Fed Interest Rate Tightening Cycles and USD Performance

Interest-Rates / US Interest Rates Sep 09, 2015 - 12:47 PM GMTBy: Ashraf_Laidi

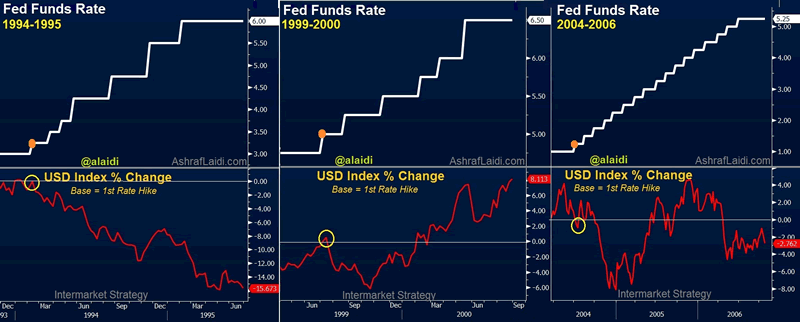

Is the peak of the US dollar behind us? Depending on your USD measure of choice, the dollar may have already peaked, when using EUR and JPY, the two largest and most liquid currencies aside from the greenback. If the bulk of the USD bull market starting in summer 2014 was based on heightened expectations of a Fed hike, then would an actual Fed hike signal the peak of the US dollar? Here is our analysis on the response of the US dollar to each of the last three Fed tightening cycles (1994-1995, 1999-2000 and 2004-2006). One common theme was found.

Is the peak of the US dollar behind us? Depending on your USD measure of choice, the dollar may have already peaked, when using EUR and JPY, the two largest and most liquid currencies aside from the greenback. If the bulk of the USD bull market starting in summer 2014 was based on heightened expectations of a Fed hike, then would an actual Fed hike signal the peak of the US dollar? Here is our analysis on the response of the US dollar to each of the last three Fed tightening cycles (1994-1995, 1999-2000 and 2004-2006). One common theme was found.

1994-1995 Tightening Cycle

As the Fed began raising rates in February 1994, the US dollar index wasted little time to fall more than 10% in the ensuing six months before stabilizing towards the end of the year and subsequently dropping an additional 7%. Among the main reasons to the USD selloff (despite the easy monetary policy pursued by Germany and Japan) was the resulting bond market crash following Greenspan's tightening, which eroded demand for the US currency. The resulting 10% decline in US equity indices didn't help the greenback either. Despite seven Fed hikes in 1994, the USD lost 5%-15% against all major currencies, with the exception of the CAD, against, which it rallied 6%. In the 1995, USD lost against all major currencies, except for GBP, JPY and AUD.

1999-2000 Tightening Cycle

The 1999-2000 Fed tightening cycle was the most positive for the greenback due to three main reasons: i) interest rates took off from a higher level of 5.00%, compared to 3.00% in 1999 and 1.00% in 2006; ii) the Clinton Administration's "strong USD" policy consisted of rhetoric backed by US-bound global capital flows as the euro crashed during its first two years due to policy errors from the ECB; iii) US-Eurozone interest and yield differentials remained firmly in favour of the US. The "New Economy" espoused by Greenspan's low-inflation-high-growth paradigm made the US stock market the only game in town as US technology stocks served as a magnet for global capital flows and emerging markets (Brazil, Russia and Asia) broke down.

2004-2006 Tightening Cycle

The Fed's 125-bps in rate hikes of 2004 didn't prevent the USD from having one of its worst years in recent history, falling against all ten top-traded currencies. Already in a 2-year bear market, the greenback went from bad to worse due to a swelling trade and budget deficit. A nascent global recovery, led by commodities and their currencies was a major negative for the buck. 2005 proved the only positive exception for the US dollar in the 2 ½ years of Fed tightening due to a temporary US tax law encouraging US multinationals to repatriate profits. But the USD rally fizzled in December 2005 over the ensuing two years, turning into a prolonged USD selloff, courtesy of a secular bull markets in commodities and higher-yielding currencies elsewhere.

Today

The USD appreciation from last summer into early spring 2015 is typical of pre-Fed hike rallies. If the Fed does tightening this autumn, will the greenback's gains could well fade away. Despite notable labour market gains, the inflation requirement remains in doubt. The 20% decline in oil since early May will further delay any recovery in price growth, which has prompted the Fed to drop its phrase in the FOMC statement that "energy prices have stabilized".

China's devaluation is increasingly becoming the biggest barrier to any Fed tighening due to the negative growth impact on the world economy, global price growth and financial markets stability, discussed widely in this website.

It will be difficult for the Fed to raise rates this year if US crude oil remains below $48.00 -- The October-March decline has already triggered a chain reaction of broadening cuts in capital and labour expenditure from big oil and iron ore producers, which effectively cast a spell on the suppliers of these energy and mining companies. And barely when oil began its spring time recovery, the declines emerged anew.

Fed hawks will ignore inflation and focus on unemployment, payrolls and wages. They will add that the non-accelerating inflation rate of unemployment aka equilibrium level of unemployment is at 5.3%-5.5%, matching the current unemployment rate of 5.3%. Fed doves will point to the fact that inflation has remained below its 2.0% target for the last three years, while the true NAIRU stands a lower 5.0%.

Dissecting market and survey-based measures of inflation will become a popular sport in the months to come.

And finally, if the Fed does raise rates, it will most likely be one-&-done rate hike, owing to the deflationary pressures weighing down through commodities. At this juncture, the peak of the USD bull market is already behind us.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2015 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.