The No. 1 Factor Dragging Down Corporate Earnings

Companies / Corporate Earnings Sep 19, 2015 - 06:10 PM GMTBy: Investment_U

Rachel Gearhart writes: It’s no secret that the broader market has been rough on investors these past few weeks.

Rachel Gearhart writes: It’s no secret that the broader market has been rough on investors these past few weeks.

For one thing, we’ve had to contend with that whole yuan fiasco, which sent the Dow plummeting more than 1,000 points.

Uncertainty about the Fed raising interest rates has also made the markets skittish (though it should be less of a concern after Thursday’s announcement... at least for a while).

And to top it all off, crummy second quarter earnings packed on the downward pressure. This is the focus of today’s chart.

Simply put, sales were down; profits were down. And as a result, for the second quarter, year-over-year earnings for the S&P 500 are expected to drop 2.2%.

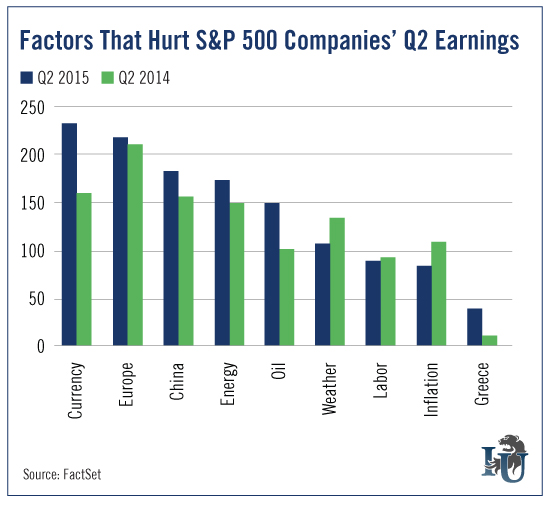

Our chart shows us which factors hurt S&P 500 companies’ earnings the most.

FactSet analyzed conference call transcripts from 417 S&P 500 companies. They then used this data to determine which factors - currency, oil prices, weather, etc. - were most harmful to the companies’ second quarter earnings.

The results should come as no surprise. With more than 45% of total revenue for all S&P 500 companies coming from outside the U.S., currency affected earnings the most - specifically, the strong dollar.

And we called it. Back in March, we featured a chart showing how the U.S. Dollar Index affected the S&P Foreign Exposure Index. (The S&P Foreign Exposure Index consists of the 47 S&P 500 companies that derive 50% or more of their revenue from foreign markets.)

From the article: “If this trend continues, the drop in our Foreign Exposure Index could very well start weighing down the entire S&P 500.”

For the short term, things look bleak. Second quarter earnings were poor. Third quarter earnings are estimated to decline 2.9%. However, there is a light at the end of the tunnel...

Next month, the third quarter will end and many companies will enter into what is historically their most profitable quarter. Now is the perfect time for investors to shop for quality companies trading at bargain-bin prices.

Or as our Chief Investment Strategist Alexander Green wisely opined on Monday: “Just as every dog has its day, every asset class has its bull market. So when you find one that is unquestionably cheap, you need only buy... and show a little patience.”

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.