Gold Mining Stocks Fundamentals

Commodities / Gold and Silver Stocks 2015 Sep 11, 2015 - 05:48 PM GMTBy: Gary_Tanashian

In the previous post Steve Saville talks about the “true” fundamentals of gold, i.e. the ones that actually matter as opposed to the ones that make a good story. In this post, let’s review something that is related but different; gold mining fundamentals.

In the previous post Steve Saville talks about the “true” fundamentals of gold, i.e. the ones that actually matter as opposed to the ones that make a good story. In this post, let’s review something that is related but different; gold mining fundamentals.

While we (NFTRH) have been noting gold’s negative fundamentals for years (especially the status of the yield curve and a thus far ironclad confidence in the Federal Reserve and indeed, relative confidence in global central banks), gold mining sector fundamentals have been on an up-swing. Gold’s fundamentals are generally what we have been calling macro fundamentals and the things that matter to mining operations are sector fundamentals.

Interlude

In a comment included with Saville’s post linked above, we noted that acting upon manipulation ghost stories is not good for a gold bug’s financial health. However, this is not to say that manipulation does not occur. As we noted at the time and still fully believe, the macro backdrop was actually manipulated into being in 2011 as Operation Twist was set loose upon the financial markets with the express goal of “sanitizing” (the Fed’s own word) inflation signals out of the picture.

Op/Twist involved official selling of short-term Treasury securities and buying long-term securities. This kick started a now years-long downtrend in the 10yr-2yr yield curve, which has been bearish for gold the whole while. Manipulation or not, it is bearish and our advice has been that you do not stand on ideology (or worse, someone else’s ideology) with money you do not want to lose. You hold your ideals, but play the game.

Gold Mining Fundamentals

Back on message, several of gold’s fundamental aspects also apply to the gold stock sector, but there are some wrinkles in this relationship. For instance, a gold mining operation, unlike the metal itself, is a moving target with many inputs to its final investment case. Unlike gold, which when tuning out the easy to comprehend promo’s about India/China demand, evil banking conspiracies and even inflation, boils down to confidence or lack thereof in centrally planned policy, gold mining is a business. Period. Gold itself is a refined rock.

So for instance, the strong US dollar, a negative gold fundamental as noted by Saville, is not necessarily so for gold mining. That is because the strong dollar also affects other assets, including global (local to gold mining operations) currencies and cost-input commodities and resources that go into the mining process.

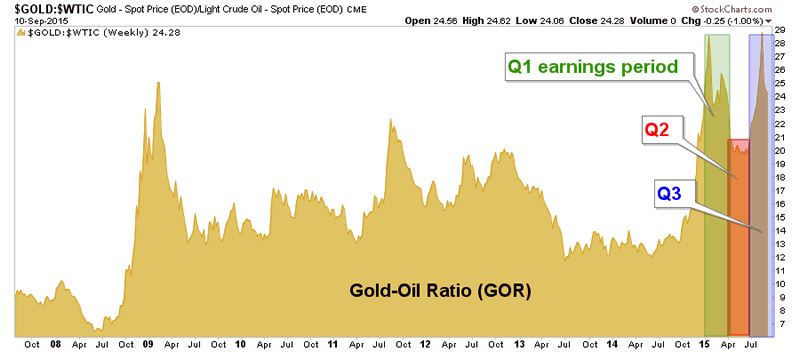

In other words and for example, a gold price rising in terms of Crude Oil is a bullish sector fundamental along with being, to a lesser degree, a macro fundamental indicator. Here is a chart we are interpreting in NFTRH in coordination with macro events to project a future bull case on the sector. Please don’t get over-excited; future means future. We do not promote here.

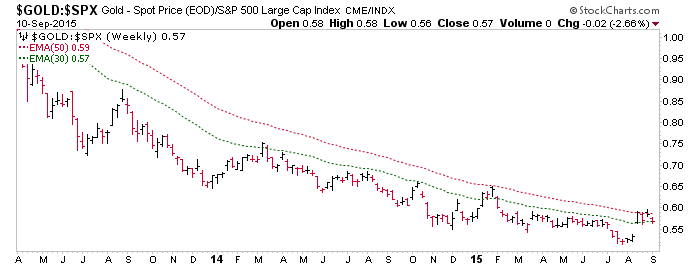

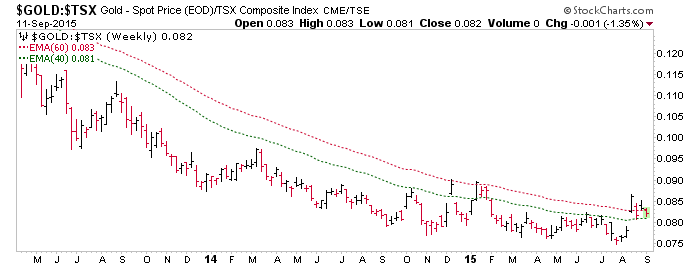

Another sector fundamental is gold’s relationship to major stock markets. In that mainstream stock investors perceive little reason to speculate in the gold stock sector when gold is under performing stock markets, this is fundamental to the gold stock case, both in sentiment/psychology and in a practical sense. Here is gold vs. the S&P 500, Toronto Stock Exchange and the Euro STOXX 50. So far, it’s not very impressive. Despite the big upset over the last month in financial markets, gold has only bumped up a little in relation to these three markets.

And that is not even to mention the nominal technicals for gold, silver and the gold stock sector, which are and have been bearish. That is a subject for a future article and weekly NFTRH reports. Also, there are other macro and sector fundamental considerations beyond the scope of this article.

I just wanted to add some color to Steve Saville’s piece and also belabor the point once again that the easy to comprehend analysis you read on the gold sector is easy for a reason. Promotions don’t work if they make you think too hard and man, in actuality it is not that easy. It is complex and those not willing to do the work have been routinely ground up over the last several years of a negative fundamental (and technical) backdrop. Do the work and tune out the cartoons.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.