Silver Price Route to $50 and Beyond

Commodities / Gold and Silver 2015 Sep 15, 2015 - 05:08 PM GMTBy: Hubert_Moolman

The Dow has been the biggest obstacle to a rise in precious metals, due to it sucking up a lot of the available value on global markets. There will be no significant silver and gold rally while we have a rallying or a "close to its high" Dow.

The Dow has been the biggest obstacle to a rise in precious metals, due to it sucking up a lot of the available value on global markets. There will be no significant silver and gold rally while we have a rallying or a "close to its high" Dow.

The Dow is up about 2.52 times from its low during the 2008/2009 crash. Based on the fact that silver has its great rallies when the Dow is weak (see here); it is no surprise that silver's performance during roughly the same time has not been what is expected during a bull market. Silver is only up about 1.7 times from its low in October 2008.

For silver to rise significantly from here, value will have to be diverted away from those other competing instruments, like the Dow. The Dow's price movement during the last two weeks of August might be signaling the beginning of value diverting from debt fueled assets (like the Dow) to silver.

Sometime during the Dow's next leg down, there is likely to be a significant silver rally, which would take silver higher than the April 2011 high. With the Dow and commodities like oil and other metals not being particularly desirable, we have perfect conditions for such a silver rally.

There are fractals (or patterns) on the silver, and Dow charts that suggest that the above scenario could happen soon.

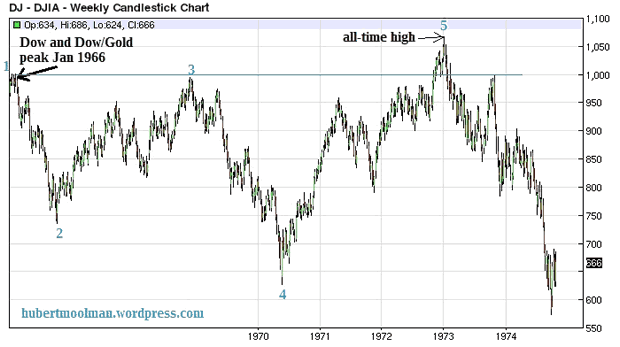

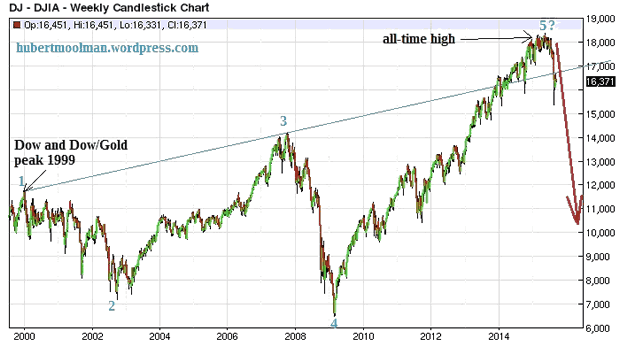

Below, is a fractal comparison between the current period (1999 to 2015) and the 60/70s, for the Dow (charts from barchart.com):

The top chart is the Dow from 1966 to 1974, and the bottom one is the Dow from 1999 to 2015. I have illustrated how these patterns are alike by marking similar points from 1 to 5. It appears that there is a very good chance that we have finally reached the peak for the Dow (point 5).

If the current pattern continues to follow the 60/70s pattern, then we would see a major decline of the Dow in the next several years. This is a good picture of the medium to short-term situation that the Dow finds itself in - right after an all-time high and just before a major decline, like in 1973.

In 1973, soon after the Dow peaked, gold and silver started a massive rally; therefore, it appears that then, the Dow was also an obstacle preventing a silver and gold rally. The silver chart since 1999 also has similarities to that of the 60/70s era.

Below, is a fractal comparison between the current period and the 60/70s, for silver (charts from barchart.com):

On both charts, silver made an all-time high peak some time after the Dow and Dow/Gold ratio peak (1966 and 1999 respectively). During the 60/70s period silver had a multi-year decline after the all-time high. This formed some kind of flag-type pattern. Sometime after the Dow peak (point 5 on the Dow chart), silver went higher than the all-time high.

On the current silver chart, silver is still in the midst of its multi-year decline, forming a flag-type pattern. If these comparisons stay consistent, then we would see silver go higher than the all-time high (April 2011 high), within the next couple of years - provided that the Dow has made its all-time high peak.

Warm regards

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report.

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

Hubert

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2015 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.