Stock Market Something Happened This Morning

Stock-Markets / Stock Markets 2015 Sep 10, 2015 - 02:17 PM GMT Good Morning!

Good Morning!

Prior to 6:00 am, the SPX futures were up to 1960.00, a near-50% retracement of yesterday’s decline. Then something happened. “S&P 500 e-mini futures have been halted twice (0551ET and 0612ET) in what one market observer exclaimed "looks like manipulation to me." So what exactly happened at 6:12am?”

Selling has begun in earnest and the Premarket is down, after appositive night prior to 6:00 am.

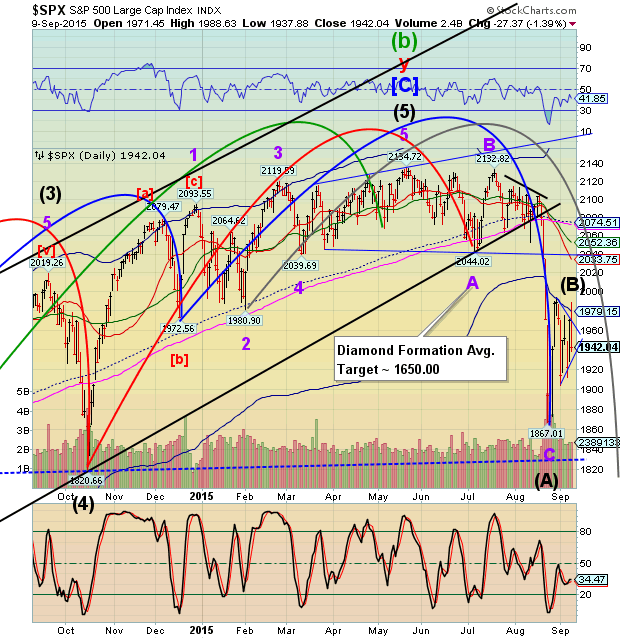

This places me in a quandary about the Cycles. As I have the daily chart marked, Assuming that August 24 is the Master Cycle low (251 days), the (A)-(B)-(C) pattern suggests a very large Wave (C) having just started. That should go to an October 15 low, in time for the next master Cycle bottom.

However, the Diamond formation is not yet complete and is more likely than not to have met its target within the same Cycle decline. If the Diamond formation target can be met in the next 3-5 days, we may have a late Master Cycle (possibly 271 days) early next week in a 5- Wave Leading Diagonal instead of the aforementioned one, as I have annotated on the chart.

Regardless how this all works out, the October 15 master Cycle low appears to be even more certain and deadly. As Bloomberg reports, “It may seem like only yesterday that the U.S. government shut down (actually, it was 2013), followed by promises from Republicans and Democrats alike: Never again.

Turns out never again may be next month.

Inside the Obama administration there is growing concern that Congress will be unable to resolve differences over the U.S. budget by Oct. 1, the start of the 2016 fiscal year, and will stumble into a shutdown though Republican leaders insist they don’t want one. Already, both sides have begun public relations campaigns to pin blame on the other.”

To make matters worse, it appears that TNX just doesn’t want to decline, despite the sell-off in stocks. Should it break back above the 50-day Moving Average at 22.24, it may also break above its Cycle Top resistance at 23.00. TYX is also edging back toward 30.00, which is what put the fear of a rate hike back on the table. Remember, the Feds follow the market, however reluctantly.

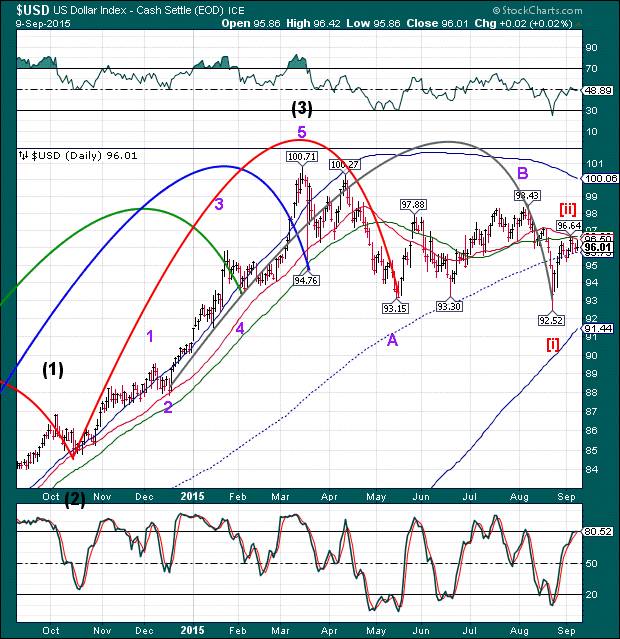

Strangely enough, the USD may be headed for a Master Cycle low in mid-October, as well. The August 24 low may not be the end of that decline, as the USD retracement has stalled precisely at the 50-day Moving Average at 96.66. Instead, it may be a Wave [i] of an Ending Diagonal that could decline to as low as 85.00. This would seem to agree with the notion that a government shutdown is being anticipated.

I will be following these developments with an eye to breaking the impasse between the two alternate views.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.