news event ... and come up with countless opposing conclusions. ... The Wave Principle is an excellent basis for assessing probabilities regarding future market movement. Probabilities are by nature different from certainties. Some people misinterpret this aspect of analysis as subjectivity, but all probabilities may be put in order objectively according to the rules and guidelines of wave formation.

So: While no one can "see" the future, you can use the Wave Principle to assess probabilities.

The Wave Principle's basic pattern includes five waves in the direction of the larger trend, followed by three corrective waves. This illustrates the pattern in a bull market:

.jpg)

In a bear market, the pattern unfolds in reverse: the five waves trend downward and the correction trends upward.

Each wave in price reflects the dominant investor mood. For example, strong price advances on high volume typically happen during wave 3, the healthiest leg of a bull market. The reverse happens during third waves in bear markets -- conspicuous fear drives prices lower.

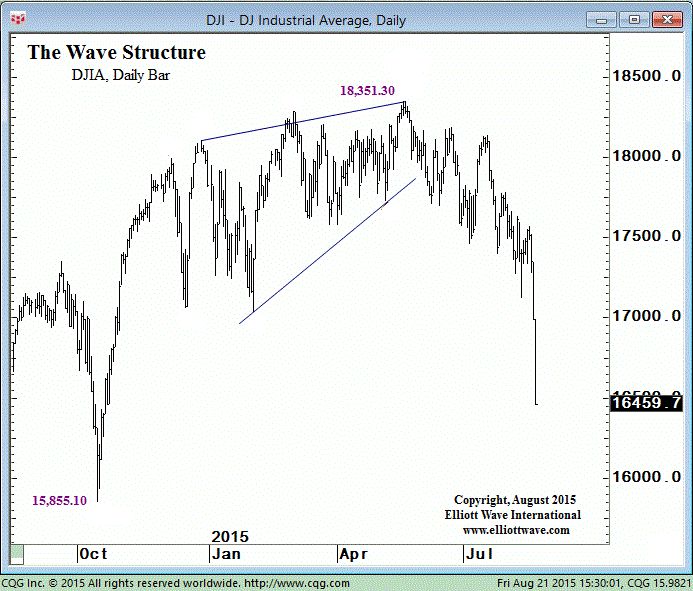

Indeed, recent market action is a case in point. Consider this chart (wave labels available to subscribers) and commentary from the August 21 Financial Forecast Short Term Update:

This week's sharp decline is clearly a third wave. It sports a steep slope with strong downside breadth and volume.

During the next trading session (August 24), the Dow fell nearly 1,100 points at the open. August was the worst month for the Dow Industrials in five years. September started with another triple-digit decline.

Here's how Prechter & Frost's Elliott Wave Principle describes a third wave:

Third waves are wonders to behold. They are strong and broad, and the trend at this point is unmistakable. ... Third waves usually generate the greatest volume and price movement ... .

But know this: The third wave in a downtrend does NOT mark the end of a price decline.

It's true that the fourth wave means an upward correction. But today's investors should learn what to expect with the important wave 5.

Free Elliott Wave TutorialYou can learn more about the Wave Principle in a free report titled, "The EWI Basic Tutorial." Here's what you'll learn:

Get instant free access to this 10-lesson comprehensive course when you join Club EWI. Membership is free, and it just takes a minute to sign up. Free Club EWI members and EWI subscribers, click here to read this free tutorial >> Need a free Club password? Follow this link to complete your free Club EWI profile and get instant access >> |

This article was syndicated by Elliott Wave International and was originally published under the headline Elliott Waves Point to Market Probabilities. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.