The #1 Reason to Love a U.S. Government Shutdown – Investor Double-Digit Profits

Companies / Investing 2015 Sep 18, 2015 - 05:19 PM GMTBy: ...

MoneyMorning.com  Keith Fitz-Gerald writes: Sigh… we stand yet again on the verge of another government shutdown. This time the bickering centers on funding related to Planned Parenthood which has been linked to the appalling sales of fetal body parts in recent months, while other legislators insist on a planned multi-billion dollar tax hike for private equity managers.

Keith Fitz-Gerald writes: Sigh… we stand yet again on the verge of another government shutdown. This time the bickering centers on funding related to Planned Parenthood which has been linked to the appalling sales of fetal body parts in recent months, while other legislators insist on a planned multi-billion dollar tax hike for private equity managers.

What could possibly go wrong – other than everything?!

The way I see it, wingnuts on both sides of the aisle are playing chicken with an $18 trillion economy and world markets once again.

Still, the investor in me is excited by the prospect.

The last government shutdown, as costly and embarrassing as it was, created some quick double-digit profit opportunities for savvy investors.

This one will, too.

But only if you’re prepared ahead of time using one of our favorite Total Wealth Tactics – the Lowball Order – and only if you’re looking at the best companies in this sector.

Congress Caused a $24 Billion Fumble in 2013 and Savvy Investors Banked Double Digit Gains Anyway

The October 2013 government shutdown came with a $24 billion price tag according to Standard & Poors, as hundreds of thousands of furloughed workers took home smaller paychecks and small businesses were hobbled by frozen government contracts and payments. Consumer confidence went into the proverbial toilet and quarterly GDP growth fell from 3% to a middling 2.4%.

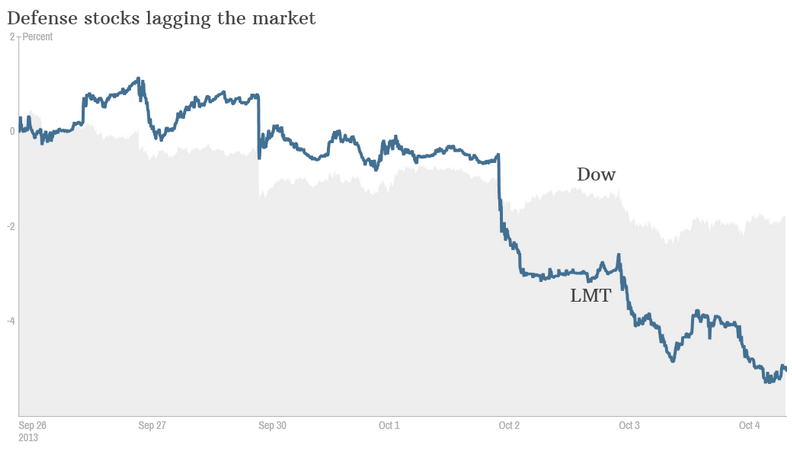

Not surprisingly, mainstream investors were spooked by headlines highlighting the unfolding doom associated with Washington’s incompetence. Nowhere was that more clearly defined than in defense stocks, with some of the bigger players losing up to 7% of their market capitalization in just three days.

As usual, though, the herd failed to grasp something we talk about all the time.

Companies tapped into Unstoppable Trends making “must have” products tend to have the strongest fundamentals, the best balance sheets and, more importantly, plenty of staying power. Any short-term price drop is, therefore, a fabulous buying opportunity under the circumstances.

Consider what happened to Lockheed Martin in late September and early October as the last shutdown became inevitable:

Raytheon and Lockheed Martin were in the same boat. Both fell approximately 6% on the news of the shutdown, shedding tens of billions of dollars in market capitalization as they tumbled. Northrop Grumman, United Technologies, and General Dynamics are just a few of the others that lost more than the broader markets back then.

But here’s the thing – each of those companies came roaring back and investors who swooped in to buy them at a steep discount as recommended have had the opportunity to more than triple the S&P 500 since our government reopened on October 17, 2013.

But companies like the ones we’re talking about are high quality players tapped into the biggest of all of our Unstoppable Trends – War, Terrorism and Ugliness. That means they’ve got trillions of dollars driving them and gobs of upside potential ahead. Short-term market movements are nothing more than noise for them.

The best way to play this situation is to use one of our favorite Total Wealth Tactics – the Lowball Order.

If you’ve never heard the term before, a “Lowball Order” is one of the simplest, yet most powerful orders available today, especially in volatile market conditions like we have right now.

They’re great for at least three powerful reasons:

- You can place them in advance.

- You don’t have to be at your computer to actively manage your money.

- You control your risk by waiting to make your move until the stock you want to buy meets YOUR risk reward criteria.

Here’s how a Lowball Order works.

