U.S. Economy Future Expectations Made Six Months Ago vs. Today's Reality

Economics / US Economy Sep 18, 2015 - 01:10 PM GMTBy: Mike_Shedlock

On Thursday, I noted Bloomberg's comment "Something Very Wrong" with the manufacturing sector.

On Thursday, I noted Bloomberg's comment "Something Very Wrong" with the manufacturing sector.

More completely, Bloomberg stated "There may very well be something wrong with the manufacturing sector, at least in the Northeast where the Empire State index has been in deep negative ground for the last two months followed now by a minus 6.0 headline for the Philly Fed index."

With that comment, let's dig deeper into the latest Philadelphia Fed Business Outlook Survey.

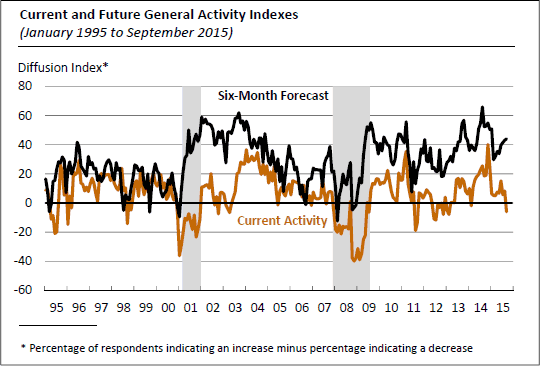

Here is a chart that shows current conditions compared to manufacturer's expectations six month's from now.

Current vs. Future Activity

Future is Bright!

The Philadelphia Fed reported ...

Future Indexes Remained Generally Optimistic

The survey's broadest indicator of future growth edged slightly higher this month. The future general activity index increased 1 point, to 44.0, its highest reading since January. The future index for new orders, at 44.4, decreased 2 points, while the future shipments index, at 41.4, increased 4 points. Furthermore, 28 percent of the firms expect expansion in their workforce over the next six months, while 10 percent expect a reduction.

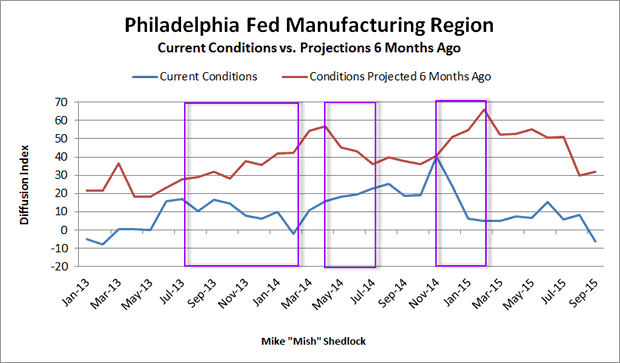

Future Expectations vs. Reality

To check the usefulness of these future projections, I downloaded the data, then shifted the look-ahead projections by six months and plotted those forecasts vs. current conditions.

The above chart shows what manufacturers expected six months ago vs. what actually happened.

A major portion of the time, look-ahead sentiment vs. reality are inversely correlated. Note in particular, the sharp rise in expectations vs. the actual sharp decline (third purple box) that started in November or December of 2014.

Northeast?

As for Bloomberg's comment "There may very well be something wrong with the manufacturing sector, at least in the Northeast" here are some thoughts also posted earlier.

- Dallas Region: Dallas Fed Region Activity Plunges Well Below Any Forecast

- Kansas City Region: Kansas City Region Activity Remains in Deep Contraction

- Richmond Region: Regional Manufacturing Expectations From Mars.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.