First, you line up with one of the six Unstoppable Trends we’re following – Medicine; Technology; Demographics; Scarcity & Allocation; Energy; or, in this case, War Terrorism & Ugliness.

Second, you select a stock that’s been beaten down or is otherwise out of line with long-term expectations, fundamentals, and earnings potential. Ideally, this isn’t just any old stock. It’s one that you’d buy if it ever went “on sale.” Great examples include Netflix Inc. (NasdaqGS:NFLX) at $60, Apple Inc. (NasdaqGS:AAPL) at $75, Gilead Sciences Inc. (NasdaqGS:GILD) at $70, or even Alibaba Group Holding Ltd. (NYSE:BABA) at $45. Your list may differ, but my point is that you have a list… at all times.

Third, you pick a price – to the penny – that matches your individual risk tolerance, your investment objectives, and your belief about what the company is really worth. You can do that using fundamental measures like the “price to book” or intrinsic valuations, a la Graham and Dodd.

Or, you can also simply pick a technical point at which there is logical “support,” or even previous lows depending on your time frame. There’s no hard-and-fast rule here, but many traders find 10%-15% below recent 30-day lows to be fertile hunting in choppy markets. To really stack the odds in your favor, though, you want to pick a price so low that others tell you that it’s impossible for XYZ to trade at that level.

Fourth, you place your order to buy “XYZ at $___ per share or less, GTC” – meaning good till cancelled.

Then, you sit back and wait for a price dip. In this case, it’s more financial buffoonery from Congress and a corresponding knee-jerk reaction from uninformed investors who don’t understand what we’re talking about today.

Here are three companies to get you started.

You’ll note they’re all defense contractors for one simple reason – the Pentagon will never hold a bake sale to fund their programs, especially with the world’s geopolitical situation the way it is. That zinger is courtesy of my editor, John Persinos.

Government Shutdown Lowball #1: The Boeing Company (NYSE:BA)

Based in Chicago, Ill., Boeing is a $93.8 billion defense company that has clients and operations in 150 companies as of 2015. As the world’s largest aerospace company, it specializes in both military and commercial aircraft, satellites, electronic and defense systems, and advanced information and communication systems. Its most recent earnings report for Q2/2015 showed earnings from operations up 11% year-over-year – unsurprising considering the continued demand for aircraft in a global rearmament trend led by the United States, Russia, China, and Saudi Arabia.

I particularly like the company’s proven ability (and desire) to raise dividend payouts aggressively over time. The company has hiked its dividend five times in the last seven years, going from a $0.40/share payout to $0.90/share – a 127% increase that’s all the more impressive considering it took place during some of the worst financial conditions the world has ever seen.

BA dropped around 4% during the last shutdown, which suggests buying at $131.95 is a good place to go shopping. However, that’s not quite a steep enough discount for me. Considering that lowball orders are meant to be serious discounts and placed at prices so low others deem them impossible, I’d be more inclined to start buying around $120-$125 per share where there’s strong support dating back to January 2014.

Government Shutdown Lowball #2: Lockheed Martin Corp. (NYSE:LTM)

Headquartered in Bethesda, Maryland, Lockheed Martin is a $64.7 billion defense company that’s a global leader in defense, security, and aerospace technology. In a promising sign of expansion, the company has begun investing heavily in alternate energy exploration, including compact nuclear fusion.

With a price-to-earnings (PE) ratio of just 18.5 today, LMT is cheap for its industry – and will be an even better bargain if it sees anything like the 7% decline it suffered during 2013’s shutdown. But, again, to really nail the spirit of lowball orders, I believe $185/share would really be great if you can get it.

Government Shutdown Lowball #3: Raytheon Co. (NYSE:RTN)

I’d be remiss not to point out your opportunity to scoop up discounted shares of one of the Money Map Report’s best performers. Currently trading at around $107/share, RTN boasts a PE ratio of just 15.5 – almost a 40% discount from the industry average, according to Yahoo!Finance. That means that this $32.6 billion defense contractor is already extremely cheap – and a shutdown-induced dip could make it even more of a screaming buy.

Like Boeing, RTN is a dividend star, having raised its payouts seven times in the last seven years. But its payout has grown at a rate that surpasses Boeing’s, at 141% growth in the same time frame. Even better, its payout ratio is a mere 36% according to Yahoo!Finance. That suggests there’s plenty of room to climb higher.

A quick look at the chart tells me that there’s support around $91 a share dating back to last August.

As always, if you fill any of these orders, I want you to do two things straight away: 1) smile knowing you swooped in at a huge discount to what other investors are paying today; and 2) immediately implement a trailing stop that’s 25% below your purchase price to protect your capital and your profits.

In closing, financial buffoonery has been a part of government since the dawn of time and another shutdown is par for the course.

This time around, though, you’ll be prepared even if the government isn’t.

Until next time,

Keith

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.